Irs 941 Printable Tax Return If you filed an adjusted return Form 941 X 943 X 944 X CT 1X to claim the ERC and you would like to withdraw your entire claim use the process below If you filed adjusted returns for more than one tax period you must follow the steps below for each tax period for which you are requesting a withdrawal

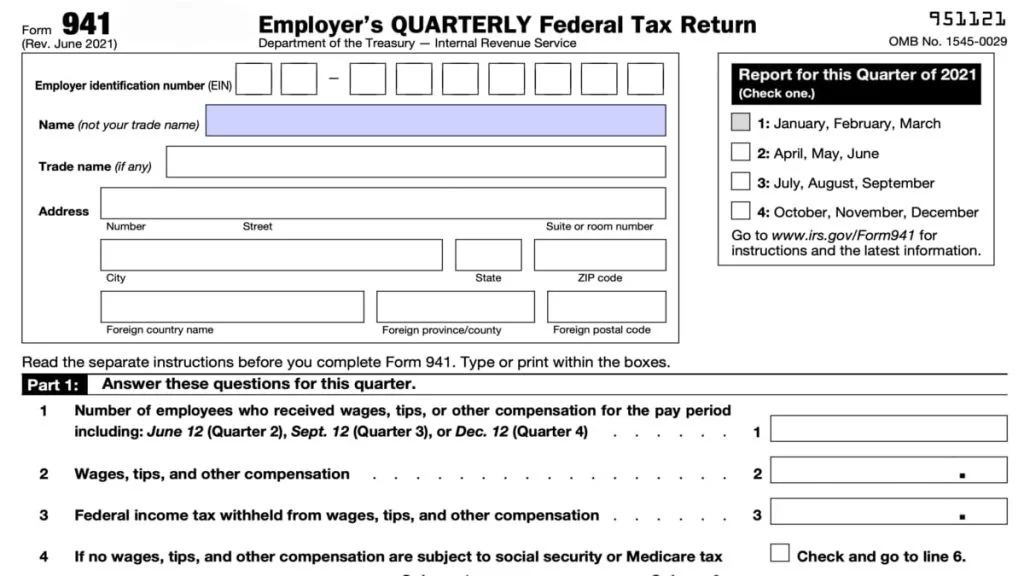

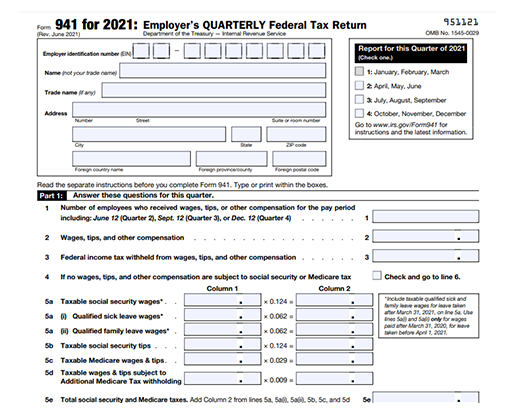

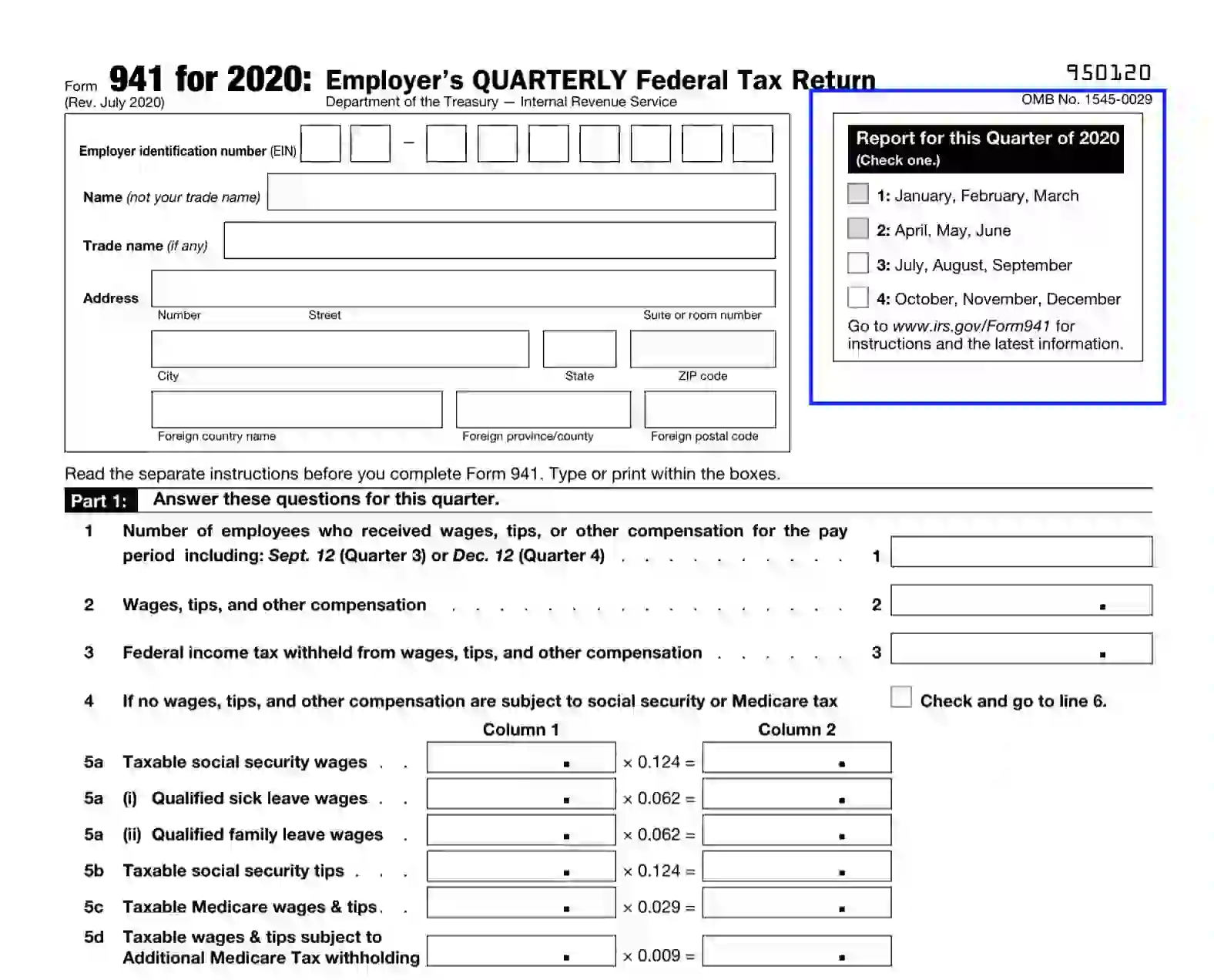

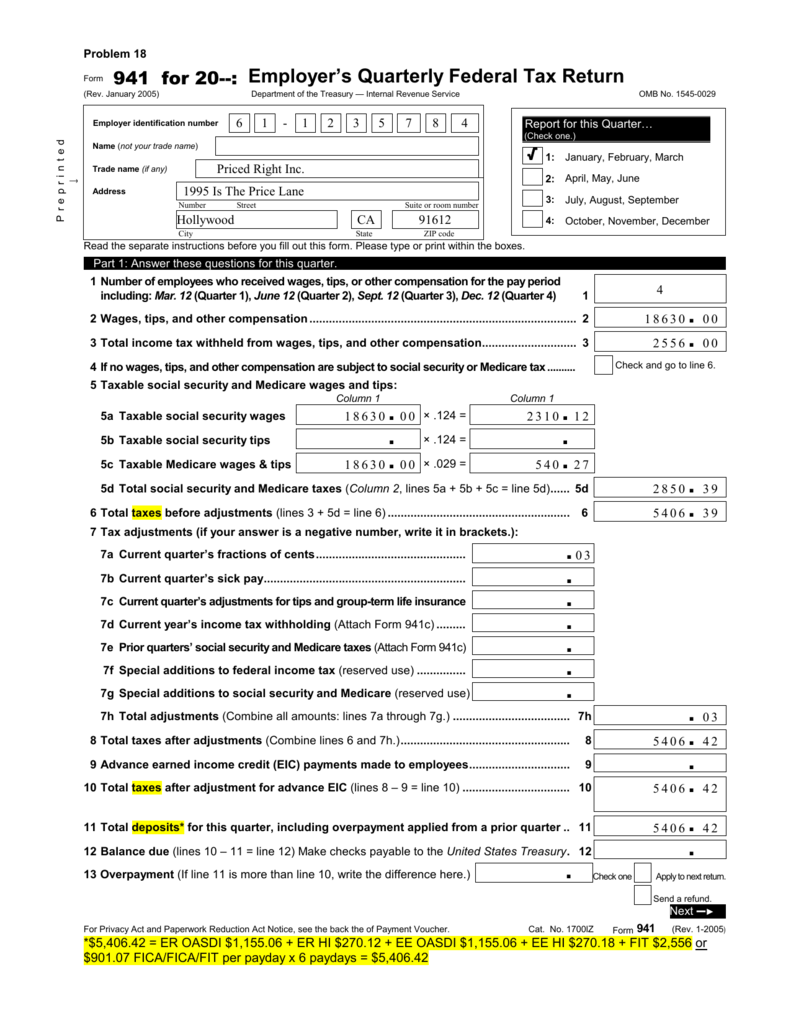

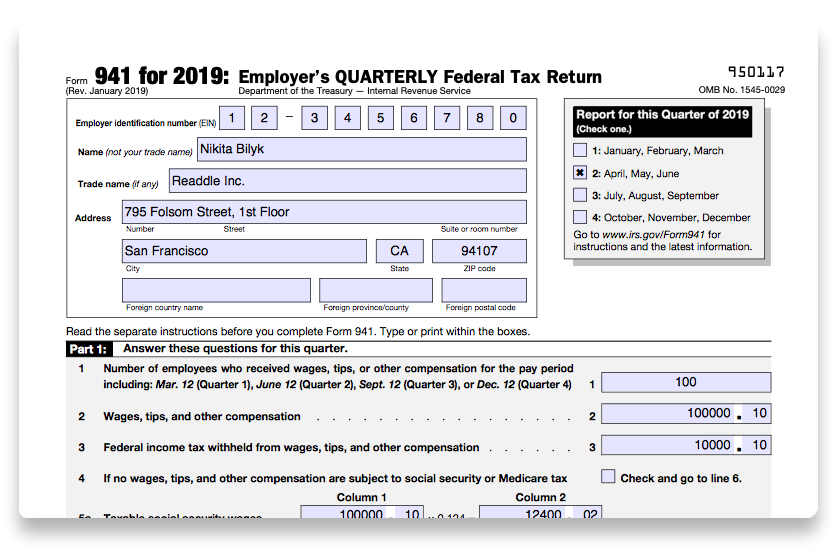

An employer that owes employment taxes of 1 000 or less for the year can file Form 944 Employer s Annual Federal Tax Return if given IRS permission to do so Call 800 829 4933 or send a The Balance Daniel Fishel Internal Revenue Service IRS Form 941 is the Employer s Quarterly Federal Tax Return It s used by