Irs Form 8821 Printable Use the following procedure to complete the Print page Select File from you browser menu Select Print from the drop down menu Select Finish when you are finished with the page Back to the Top of the Page Frequently Asked Questions How do I set the margins to print For best results set all the page margins to 0 183 inches

If you want copies of tax information notices and other written communications sent to the appointee on an ongoing basis check this box a Note Appointees will no longer receive forms publications and Report Error It appears you don t have a PDF plugin for this browser Please use the link below to download 2022 federal form 8821 pdf and you can print it directly from your computer Download This Form Print This Form

Irs Form 8821 Printable

Irs Form 8821 Printable

Irs Form 8821 Printable

https://www.pdffiller.com/preview/429/367/429367548/big.png

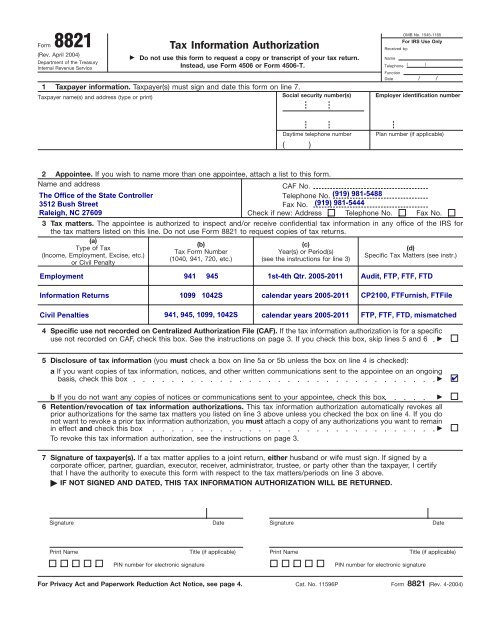

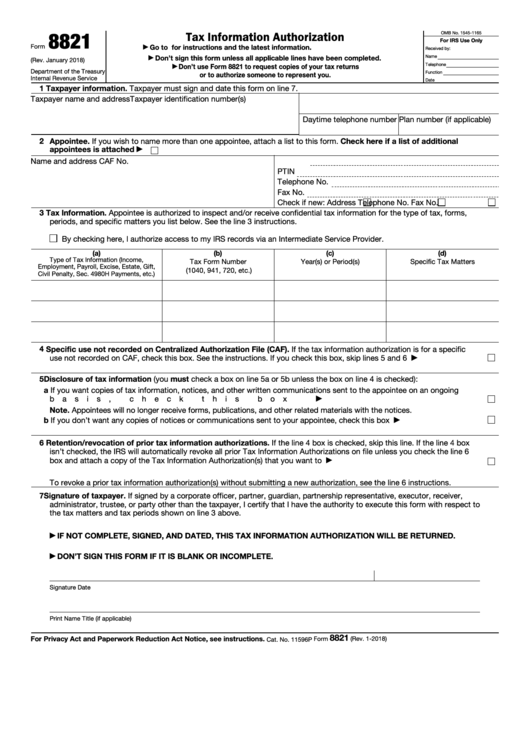

Specific Tax Matters Tax Liablity Type of Tax Information Income Employment Payroll Excise Estate Gift Civil Penal Sec 4980H Pa ments etc b Tax Form Number 1040 941 720 etc c Year s or Period s income withholding employment tax 940 941 941X941R W2W2C 01 02 03 YYYY YYYY

Templates are pre-designed files or files that can be utilized for various purposes. They can save time and effort by supplying a ready-made format and layout for developing different sort of material. Templates can be used for individual or expert jobs, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

