Irs Extension Form Printable TurboTax Personal Taxes Easy Extension Free federal tax extension is now closed for tax year 2022 File an extension by April 18 2023 and have until October 16 2023 to finish your taxes Avoid penalties and get a little extra time to file your return Learn more about penalties Easily complete your IRS tax extension from a brand you trust

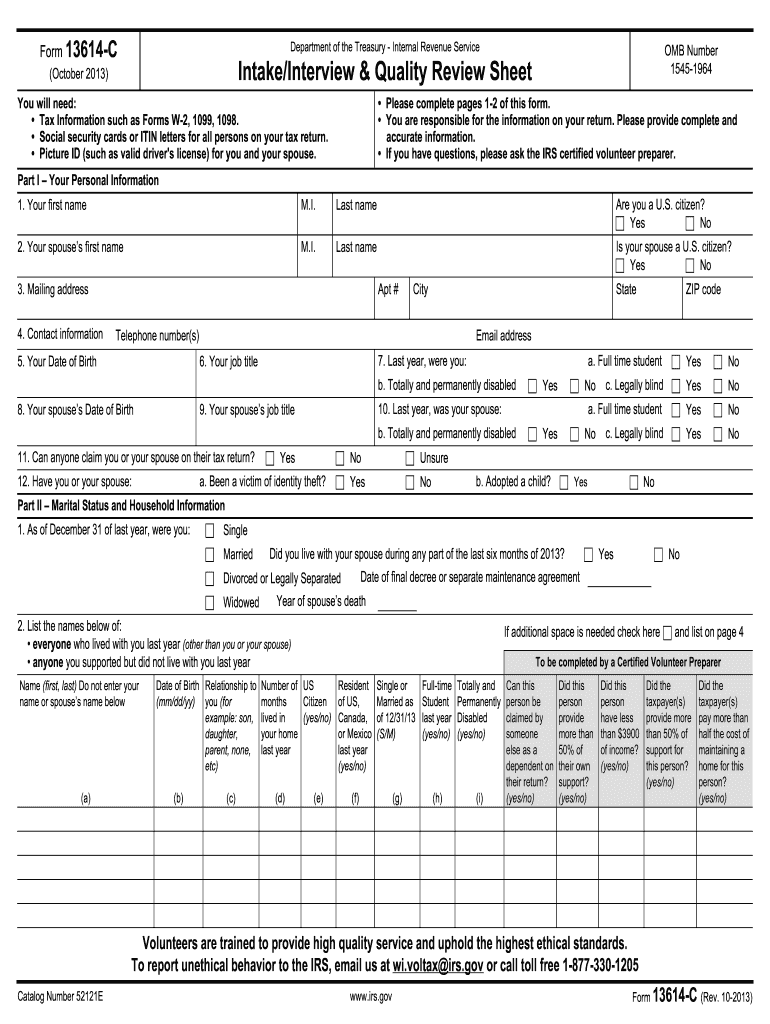

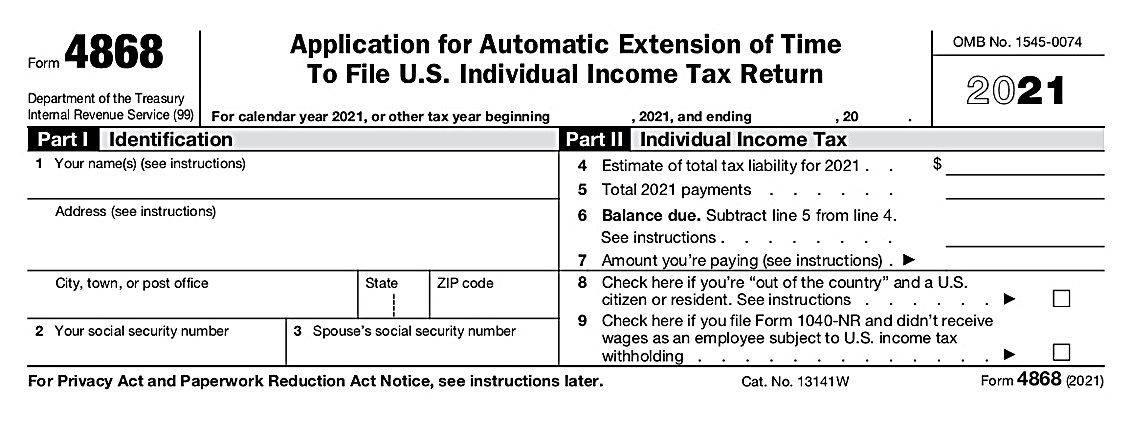

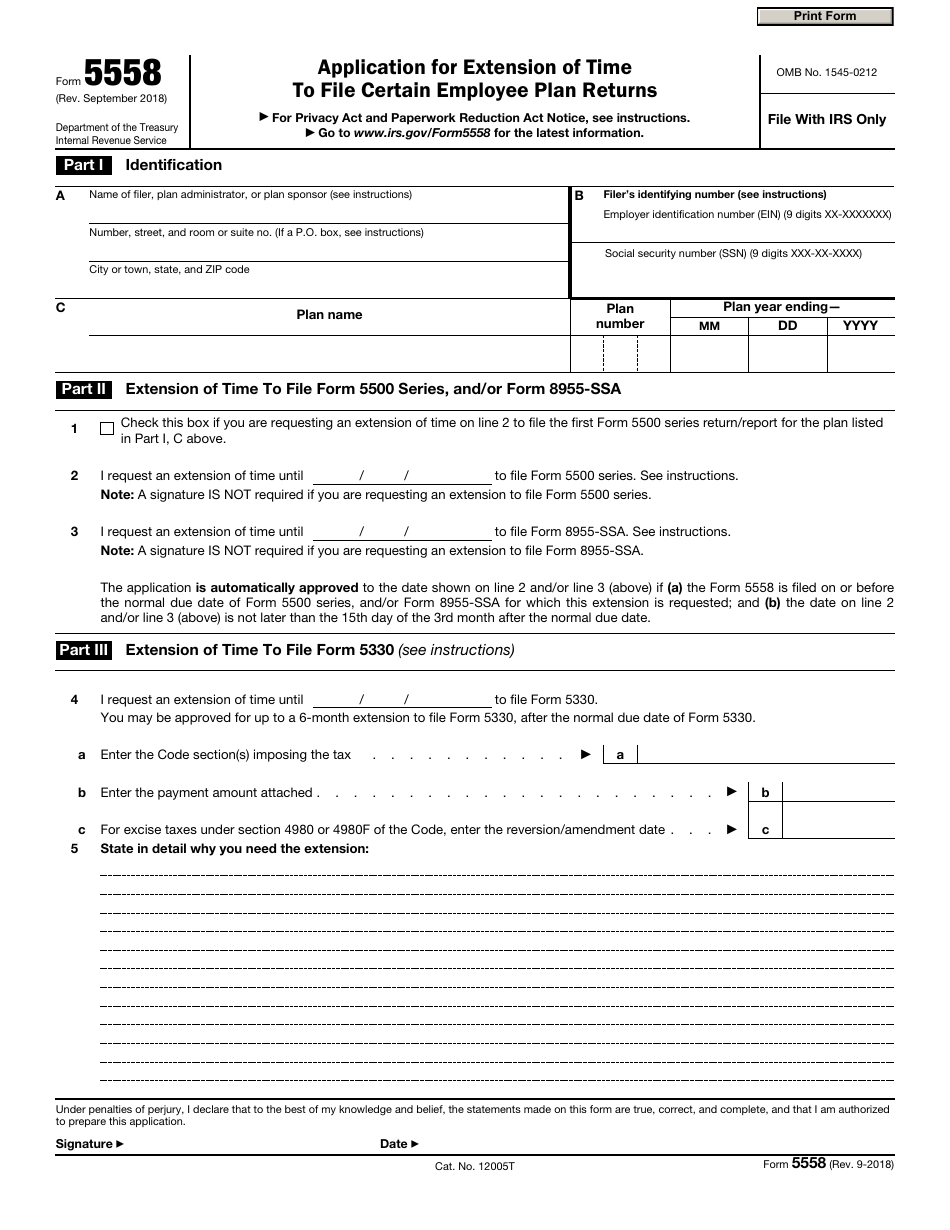

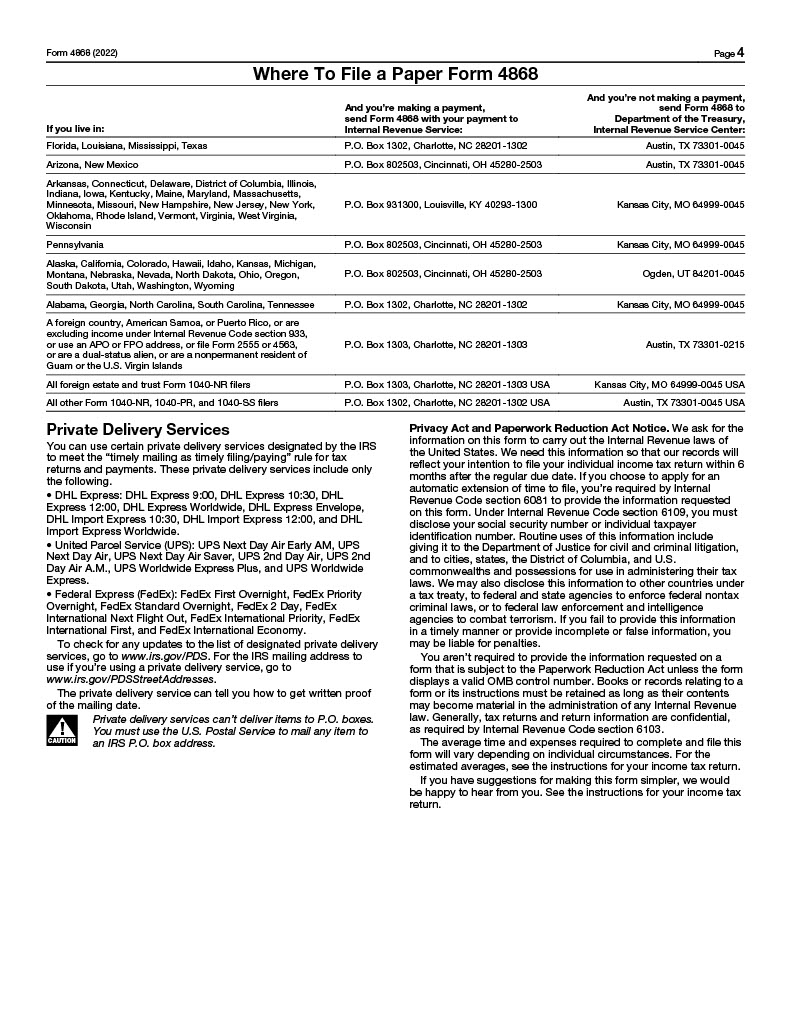

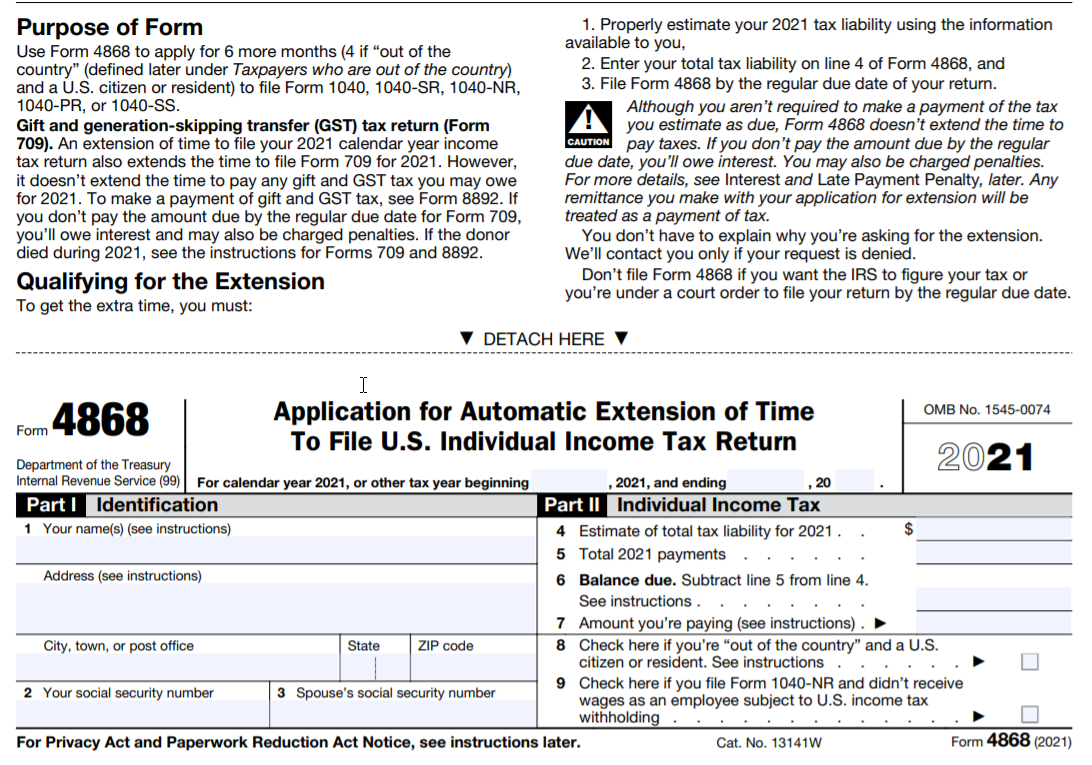

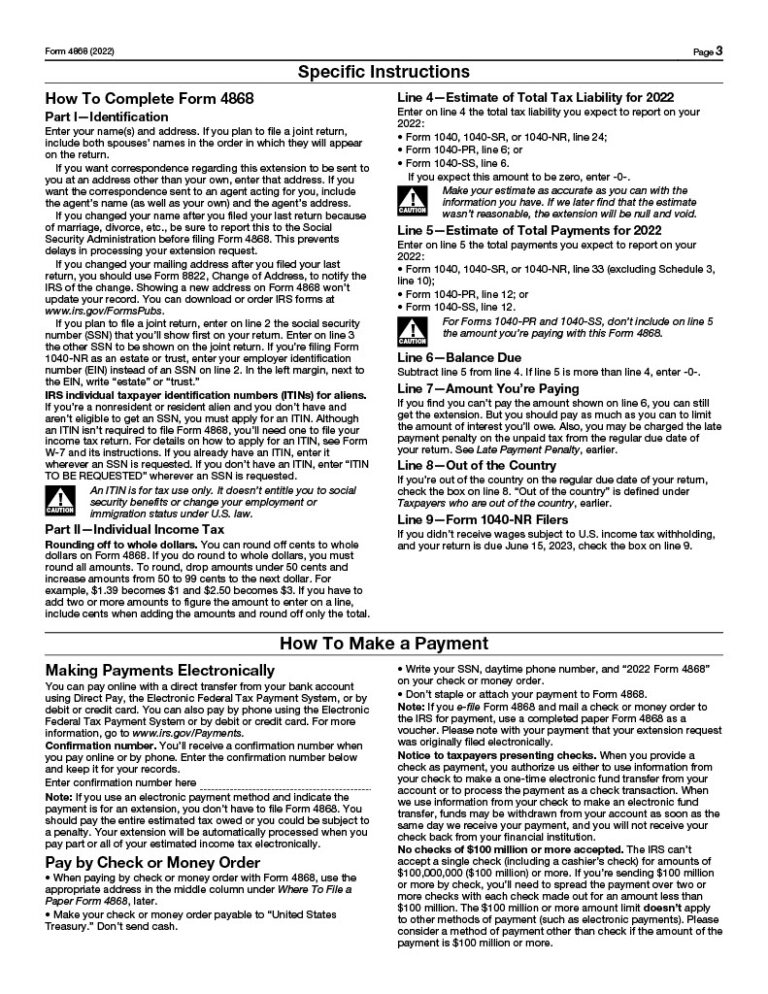

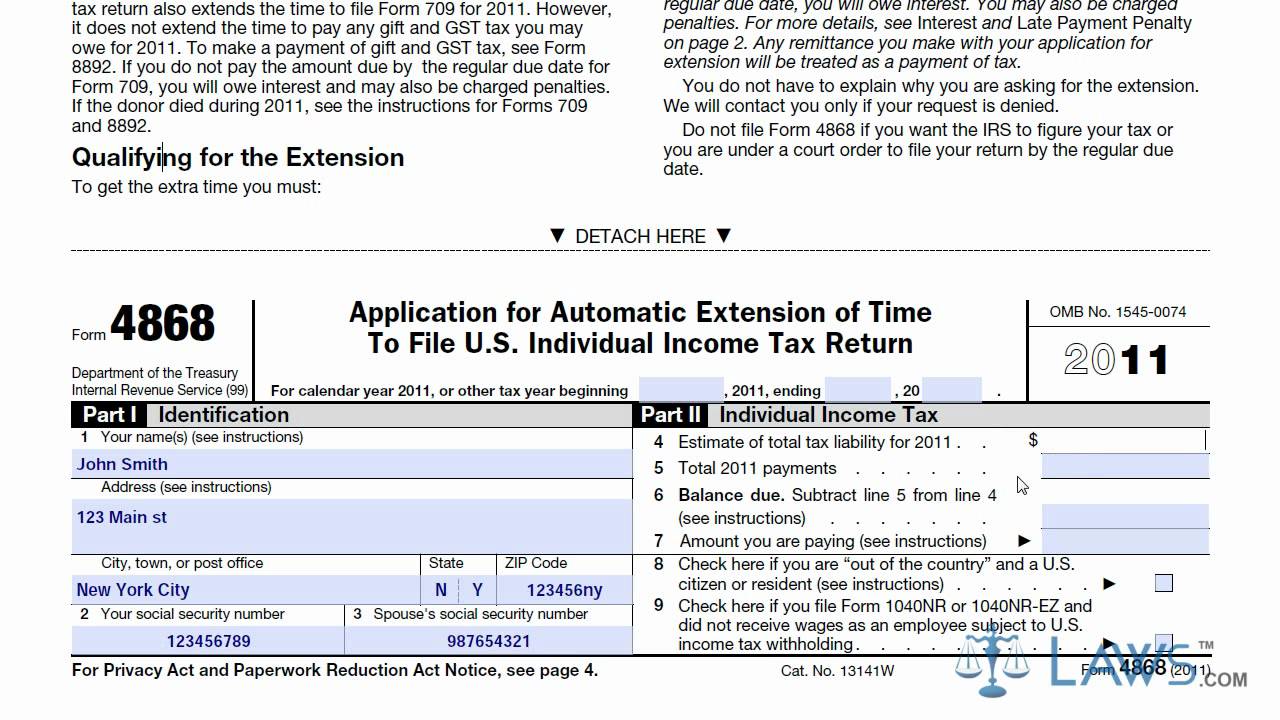

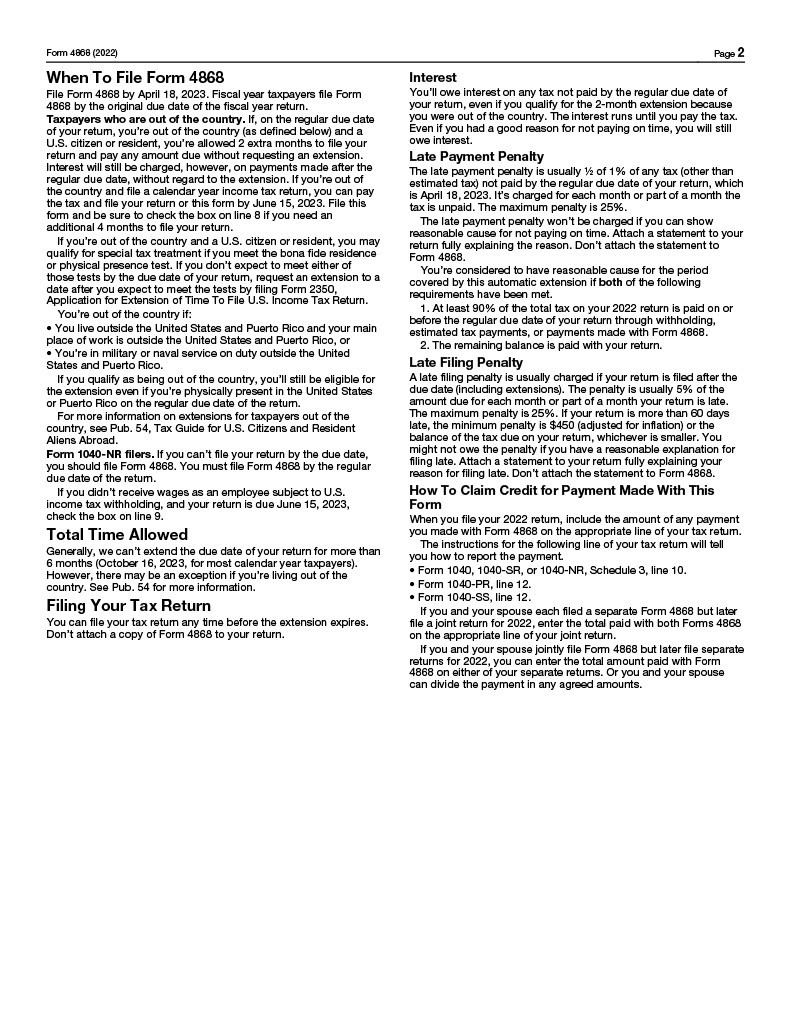

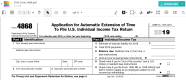

