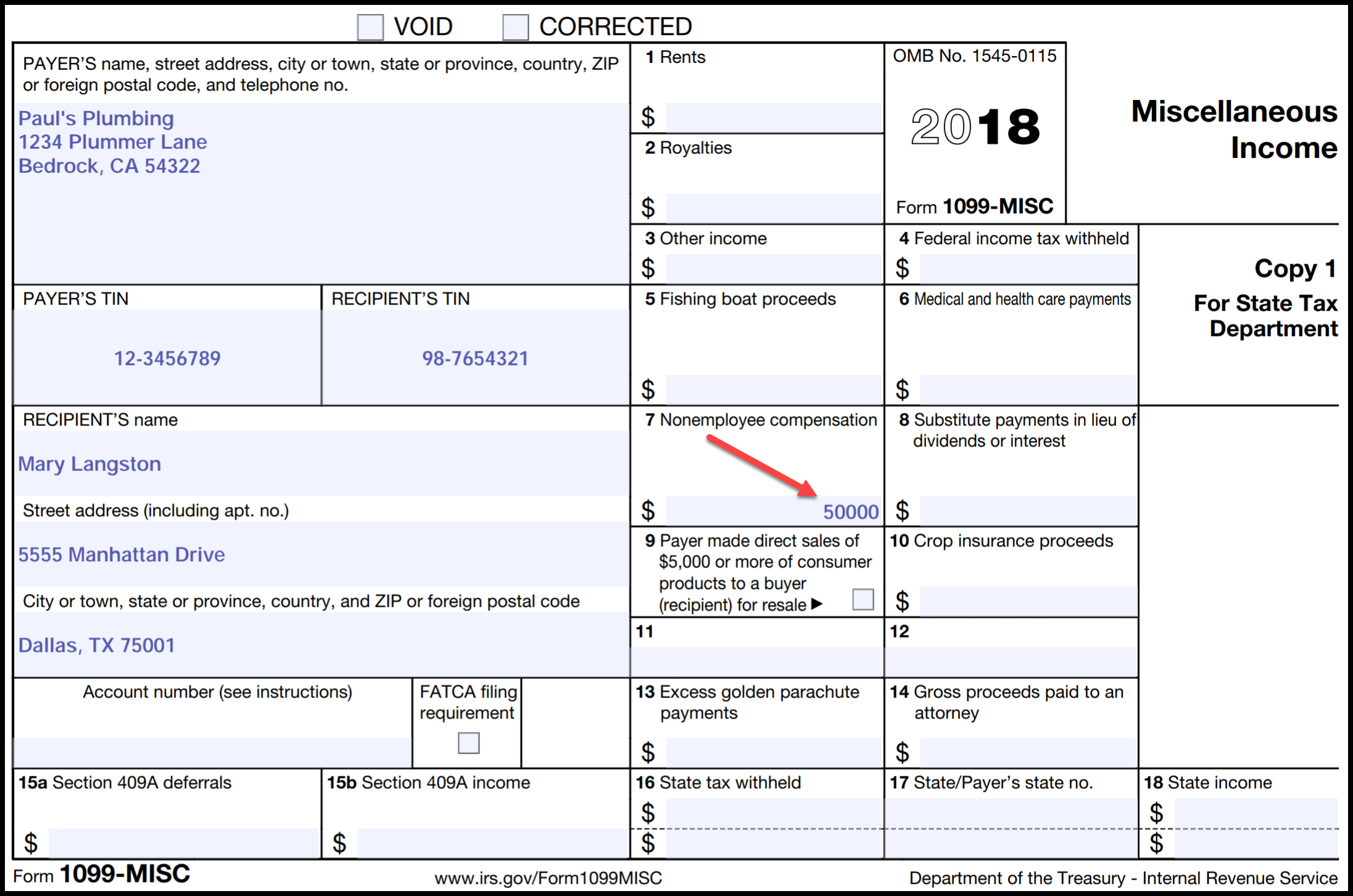

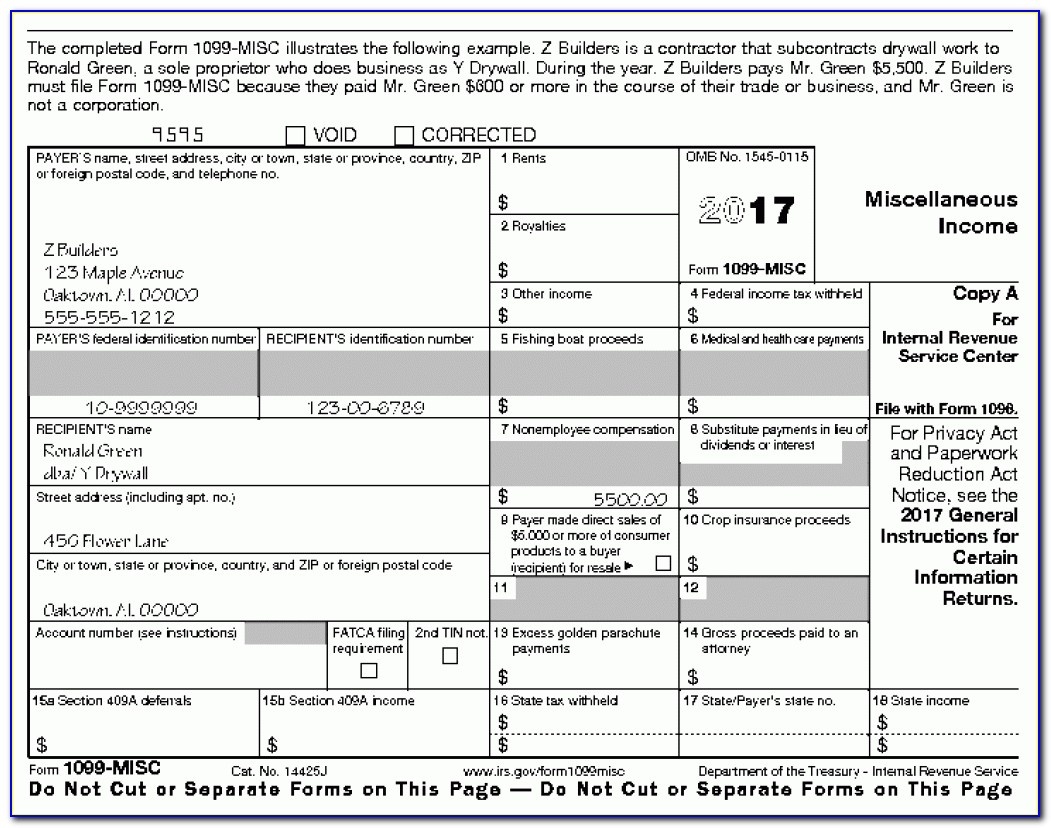

Irs 1099 Misc Printable OVERVIEW Form 1099 MISC reports payments other than nonemployee compensation made by a trade or business to others This article answers the question What is the 1099 MISC form after the reintroduction of the 1099 NEC TABLE OF CONTENTS Payments to others What s changed on the new 1099 MISC Where is

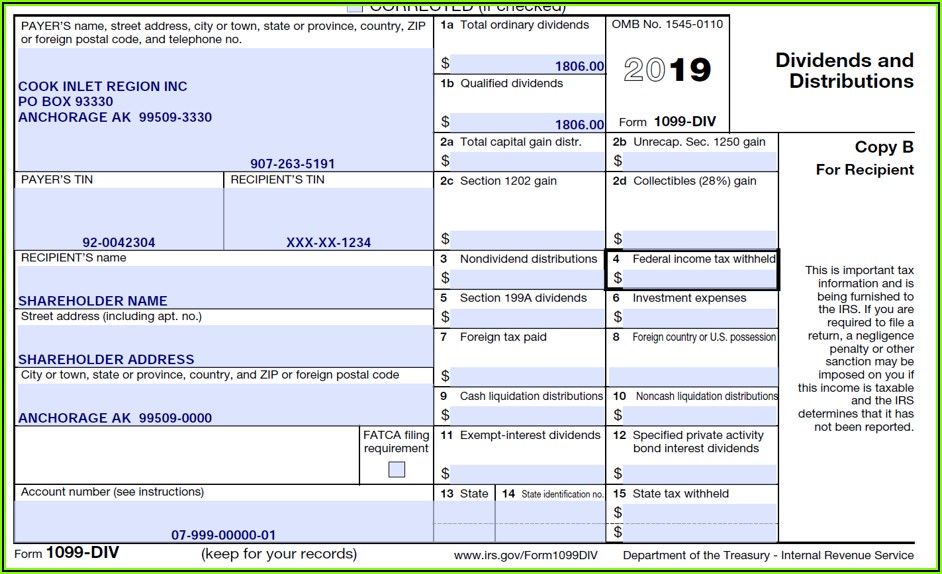

IRIS is a free service that lets you Fill and file Forms 1099 MISC 1099 NEC 1099 INT 1099 DIV and more Submit up to 100 records per upload with CSV templates File corrected Forms 1099 Manage issuer information Request automatic extensions to file Forms 1099 Select which type of form you re printing 1099 NEC 1099 MISC or 1096 Print a sample by clicking Print sample on blank paper This will let you see if your printer will fill in those pre printed red forms with all the information in the right boxes