Irs Form 8821 Printable

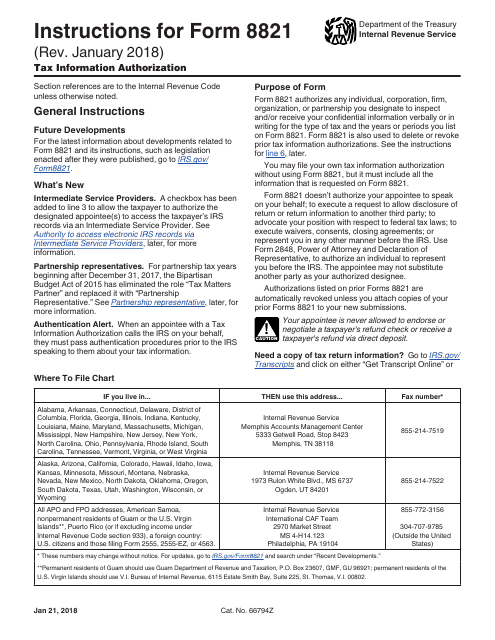

Download Instructions For IRS Form 8821 Tax Information Authorization

Form 8821 1596d04 Internal Revenue Service Social Institutions

Indiana Excise Tax Form Micha Eagle

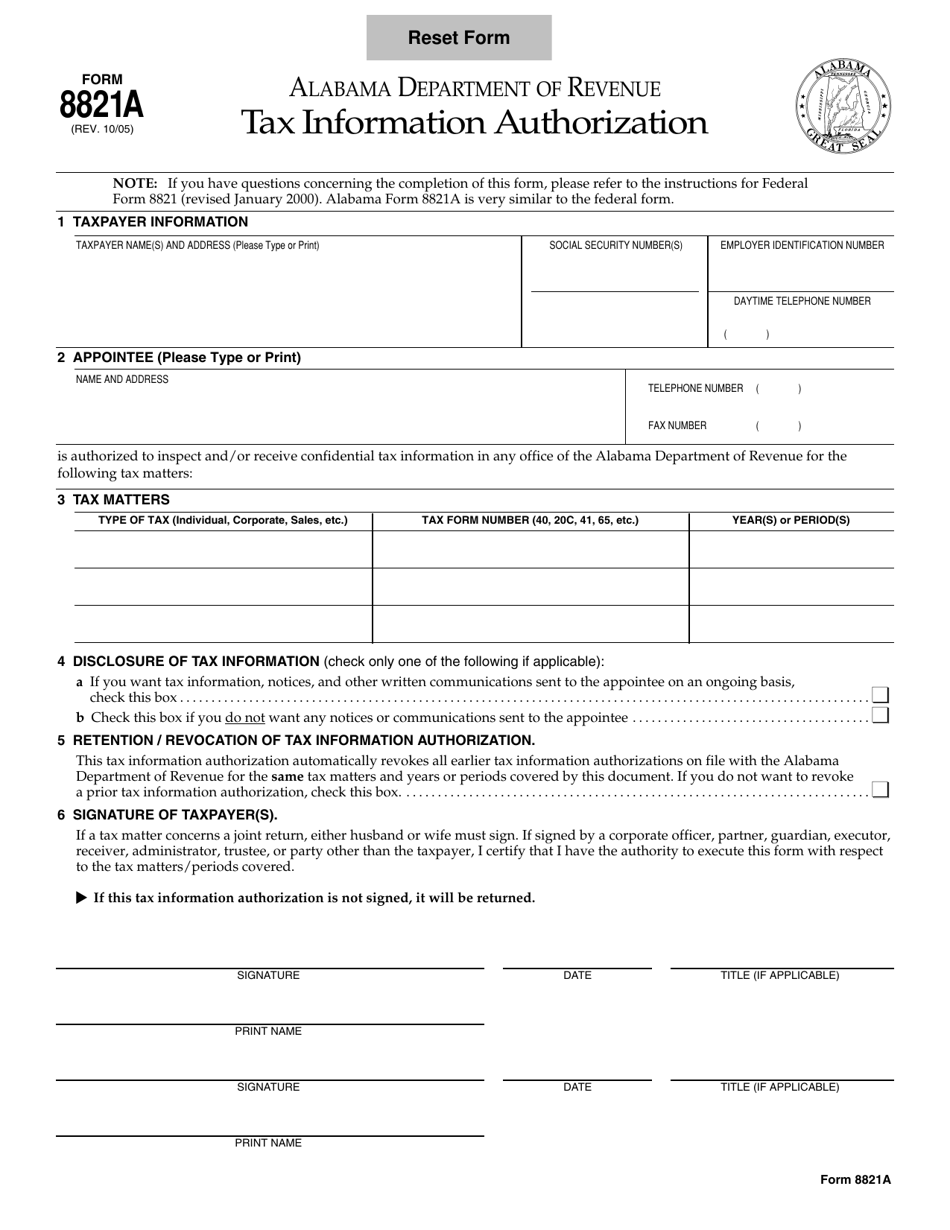

Form 8821A Download Fillable PDF Or Fill Online Tax Information

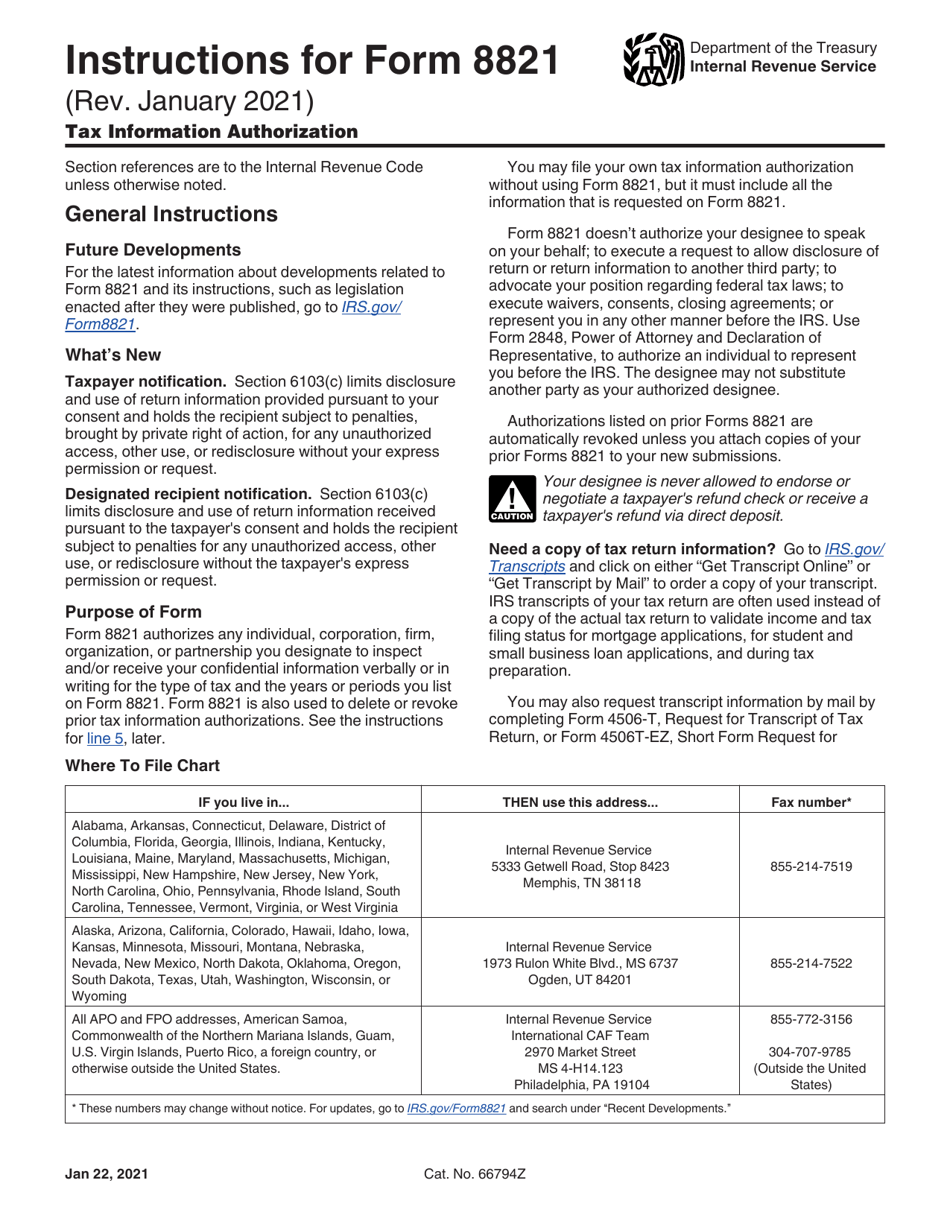

Download Instructions For IRS Form 8821 Tax Information Authorization

IRS Form 8821 Tax Information Authorization

https://www.irs.gov/forms-pubs/about-form-8821

File Form 8821 to Authorize any individual corporation firm organization or partnership you designate to inspect and or receive your confidential information verbally or in writing for the type of tax and the years or periods listed on the form

https://www.irs.gov/pub/irs-pdf/i8821.pdf