employers to report tax withholding amounts for estimated income tax payments employer payments and FICA taxes more commonly known as Social Security and Medicare

Irs 941 Printable Tax Return

Irs 941 Printable Tax Return

Irs 941 Printable Tax Return

https://www.taxbandits.com/content/images/form941-article-mail.png

2022 Form 941 Author W CAR MP FP Subject Employer s QUARTERLY Federal Tax Return Created Date 8 23 2023 2 41 09 PM

Templates are pre-designed files or files that can be utilized for various functions. They can save effort and time by supplying a ready-made format and design for producing various kinds of material. Templates can be used for personal or expert tasks, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

Irs 941 Printable Tax Return

Form 941 Fillable Pdf Printable Forms Free Online

2023 Form 941 Printable Forms Free Online

Free Printable Irs Form 941 Printable Forms Free Online

Tax Form 941 For 2023 Printable Forms Free Online

Mailing Address For Form 941 2023 Printable Forms Free Online

Draft Of Revised Form 941 Released By IRS Includes FFCRA And CARES

https://www.irs.gov/forms-pubs/about-form-941

Information about Form 941 Employer s Quarterly Federal Tax Return including recent updates related forms and instructions on how to file Form 941 is used by employers who withhold income taxes from wages or who must pay social security or Medicare tax

https://www.irs.gov/form

Employer s Quarterly Federal Tax Return Employers who withhold income taxes social security tax or Medicare tax from employee s paychecks or who must pay the employer s portion of social security or Medicare tax Form 941 PDF Related Instructions for Form 941 PDF