Irs 1099 Misc Printable

Irs 1099 Misc Printable

Irs 1099 Misc Printable

https://4freeprintable.com/wp-content/uploads/2019/06/irs-form-1099-reporting-for-small-business-owners-free-printable-1099-misc-forms.png

The 1099 MISC is a common type of IRS Form 1099 which is a record that an entity or person not your employer gave or paid you money You might have received a 1099 MISC tax form from

Templates are pre-designed documents or files that can be used for different functions. They can save effort and time by offering a ready-made format and design for developing various sort of content. Templates can be utilized for individual or expert projects, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

Irs 1099 Misc Printable

1099 Misc Printable Template Free Printable Templates

Free Printable 1099 Misc Tax Form Template Printable Templates

1099 Misc Printable Template Free

1099 Misc Printable Template Free Printable World Holiday

Where To Mail 1099 Misc To Irs

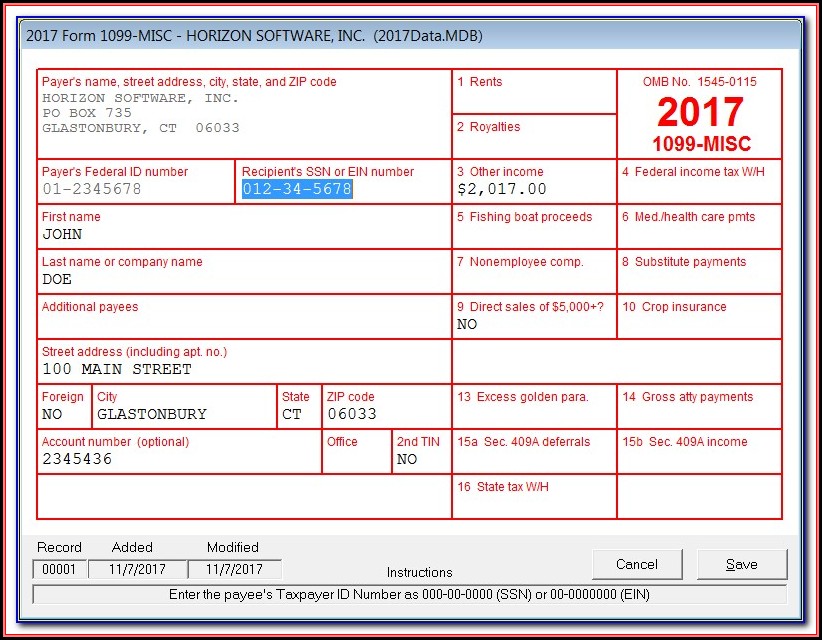

Printable 1099 Misc Form 2017 Pdf Form Resume Examples Bw9jzp497X

https://eforms.com/irs/form-1099/misc

Updated October 19 2023 A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal exchanges and several other specific transactions must be reported to the IRS using this form

