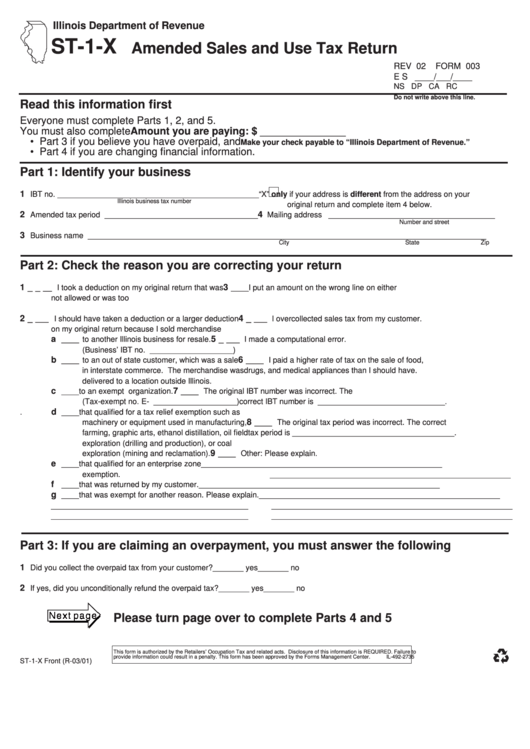

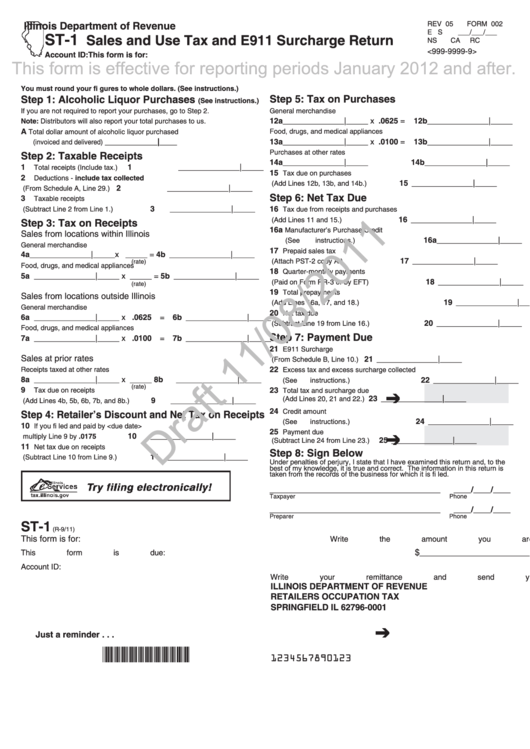

Illinois St 1 Form Printable ID s on Schedule RE and attach to Form ST 1 X b to an out of state customer and it was delivered to a location outside Illinois c to an exempt organization List the tax exempt E number s on Schedule RE and attach to Form ST 1 X d that qualifies for a tax exemption for machinery or equipment used in manufacturing farming or

