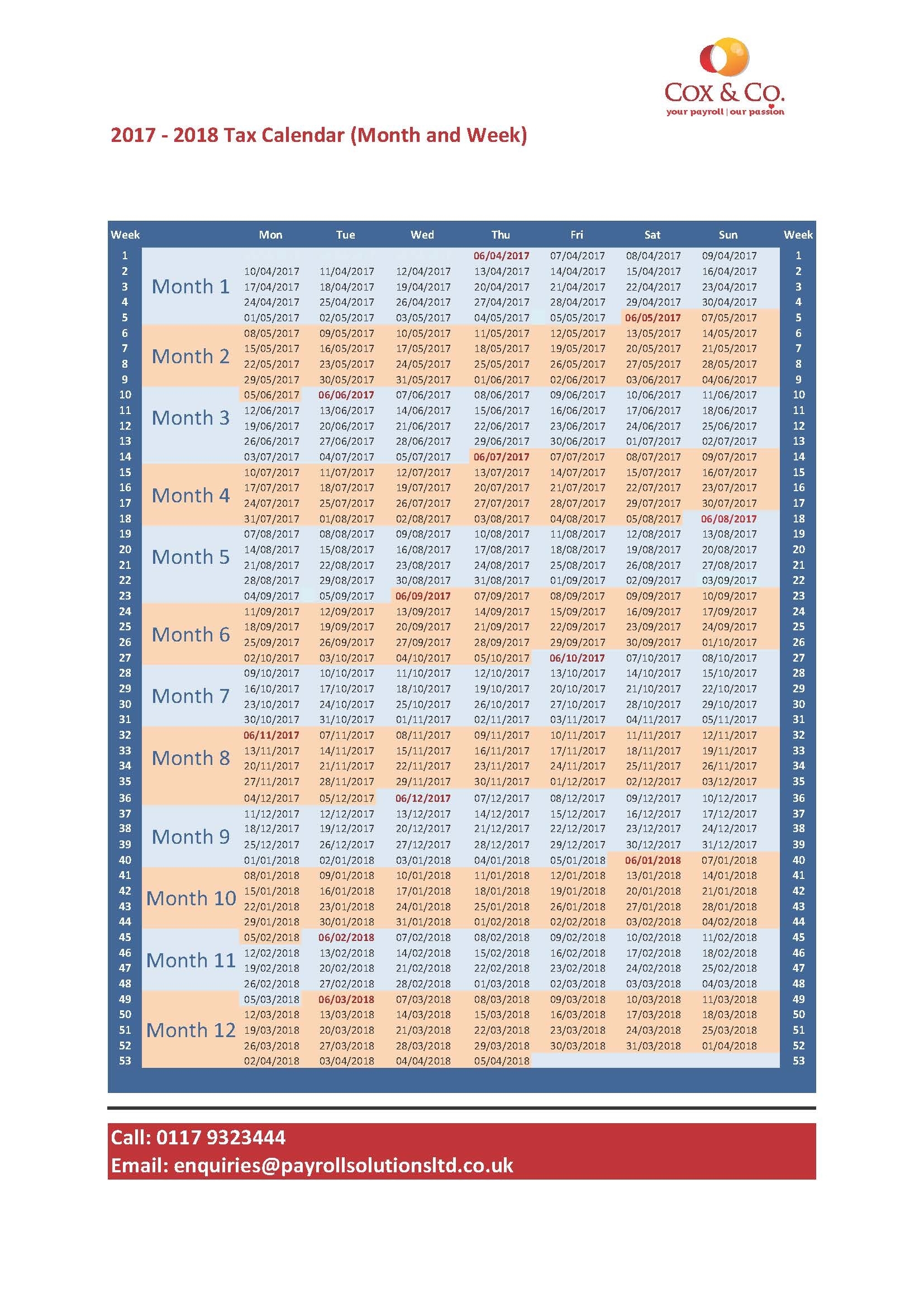

Hmrc End Of Year Tax Printable The last tax year started on 6 April 2022 and ended on 5 April 2023 Deadline for telling HMRC you need to complete a return You must tell HMRC by 5 October if you need to complete a tax

