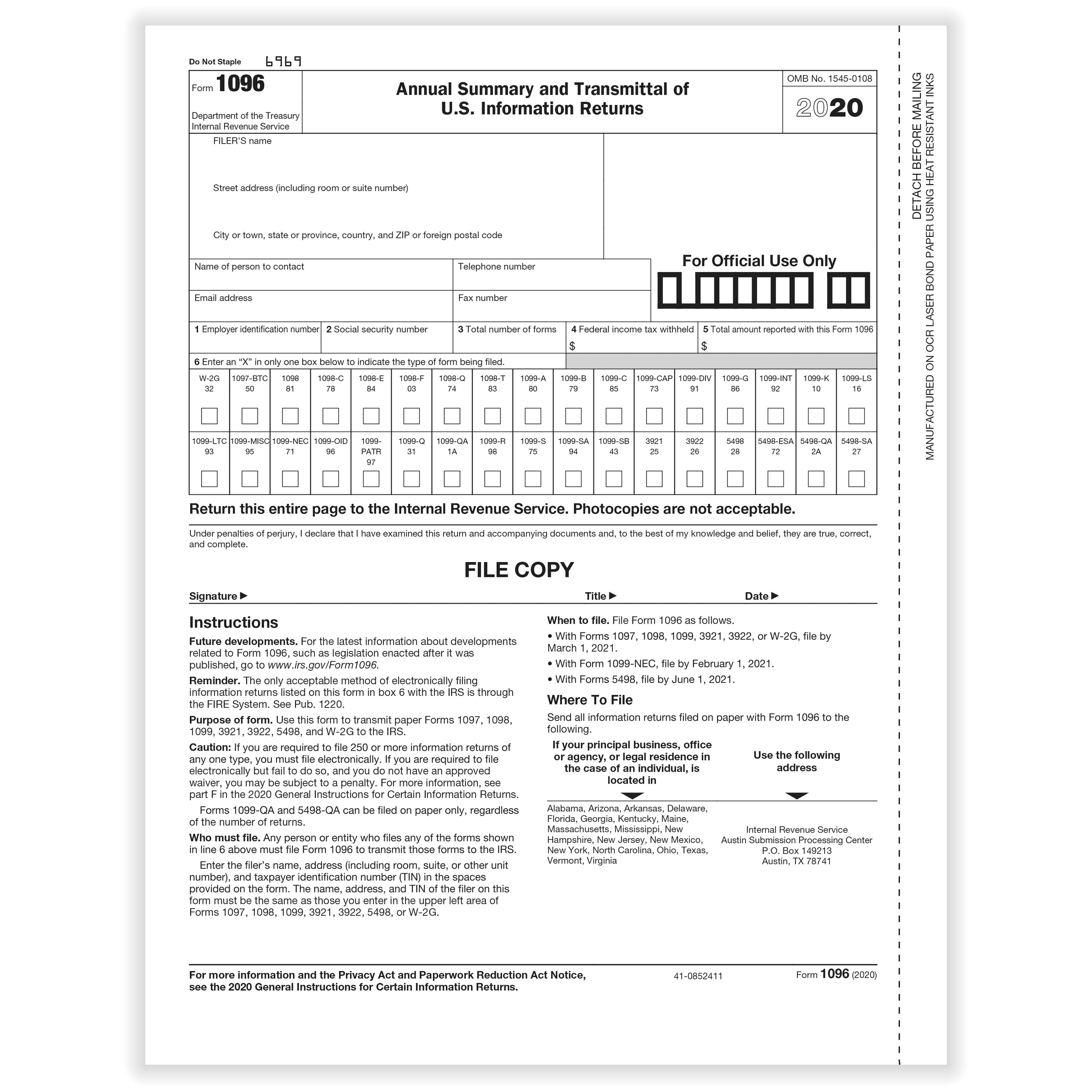

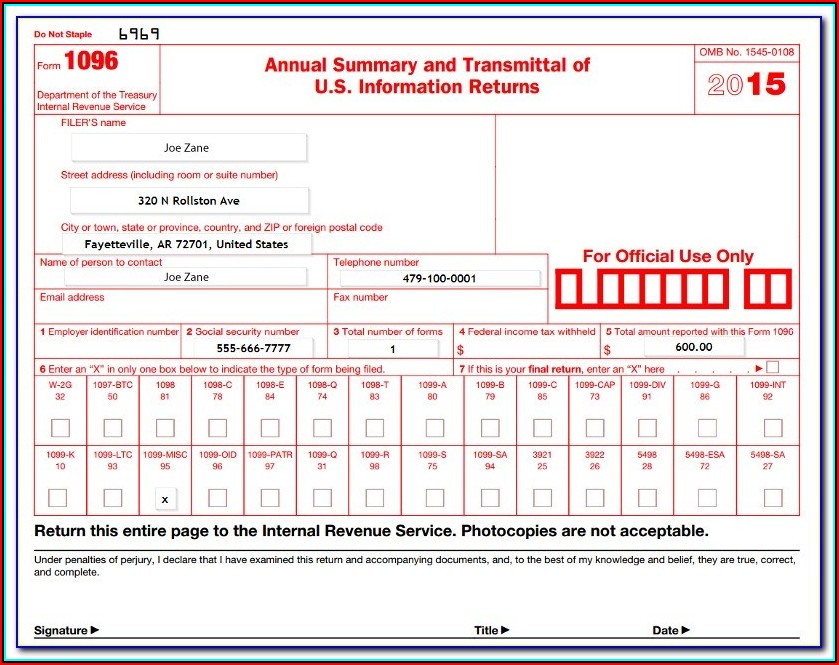

Irs 1096 Printable Form Create My Document IRS Form 1096 is a tax form used by tax tempt organizations when they prepare their federal filings It is better known as an Annual Summary and Transmittal of US Information Returns

No In order for the IRS to process Form 1096 you must submit a scannable version of the document which you have to order from the IRS ahead of time Printing a PDF of the form from the IRS website will result in a document that cannot be scanned by the IRS Submitting one of those to the IRS could result in a penalty IRS Form 1096 is a summary and transmittal tax form that gives the IRS information on the Forms 1097 1098 1099 3921 3922 5498 or W 2G your company sent out to other recipients Your business needs to use it only when you submit those forms to the IRS in a paper format

Irs 1096 Printable Form

Irs 1096 Printable Form

Irs 1096 Printable Form

https://i2.wp.com/universalnetworkcable.com/wp-content/uploads/2019/03/irs-form-1096-fillable.gif

Form 1096 officially the Annual Summary and Transmittal of U S Information Returns is an Internal Revenue Service IRS tax form used in the United States used to summarize information returns being sent to the IRS Information returns are sent by the issuer to recipients as well as the IRS but Form 1096 is not sent to the recipients rather it is only

Templates are pre-designed documents or files that can be used for numerous functions. They can save time and effort by offering a ready-made format and design for developing different kinds of material. Templates can be used for personal or expert projects, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

Irs 1096 Printable Form

1096 Transmittal Form L1096

Free Printable 1096 Form Printable Templates

5100 L1096 1096 2018 Universal Network

Irs 1096 Template To Fillable Form Printable Forms Free Online

Printable Form 1096 Form R 1096 Download Fillable PDF Or Fill Online

Continuous Tax Form 1096 Summary Transmittal Sheet Free Shipping

https://www.irs.gov/pub/irs-prior/f1096--2021.pdf

Attention filers of Form 1096 This form is provided for informational purposes only It appears in red similar to the official IRS form The official printed version of this IRS form is scannable but a copy printed from this website is not Do not print and file a Form 1096 downloaded from this website a

