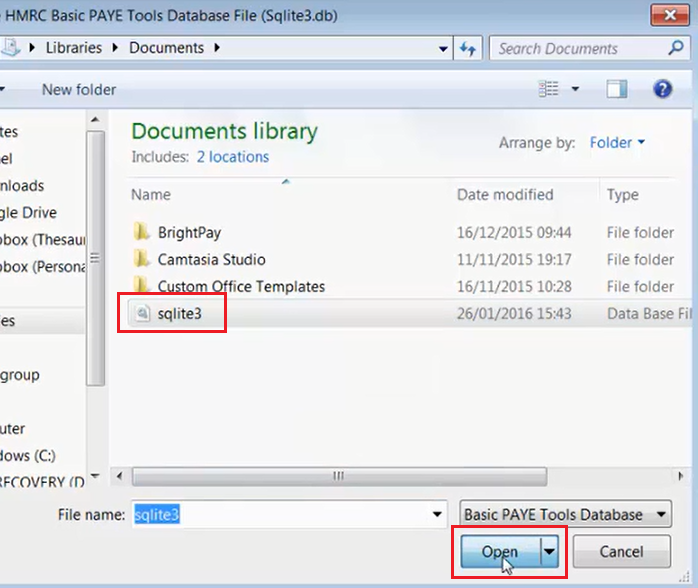

Hmrc Basic Paye Tools Printable Iwantto install Basic PAYE Tools Real Time Informationon one networked computer ordrive and run it from multiple computers and store the database on a network drive ornetwork computer which all computers will share Note Basic PAYE Tools Real Time Information is not designed to support multiple computers accessing the same database

This is the user guide for the Basic PAYE Tools Before you use this guide you need to have already done the following Registered as an employer with HMRC Enrolled to use HMRC online This is the Basic PAYE Tools guide for What to do when an employee leaves It explains the steps you need to follow when an employee leaves and the order in which they need to be done This guide is intended for use if you are currently using the Basic PAYE Tools to operate payroll