https://www.irs.gov/forms-pubs/about-form-1099-misc

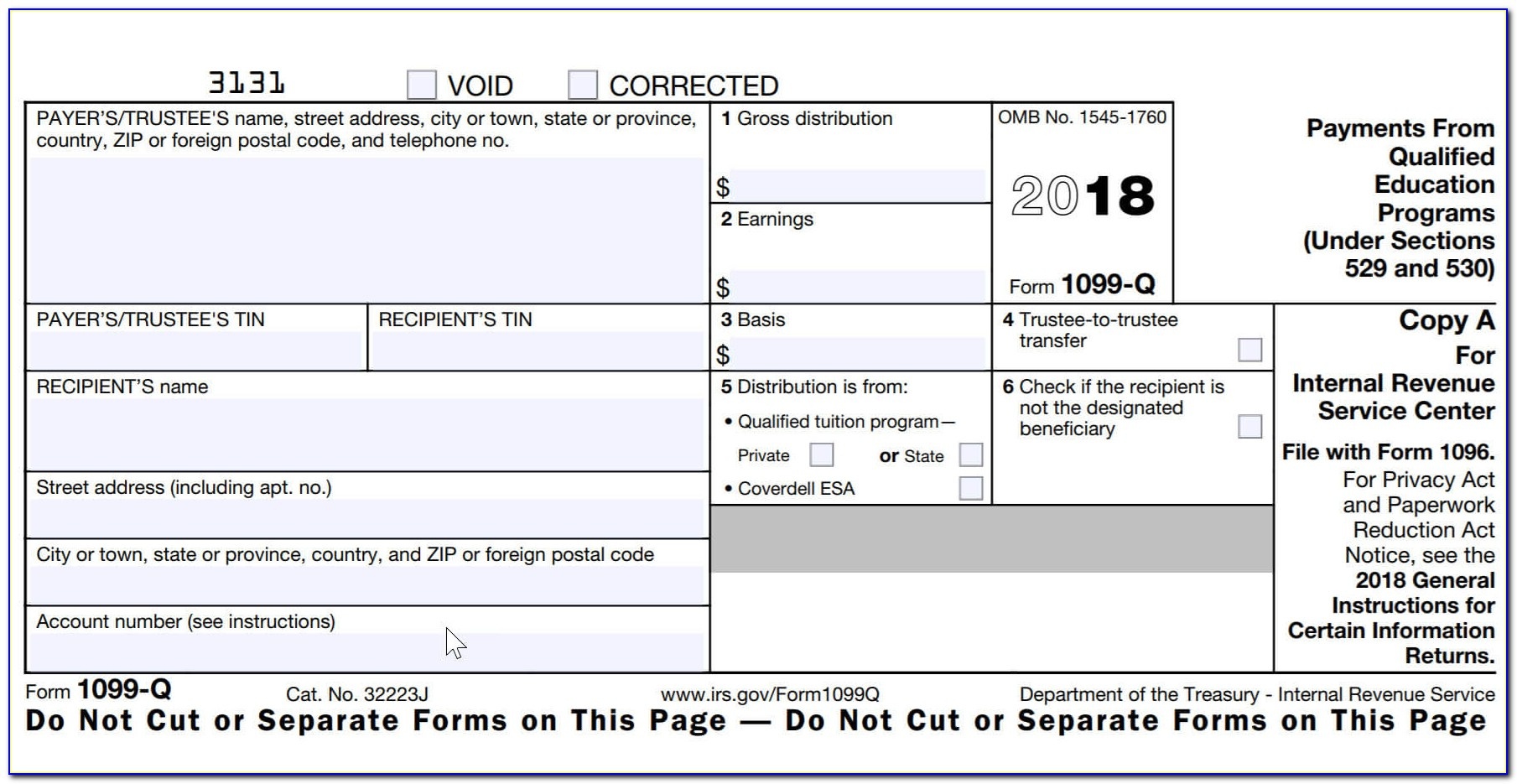

Current Revision Form 1099 MISC PDF Instructions for Forms 1099 MISC and 1099 NEC Print Version PDF Recent Developments Announcement 2021 2 Correction of Forms 1099 MISC for Certain CARES Act Subsidized Loan Payments Other Items You May Find Useful All Form 1099 MISC Revisions Online Ordering for

