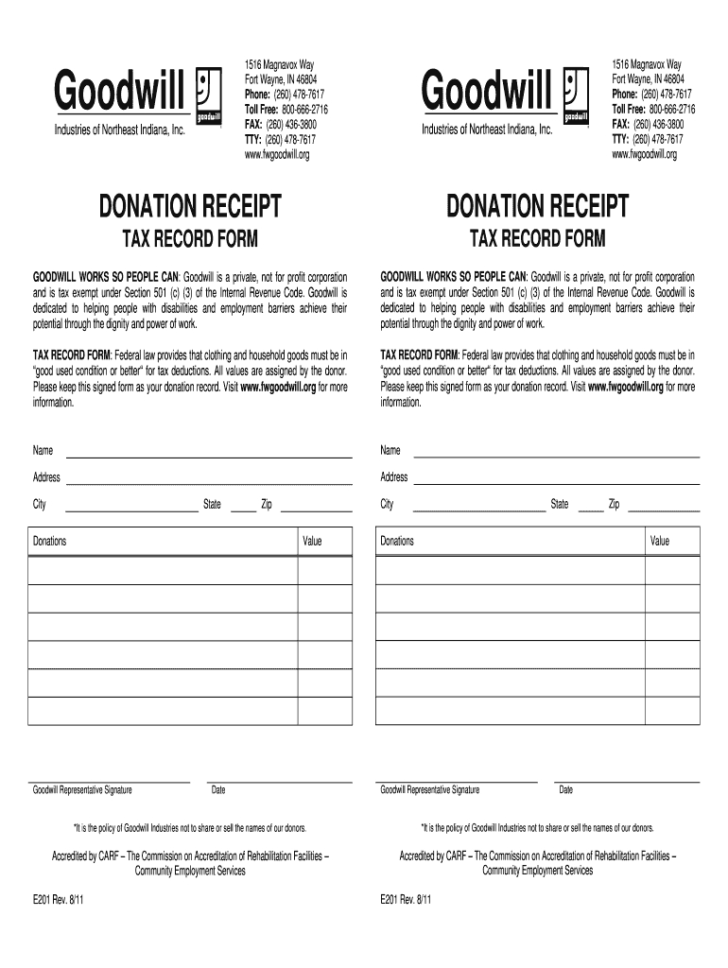

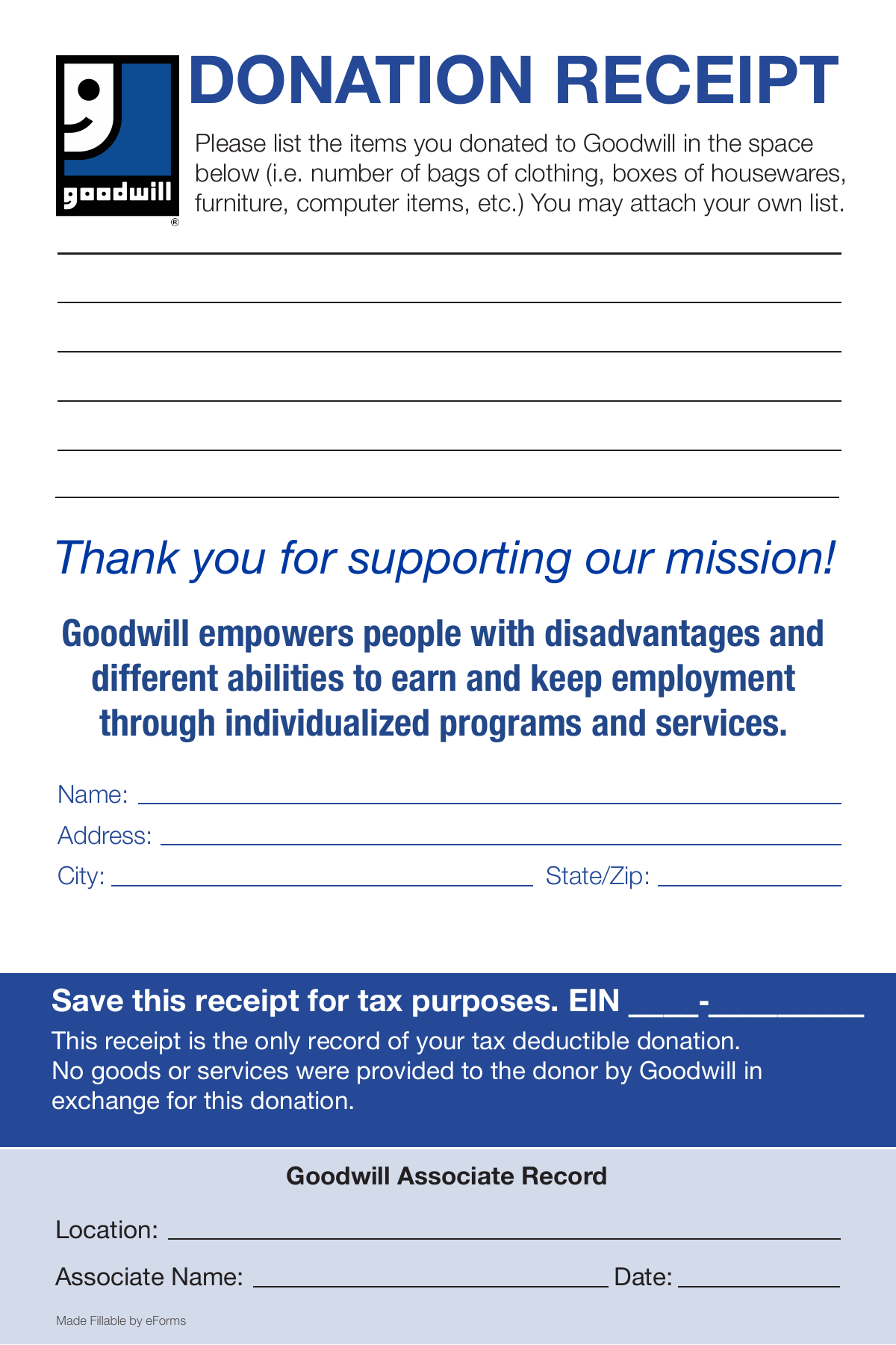

Goodwill Pennsylvania Printable Tax Receit This step by step guide will help you fill output the donation tax receipt and get things in order for tax season This form is ready at the time away donation from our stores or giving centers in Maine New Hampshire and Vermont

Your receipt is the only record of your tax undoubtable donation No goods press professional inhered provided the which donor by Asset of Southwestern Pennsylvania in exchange for this donation Your receipt is the only record of your tax excess donation No goods or related were provided to the donor by Goodwill of Sun Pennsylvania in exchange for this offering