Hmrc Basic Paye Tools Printable

Hmrc Basic Paye Tools Printable

Hmrc Basic Paye Tools Printable

https://windows-cdn.softpedia.com/screenshots/Basic-PAYE-Tools_3.png

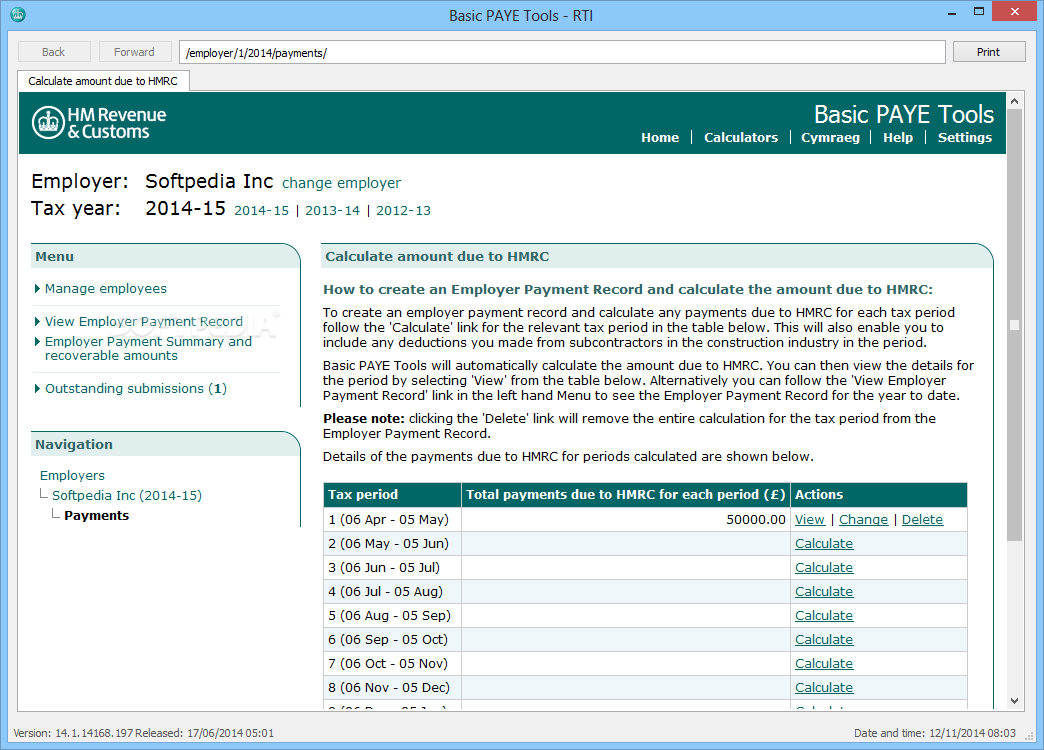

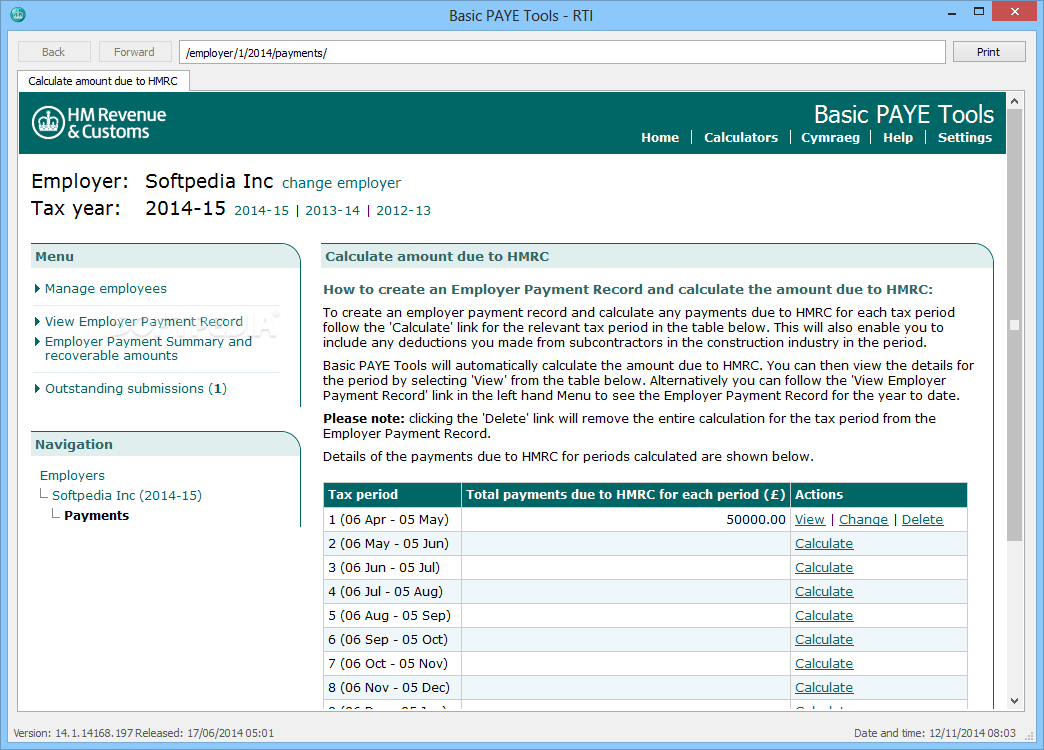

View a printable version of the whole guide Regular payroll tasks record employee pay calculate deductions give payslips report to and pay HMRC view the balance of what you owe HMRC

Templates are pre-designed documents or files that can be utilized for different functions. They can save time and effort by offering a ready-made format and layout for developing different type of material. Templates can be used for individual or expert jobs, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