12 February 2018 Form Expenses and benefits reporting PAYE car provided to employee for private use P46 Car 6 April 2022 Form Expenses and benefits working sheets PAYE living Published 27 September 2022 HM Revenue and Customs HMRC is reminding customers who need to complete a tax return for the 2021 to 2022 tax year to let HMRC know by 5 October 2022 They can do

Hmrc End Of Year Tax Printable

Hmrc End Of Year Tax Printable

Hmrc End Of Year Tax Printable

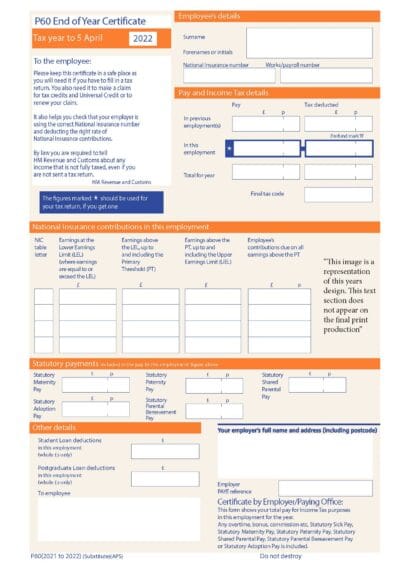

https://c8.alamy.com/comp/2J3R94M/p60-end-of-year-certificate-issued-by-hmrc-in-the-united-kingdom-blank-tax-form-2J3R94M.jpg

Help with filling in your tax return Short Tax Return notes Tax year 6 April 2022 to 5 April 2023 2022 23 Help with filling in your tax return These notes will help you fill in your

Templates are pre-designed files or files that can be utilized for different functions. They can conserve effort and time by offering a ready-made format and layout for developing various type of material. Templates can be used for individual or expert projects, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

Hmrc End Of Year Tax Printable

HMRC Is Shite Poll Favours Change In Tax Year End

Sage P60 2021 2022 HMRC End Of Year Self Seal Mailer SCP60 Pack Of 10

Sage P60 2021 2022 HMRC End Of Year Self Seal Mailer SCP60 Pack Of 10

Sage 2022 2023 P60 HMRC End Of Year Form SSPP60 Pack Of 100

Hmrc Tax Year Calendar 2021

UK Payroll Tax Calendar 2022 2023 Shape Payroll

https://www.gov.uk/government/publications/self-assessment-tax-return

If you decide to fill in your tax return online or you miss the paper deadline you must send it online by 31 January 2023 or 3 months after the date on your notice to complete a tax return if

https://www.gov.uk//file-your-tax-return-early

Updated 16 May 2023 You don t have to wait until January to file your Self Assessment tax return as soon as the tax year ends you can submit your tax return at a time that suits you In

https://www.gov.uk/guidance/annual-tax-summary

Find a breakdown of how public spending has been calculated in annual tax summaries Get an estimate of the Income Tax and National Insurance you will pay in the current tax year by using