Goodwill Pennsylvania Printable Tax Receit

Goodwill Pennsylvania Printable Tax Receit

Goodwill Pennsylvania Printable Tax Receit

https://www.gwoutletstorelocator.com/wp-content/uploads/2015/08/PA-goodwill-outlet-store-Camp-Hill-Pennsylvania-768x449.png

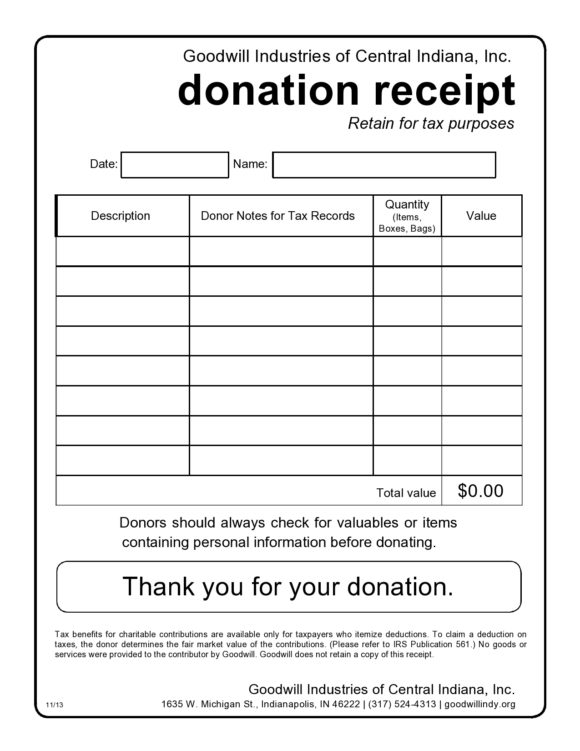

Here you should only provide a correctly completed Goodwill Donation Receipt Total assets worth over 500 USD but don t exceed 5 000 USD To claim this type of tax benefits the declarant needs to provide a Goodwill Donation Receipt and a completed IRS Form 8283 The latter should contain the acquisition process description