Hmrc Basic Paye Tools Printable

Basic PAYE Tools User Guide GOV UK

Importing From HMRC Basic PAYE Tools BrightPay Documentation

Basic PAYE Tools User Guide GOV UK

8 Software Every Small Business Should Consider Using

Basic PAYE Tools User Guide GOV UK

Basic PAYE Tools User Guide GOV UK

https://www.gov.uk/government/publications/basic-paye-tools-user-guid…

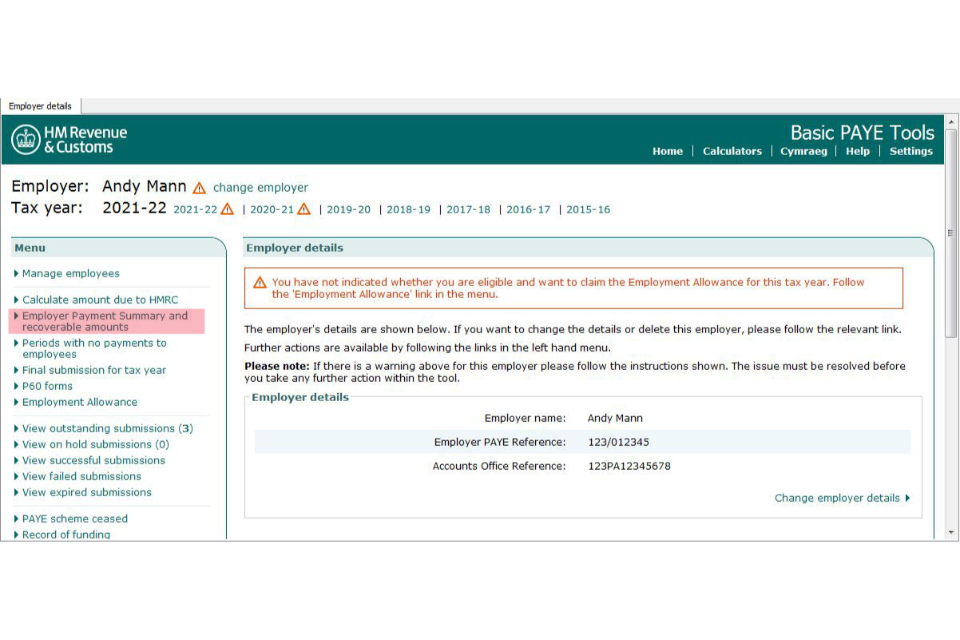

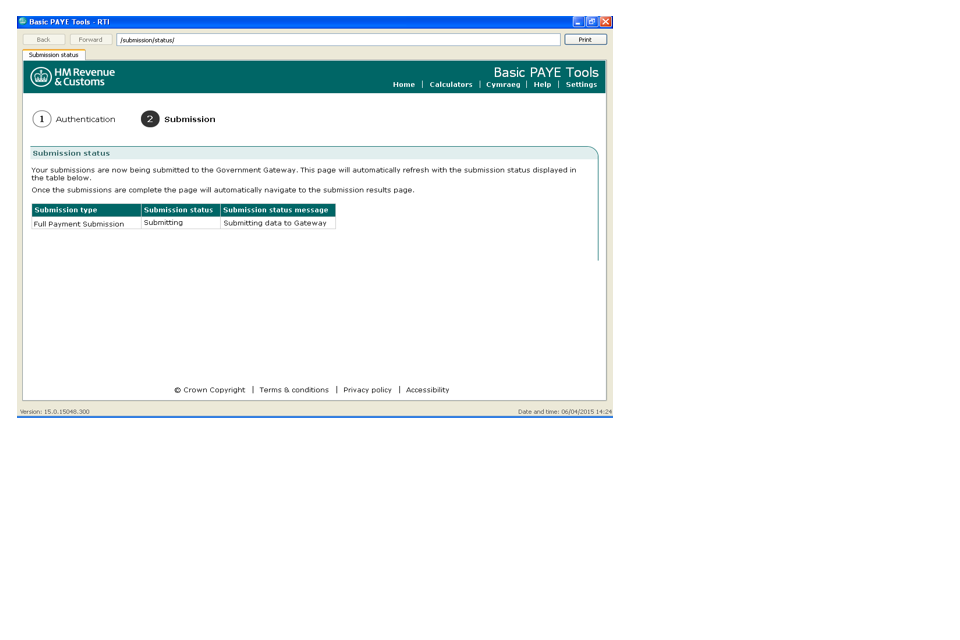

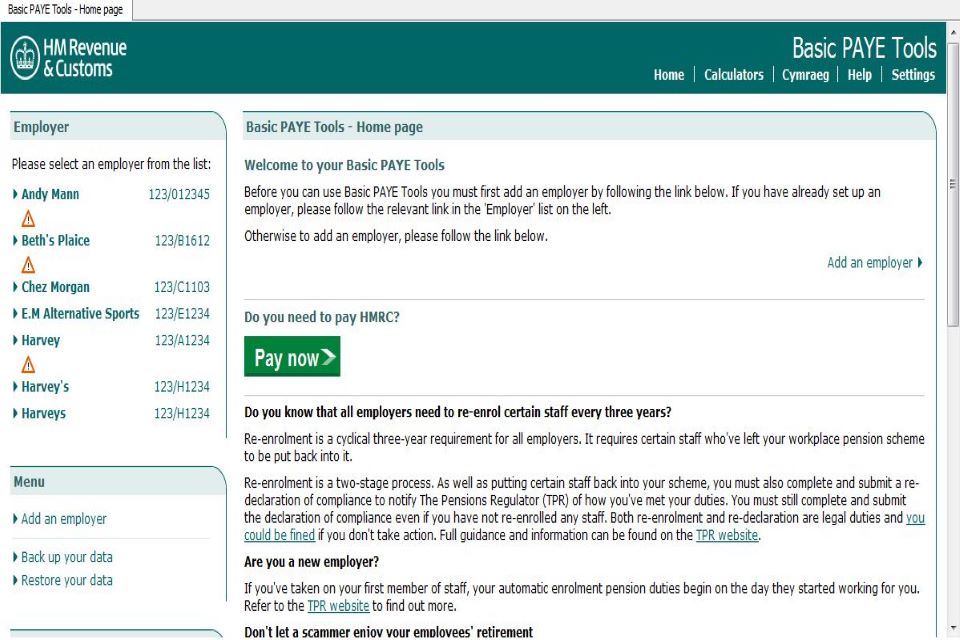

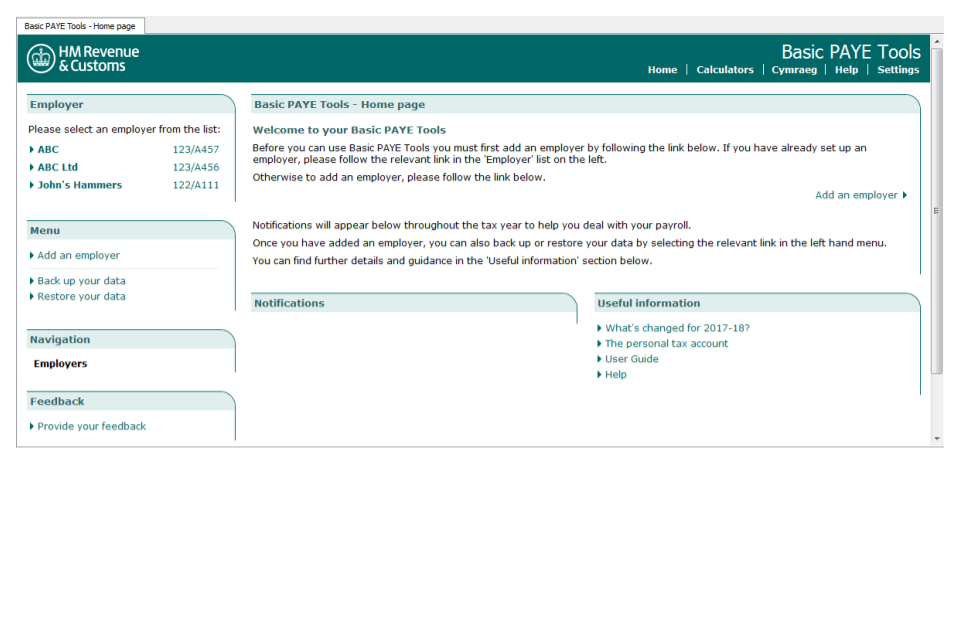

Updated 29 June 2021 This guide will help you when using Basic PAYE Tools BPT It contains examples of screens you ll see in BPT and includes simple to follow instructions You can use