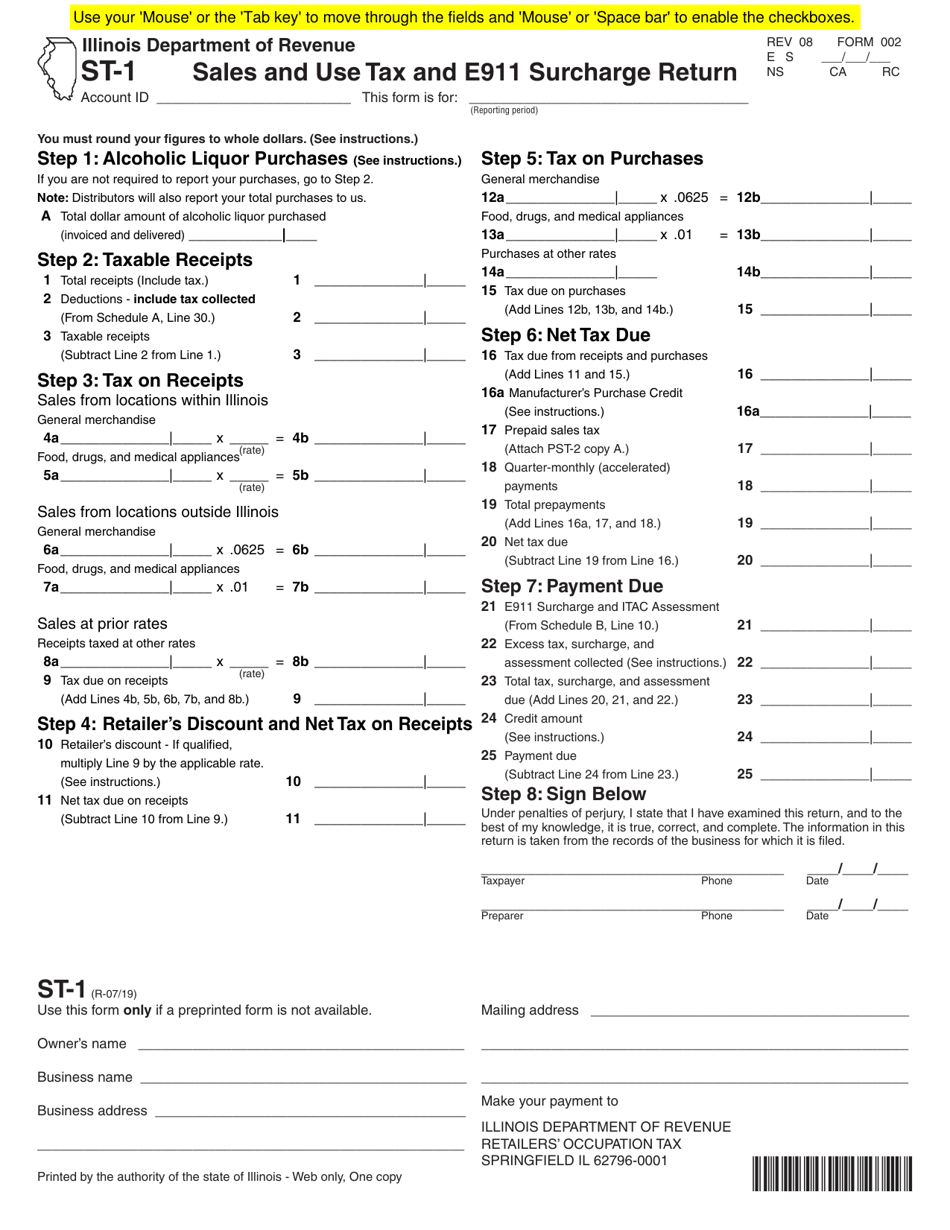

ST 1 Instructions R 0717 Who must file Form ST 1 You must file Form ST 1 Sales and Use Tax and E911 Surcharge Return if you are making retail sales of any of the following in Illinois general merchandise qualifying foods drugs and medical appliances and or prepaid wireless telecommunications service St 1 Form Use a illinois st 1 form 2022 template to make your document workflow more streamlined Show details How it works Browse for the illinois st 1 form printable Customize and eSign st 1 Send out signed illinois st 1 or print it What makes the illinois st 1 form printable legally binding

Illinois St 1 Form Printable

Illinois St 1 Form Printable

Illinois St 1 Form Printable

https://www.pdffiller.com/preview/65/562/65562599/large.png

The Form 15 ST 1 Sales and Use Tax and Illinois form is 2 pages long and contains 0 signatures 0 check boxes 200 other fields Country of origin US File type PDF BROWSE ILLINOIS FORMS Fill has a huge library of thousands of forms all set up to be filled in easily and signed Fill in your chosen form Sign the form using our drawing tool

Pre-crafted templates offer a time-saving solution for producing a diverse variety of documents and files. These pre-designed formats and designs can be made use of for different personal and expert tasks, consisting of resumes, invitations, leaflets, newsletters, reports, presentations, and more, improving the content production procedure.