https://www.zillionforms.com/2021/F2131000776.PDF

Employer s QUARTERLY Federal Tax Return Form 941 for 2021 Rev March 2021 Employer s QUARTERLY Federal Tax Return Department of the Treasury Internal Revenue Service Employer identification number EIN Name not your trade name Trade name if any Address Number Street Suite or room number City State ZIP code

https://www.irs.gov/pub/irs-pdf/i941.pdf

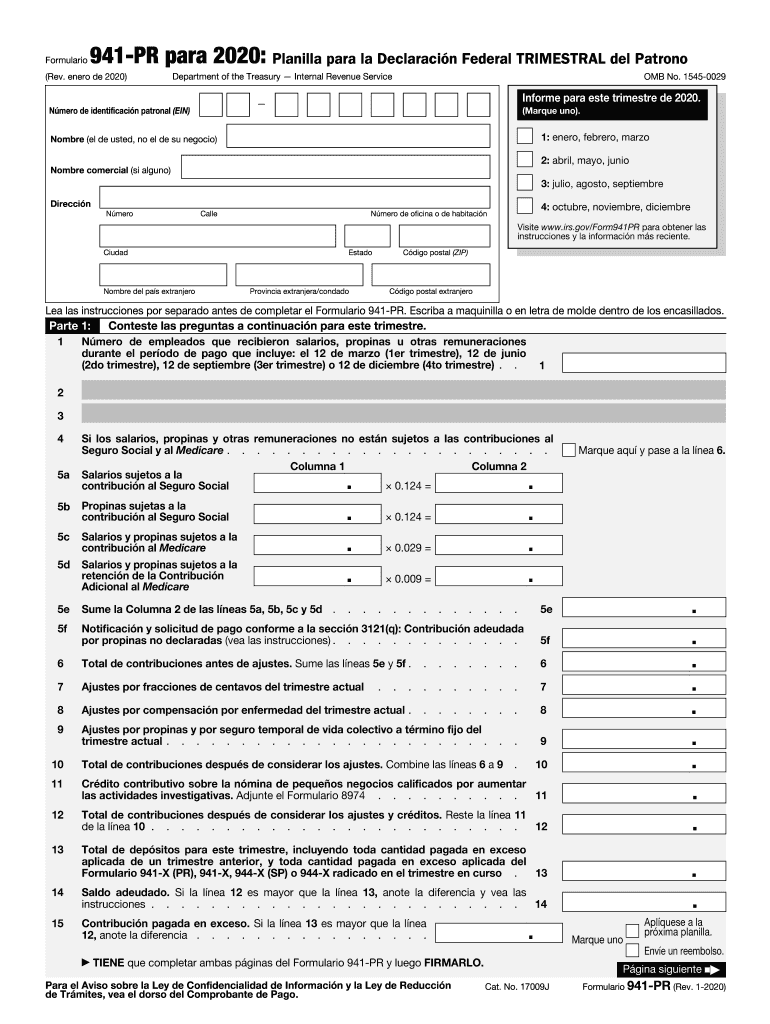

Form 941 SS Employer s QUARTERLY Federal Tax Return American Samoa Guam the Commonwealth of the Northern Mariana Islands and the U S Virgin Islands and Form 941 PR Planilla para la Declaraci n Federal TRIMESTRAL del Patrono will no longer be available after the fourth quarter of 2023

https://www.nerdwallet.com/article/small-business/irs-form-941-instructions

IRS Form 941 also known as the Employer s Quarterly Federal Tax Return is where businesses report the income taxes and payroll taxes that they withheld from their employees wages as

A simple tax return is one that s filed using IRS Form 1040 only without having to attach any forms or schedules Only certain taxpayers are eligible You must file IRS Form 941 if you operate a business and have employees working for you Certain employers whose annual payroll tax and withholding liabilities are less than 1 000 might Employer s Quarterly Federal Tax Return Form 941 Rev June 2022 941 for 2022 Form Rev June 2022 Employer s QUARTERLY Federal Tax Return 950122 OMB No 1545 0029 Department of the Treasury Internal Revenue Service Report for this Quarter of 2022 Employer identification number EIN Check one

What is Form 941 IRS Form 941 Employer s Quarterly Tax Return is used to report employment taxes Employers who own and operate a business with employees need to file IRS Form 941 quarterly and are responsible for withholding federal income tax social security tax and Medicare tax from each employee s salary This form is also used to