https://www.gov.uk/government/publications/basic-paye-tools-first-time

At that stage you may want to read and maybe print the user guide All users Using Basic PAYE Tools Step 1 Register as an employer with HMRC and enrol to use online services To start using BPT

https://www.gov.uk/government/publications/basic-paye-tools-user-guide

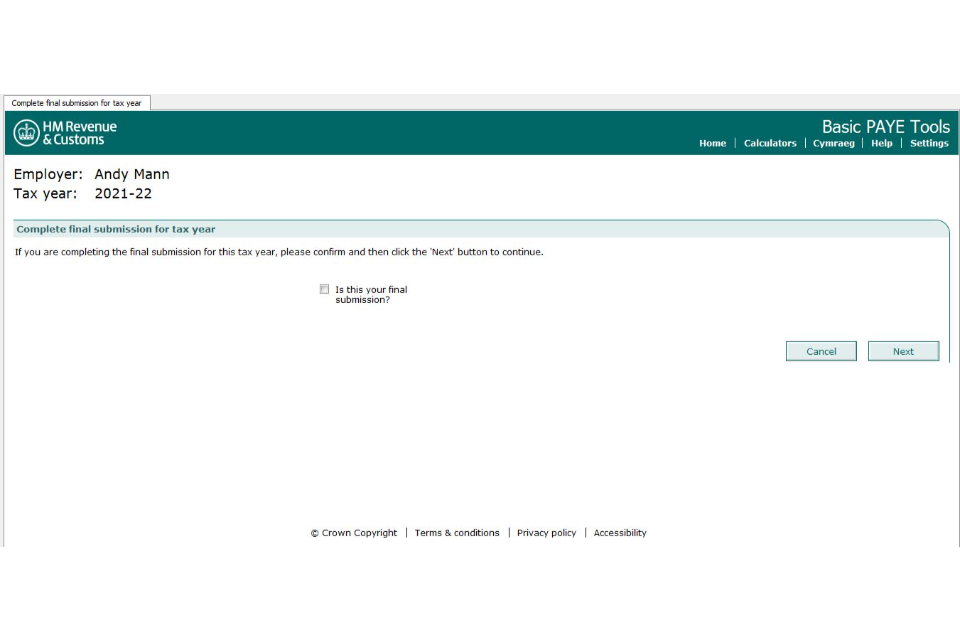

Get step by step help on using Basic PAYE Tools including how to send your final payroll report and amending or correcting details From HM Revenue Customs Published

https://www.gov.uk/government/publications/basic-paye-tools-what-to-do

Now that you ve sent the leaver details to HMRC you can view and print the P45 Follow these steps from the home page select the employer name select the Manage employees link

https://www.gov.uk/government/publications/basic-paye-tools-first-time

Home PAYE Guidance First time users how to download and install Basic PAYE Tools English Cymraeg Step by step help on downloading and installing Basic PAYE Tools onto your computer

HMRCs Basic PAYE Tools User guide Topics manualzilla manuals Collection manuals contributions manuals additional collections Addeddate 2021 05 23 15 53 34 Identifier manualzilla id 6893918 31 July 2019 HMRC s Basic PAYE Tools user guide has been updated for the 2019 20 tax year Basic PAYE Tools is free payroll software from HM Revenue and Customs HMRC for businesses with fewer than 10 employees The guide will help you when using Basic PAYE Tools BPT and can be used from 6 April 2019

HMRC s Basic PAYE Tools will also be updated to calculate the correct National Insurance contributions from 6 November 2022 and therefore if you are a user of Basic PAYE Tools you should make sure you install this new update which will be available to download from 4 November 2022 For any employee payments due on or