https://assets.publishing.service.gov.uk/government/uploads/sys…

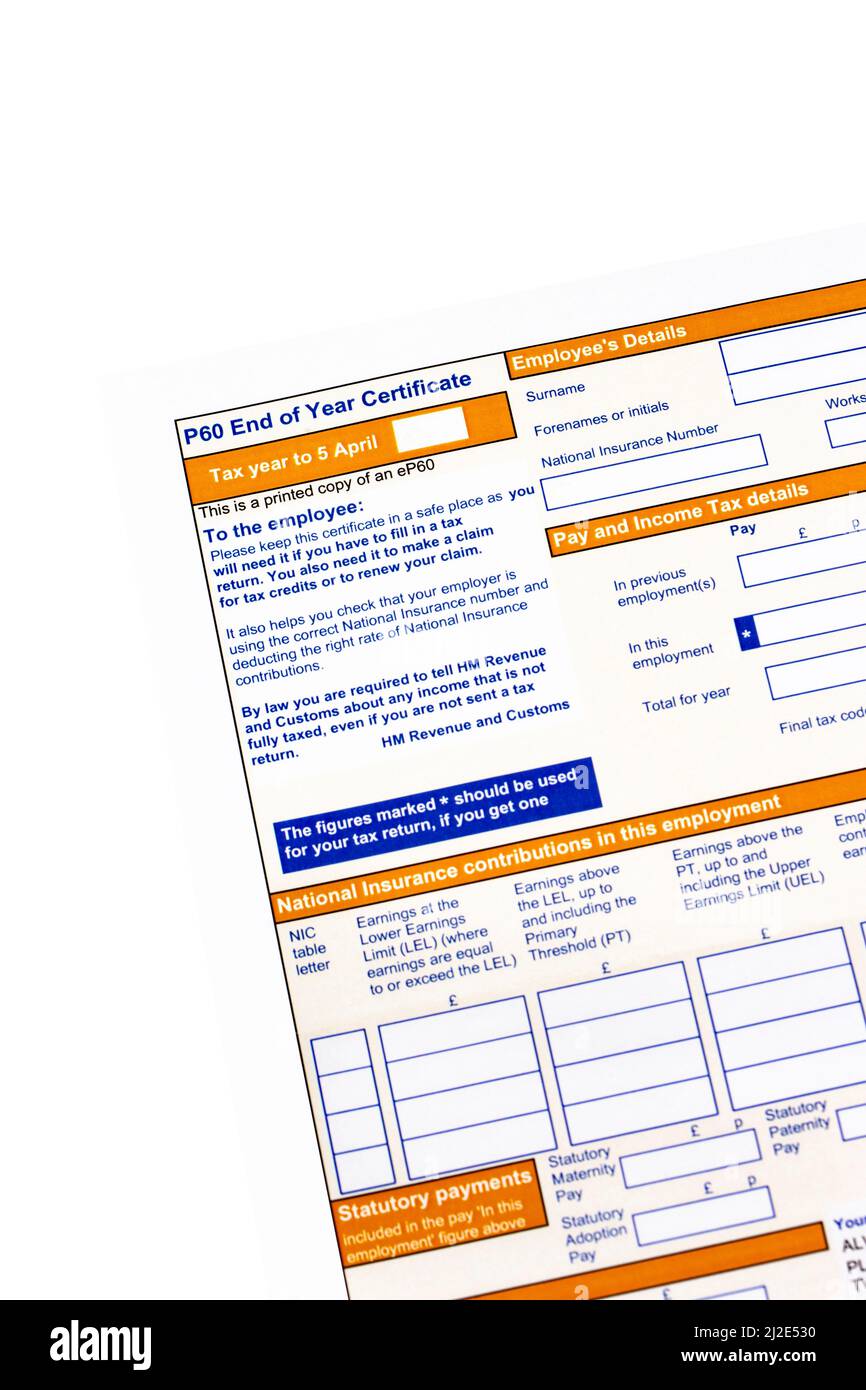

At the end of each tax year HMRC send customers an End of Year Tax Calculation P800 if they have under or overpaid their taxes This personalised letter indicates whether the recipient

https://assets.publishing.service.gov.uk/government/uploads/sys…

Tax year 6 April 2020 to 5 April 2021 2020 21 Please read the Self employment full notes to check if you should use this page or the Self employment short page For help filling in

Print the form Sign the declaration Post to HMRC What happens next Once we have received your completed claim we will confirm if you are owed a refund or contact you if we need more information Print this page Self Assessment Use supplementary pages SA103F to record self employment income on your SA100 Tax Return if your annual turnover was above the VAT threshold for the tax year

Download issues with HMRC Online End of Year Expenses and Benefits Software Before Adobe Reader will allow you to view print or submit the HMRC downloadable software you will need to