To get the extension taxpayers must estimate their tax liability on this form and file it by April 18 Get an extension when making a payment Other fast free and easy ways to get an extension include using IRS Direct Pay the Electronic Federal Tax Payment System or by paying with a credit or debit card or digital wallet There s no need to IRS Form 4868 also known as an Application for Automatic Extension of Time to File U S Individual Income Tax Return is a form that taxpayers can file with the IRS if they need more time

Irs Extension Form Printable

Irs Extension Form Printable

Irs Extension Form Printable

https://www.expressextension.com/Content/Images/newImages/personalTaxExtension.png

IRS Form 4868 also called the Application for Automatic Extension of Time to File U S Individual Income Tax Return is used by those that need more time to file their federal income tax return Submission of the form allows for an automatic six month extension to file taxes

Pre-crafted templates provide a time-saving option for developing a varied variety of documents and files. These pre-designed formats and layouts can be used for numerous personal and expert projects, consisting of resumes, invitations, leaflets, newsletters, reports, presentations, and more, streamlining the content creation process.

Irs Extension Form Printable

Irs Printable Form For 2016 Extension Form Advisorsker

Irs Extension Form For 2023 Printable Forms Free Online

Irs Extension Form Printable Printable Forms Free Online

Irs Printable Extension Form Printable Forms Free Online

IRS Form 4868 Extension Printable 4868 Form 2023

Form 4868 Printable

https://www.irs.gov/pub/irs-pdf/f4868.pdf