Illinois St 1 Form Printable

St 1 Sales Tax Form Australian Examples User Tutorials

Illinois St 1 Form Printable Printable World Holiday

Illinois St 1 Form Printable Printable World Holiday

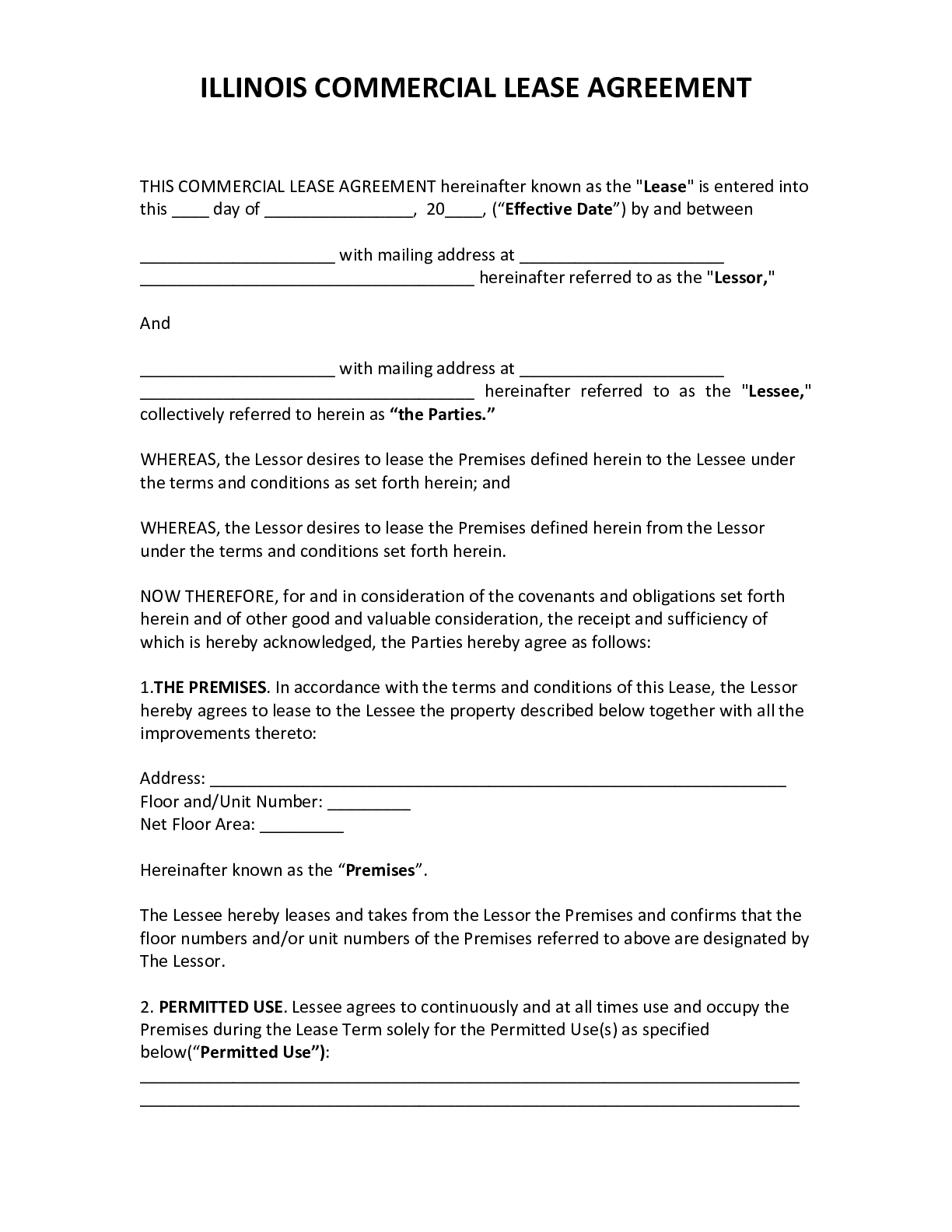

Illinois Lease Agreement Form Pdf Printable Form Templates And Letter

Download Instructions For Form ST 1 X 003 Amended Sales And Use Tax

How To Fill Out Illinois ST 1 Form Quarterly Monthly Tax YouTube

https://tax.illinois.gov/forms/sales/st-1.html

Forms Sales Use Tax Forms ST 1 Sales and Use Tax and E911 Surcharge Return For Reporting Periods January 2019 and After