How to submit your Form 8821 from the options below If you use an electronic signature see Electronic Signatures below you must submit your Form 8821 online Online Submit your Form 8821 securely at IRS gov Submit8821 Note You will need to have a Secure Access account to submit your Form 8821 online For more information on

https://www.irs.gov/pub/irs-pdf/f8821a.pdf

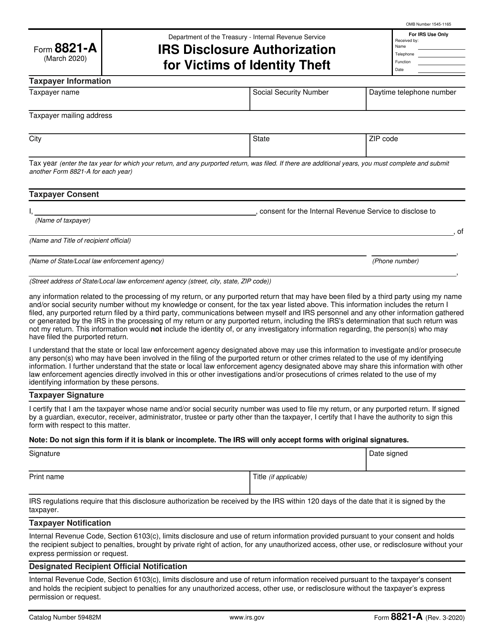

Instructions for Form 8821 A IRS Disclosure Authorization for Victims of Identity Theft

https://www.taxdischargedeterminator.com/content/docs/form8…

A IF NOT COMPLETED SIGNED AND DATED THIS TAX INFORMATION AUTHORIZATION WILL BE RETURNED a DON T SIGN THIS FORM IF IT IS BLANK OR INCOMPLETE Signature Date Print Name Title if applicable For Privacy Act and Paperwork Reduction Act Notice see the instructions Cat No 11596P Form 8821 Rev

https://esign.com/wp-content/uploads/Form-8821-Instructions.pdf

Purpose of Form Form 8821 authorizes any individual corporation firm organization or partnership you designate to inspect and or receive your confidential information verbally or in writing for the type of tax and the years or periods you list on Form 8821

Fillable Form 8821 Tax Information Authorization IRS Fill Online Printable Fillable Blank Form 8821 Tax Information Authorization IRS Form Use Fill to complete blank online IRS pdf forms for free IRS Form 8821 can be especially useful if a taxpayer needs assistance with his or her tax account and would like to allow a tax professional or family member to ask questions and discuss the account with the IRS Corporations firms and organizations are also able to file IRS Form 8821

In this case you only need to file form 8821 It ll provide you with the information you need to give them tax advice 2 You and your client can agree on a validity period Form 8821 allows your client to establish a validity period i e an agreed upon time frame for you to access their information