https://www.irs.gov/forms-pubs/about-form-1096

Information about Form 1096 Annual Summary and Transmittal of U S Information Returns including recent updates related forms and instructions on how to file Form 1096 is used by filers of paper Forms 1099 1098 5498 and W 2G to transmit copies to IRS not used to transmit electronically

https://www.nerdwallet.com/article/small-business/form-1096

In order to correctly file IRS Form 1096 you ll complete the form for each of your information returns remembering that you must use an official version of Form 1096 and not print

https://news.bloombergtax.com/payroll/irs-releases-2023-form-1096

The 2023 transmittal form for Forms 1099 and other information returns was released April 14 by the Internal Revenue Service Compared to the 2022 form the 2023 Form 1096 Annual Summary and Transmittal of US Information Returns removes language about a potential change to the e filing threshold

https://intuitmarket.intuit.com/tax-forms/1096-forms

IRS Form 1096 is officially named the Annual Summary and Transmittal of U S Information Returns by the IRS It s used to summarize details about other tax forms that you are submitting but only if you are submitting them in paper form

How it works Browse for the 1096 form Customize and eSign 1096 Send out signed irs form 1096 or print it What makes the 1096 form legally binding Because the society ditches office work the completion of paperwork more and more takes place electronically The 1096 isn t an exception Free Printable 1096 Form There is not an online free printable Form 1096 The IRS requires that Form 1096 be scannable for ease of processing so you must order Form 1096 from them ahead of time The form is still free but you ll need to visit www IRS gov orderforms to order the forms

Perform your docs within a few minutes using our simple step by step instructions Get the IRS 1096 you require Open it using the cloud based editor and begin altering Fill the blank areas engaged parties names places of residence and phone numbers etc Change the blanks with unique fillable fields Include the particular date and place