https://tax.illinois.gov/forms/sales/salesandusetax.html

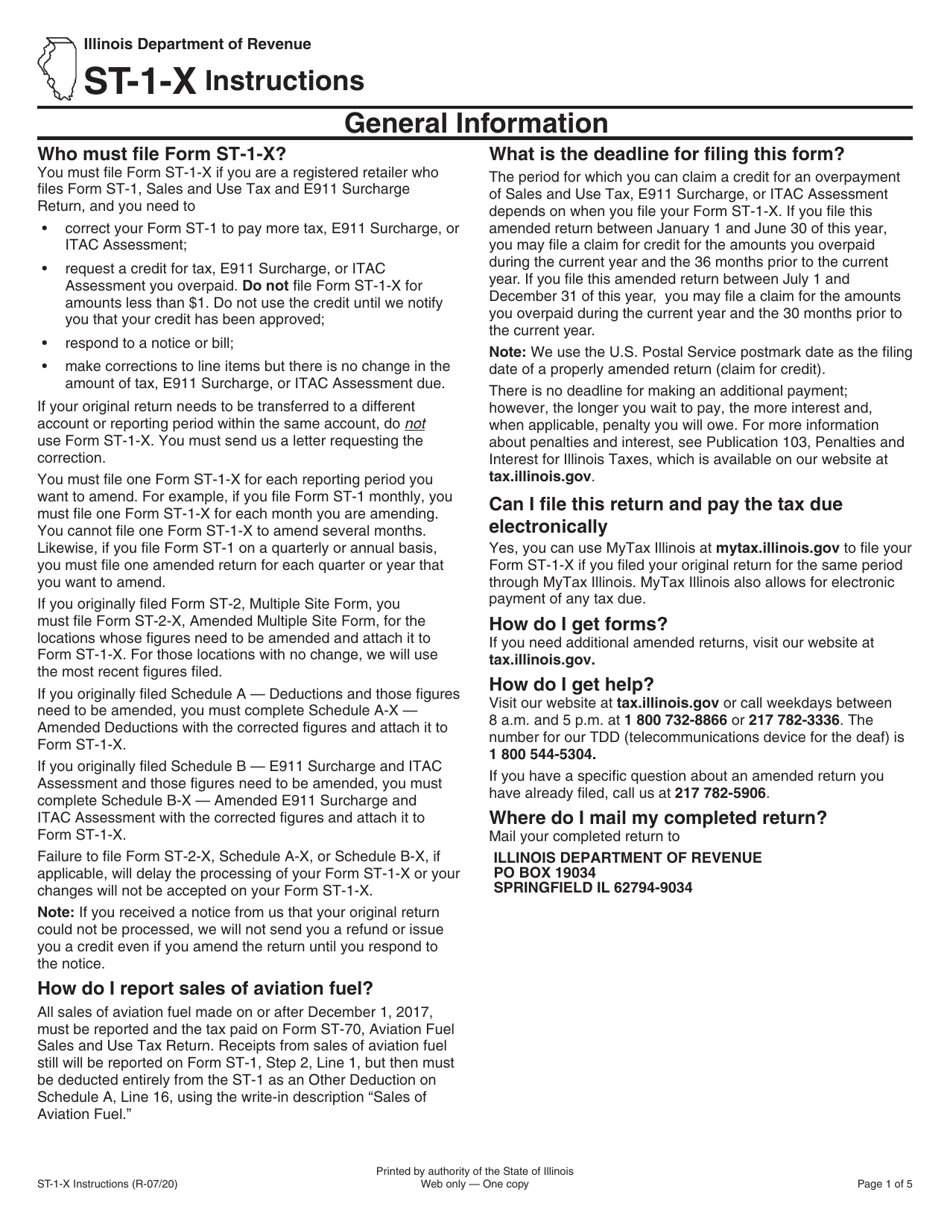

ST 1 Instructions Sales and Use Tax and E911 Surcharge Return Instructions updated 07 08 2022 to include information for Schedule GT Sales and Use Tax Holiday and Grocery Tax Suspension Schedule Instructions apply to the current ST 1 and for all prior periods Sch GT Instructions

https://tax.illinois.gov//forms/sales/documents/sales/st-1-inst…

Who must file Form ST 1 You must file Form ST 1 Sales and Use Tax and E911 Surcharge Return if you are making retail sales of any of the following in Illinois general merchandise qualifying foods drugs and medical appliances and or prepaid wireless telecommunications service

https://d2l2jhoszs7d12.cloudfront.net/state/Illinois/Illinois

This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed Disclosure of this information is ST 1 back R 07 17 required Failure to provide information may result in this form not being processed and may result in a penalty IDOR ST 1 Account ID

https://www.formalu.com/forms/41286/sales-and-use-tax-and-e911

Sales and Use Tax and E911 Surcharge Return Instructions ST 1 Department of Revenue Government Form in Illinois Formalu

Use a st 1 form illinois template to make your document workflow more streamlined Show details How it works Upload the illinois st 1 form Edit sign illinois st1 from anywhere Save your changes and share st1 tax Handy tips for filling out St 1 form illinois online Printing and scanning is no longer the best way to manage documents 1st Quarter filing due April 20th As a small business e commerce seller in Illinois you are required to collect and file Sales and Use Tax form ST 1 To file you can mail in a paper

You must file Form ST 1 X if you are a registered retailer who files Form ST 1 Sales and Use Tax and E911 Surcharge Return and you need to correct your Form ST 1 to pay more tax E911 Surcharge or ITAC Assessment request a credit for tax E911 Surcharge or ITAC Assessment you overpaid Do not file Form ST 1 X for amounts less than 1