Use Form 4868 to apply for 6 more months 4 if out of the country defined later under Taxpayers who are out of the country and a U S citizen or resident to file Form 1040 1040 SR 1040 NR 1040 PR or 1040 SS Gift and generation skipping transfer GST tax return Form 709

https://www.irs.gov/pub/irs-pdf/f7004.pdf

Form 7004 Rev December 2018 Department of the Treasury Internal Revenue Service Application for Automatic Extension of Time To File Certain Business Income Tax Information and Other Returns File a separate application for each return Go to www irs gov Form7004 for instructions and the latest information OMB No 1545 0233

https://www.irs.gov/forms-pubs/about-form-4868

A U S citizen or resident files this form to request an automatic extension of time to file a U S individual income tax return Current Revision Form 4868 PDF Recent Developments Form 4868 extension not required if you are in certain disaster areas 20 APR 2023 Filing Extension and Other Relief for Form 4868 Filers PDF 29 March 2021

https://www.usa.gov/federal-tax-extensions

You can request an extension Online using IRS Free File program When you pay your estimated tax bill Using IRS Form 4868 LAST UPDATED July 24 2023 SHARE THIS PAGE Have a question Ask a real person any government related question for free They will get you the answer or let you know where to find it Call USAGov Chat

https://www.irs.gov/newsroom/if-you-need-more-time-to-file-your-taxes

April 11 2023 If you can t file your federal tax return by the April 18 2023 deadline request an extension An extension gives you until October 16 2023 to file your 2022 federal income tax return You can use IRS Free File at IRS gov freefile to request an automatic filing extension or file Form 4868 Application for Automatic Extension

The Internal Revenue Service will automatically grant you an extension to file your tax return by October 16 All you need to do is submit Form 4868 You can file electronically via IRS e file from your home computer or have your tax preparer do it for you Go to the IRS website and fill out IRS Form 4868 You can access this form directly at this link and file it yourself Also it is free If you are working with a paid tax preparer or CPA they

Published Apr 17 2023 5 min read SHARE Pete Ryan for Money Need more time to file your taxes Good news It s surprisingly easy to ask the IRS for a later due date This year taxes are due Tuesday that s April 18 for most folks