https://www.irs.gov/pub/irs-prior/f1099msc--2020.pdf

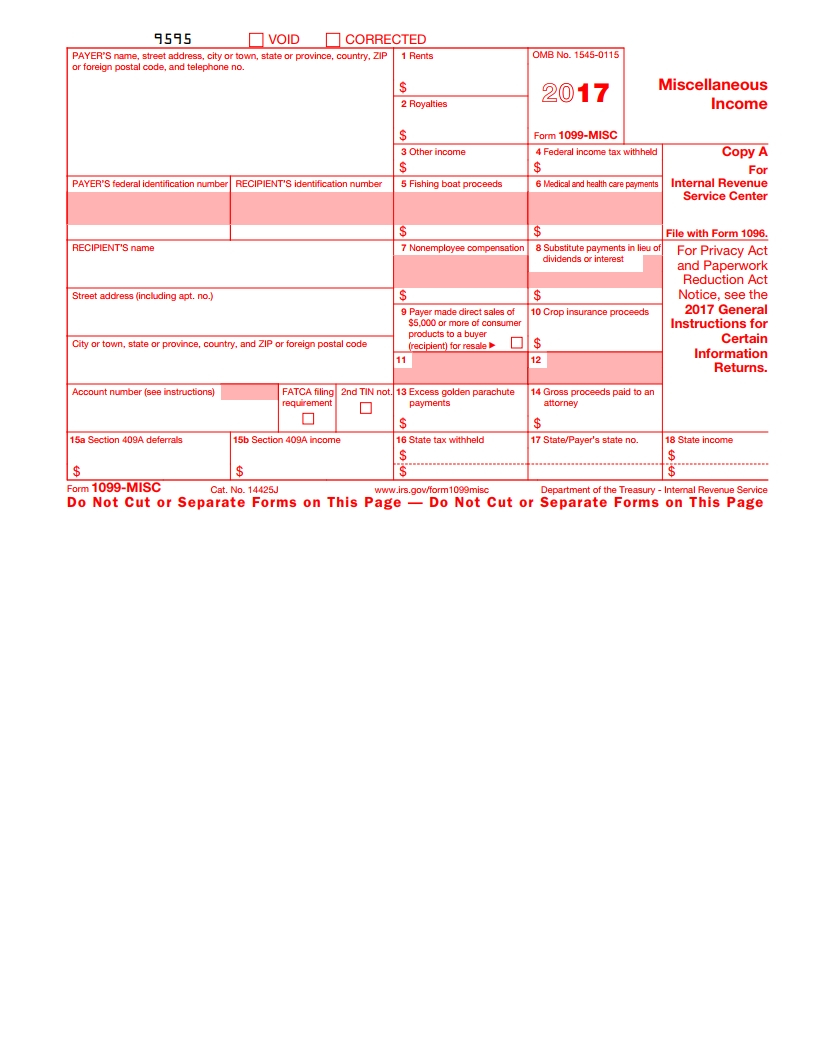

Print and file copy A downloaded from this website a penalty may be imposed for filing with the IRS 1099 MISC 2020 Cat No 14425J Miscellaneous Income Copy A For Internal Revenue Service Center Department of the Treasury Internal Revenue Service To be filed with recipient s state income tax return when required

https://www.irs.gov/instructions/i1099mec

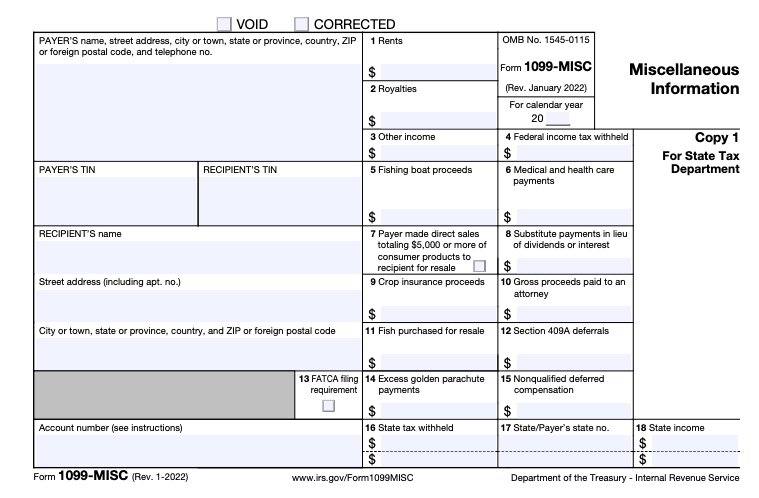

Instructions for Forms 1099 MISC and 1099 NEC 01 2022 Miscellaneous Information and Nonemployee Compensation Section references are to the Internal Revenue Code unless otherwise noted Revised 01 2022 Instructions for Forms 1099 MISC and 1099 NEC Introductory Material Future Developments

https://www.irs.gov/pub/irs-pdf/i1099mec.pdf

For further information see the instructions later for box 2 Form 1099 NEC or box 7 Form 1099 MISC Online fillable copies To ease statement furnishing requirements Copies B C 1 and 2 have been made fillable online in a PDF format available at IRS gov Form1099MISC and IRS gov Form1099NEC

IRS Form 1099 MISC is used by any company that pays an individual or external company in excess of 600 in any calendar year or 10 in royalties including Rents Prizes and awards Medical and health care payments Crop insurance proceeds Fishing boat proceeds Section 409A deferrals Nonqualified deferred compensation Get printable IRS Form 1099 for 2022 2023 Download the 1099 tax form in PDF or fill it out online and print it Follow our guides to complete the 1099 MISC related Schedules

Starting with the tax year of 2020 a 1099 MISC Form is meant to be filed for every person i e non employee you have paid over 600 for an assorted list of miscellaneous business payments The list of payments that require a business to