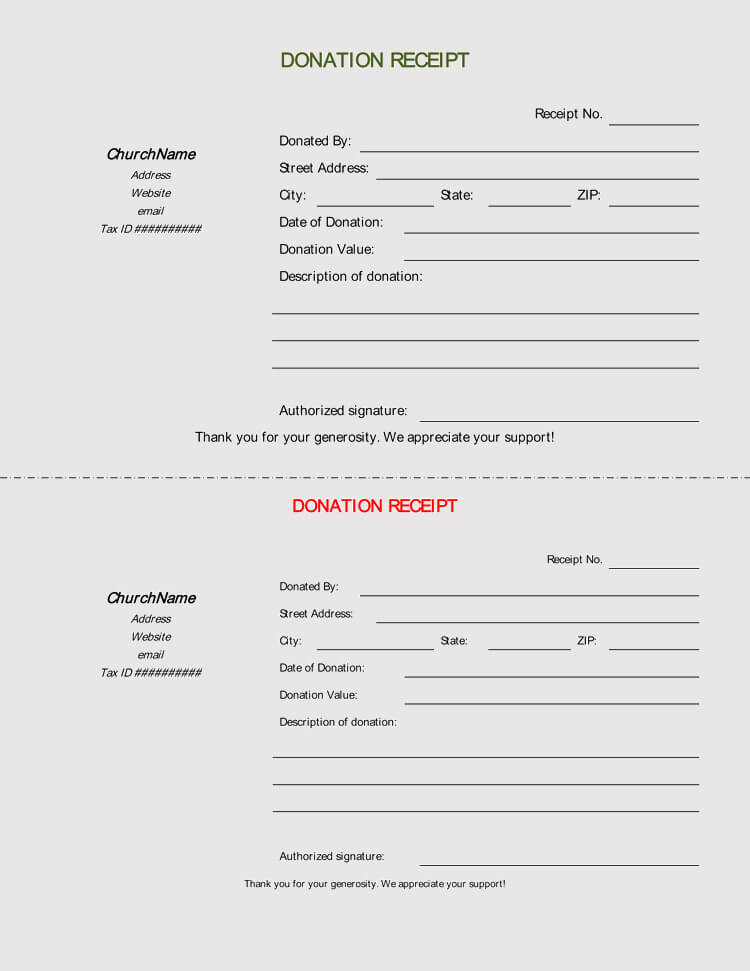

Pre-crafted templates use a time-saving solution for creating a diverse variety of files and files. These pre-designed formats and designs can be used for various personal and professional tasks, including resumes, invitations, leaflets, newsletters, reports, presentations, and more, improving the material production process.

Goodwill Pennsylvania Printable Tax Receit

Tax Value For Donated Items Goodwill TAXW

Pennsylvania Goodwill Outlet Store Centers

Goodwill Donation Receipt Fill Online Printable Fillable Db excel

13 Dental Receipt Templates DOC PDF

Donating Clothes To Charity Tax Deduction Uk Sante Blog

How To Fill Out A Goodwill Donation Tax Receipt Goodwill NNE

https://eforms.com/receipt/donation/501c3/goodwill

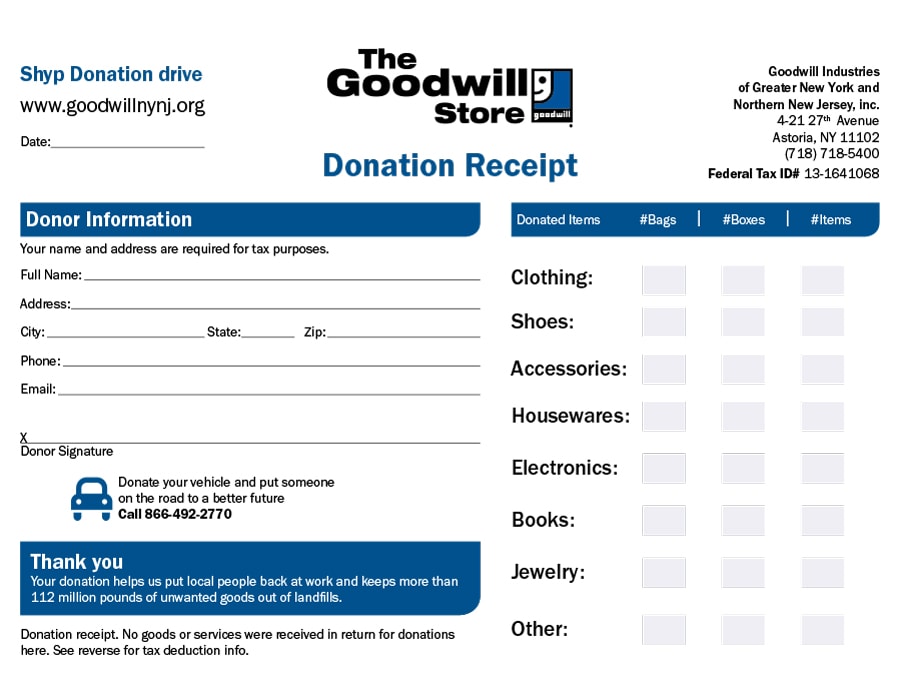

Updated August 13 2023 A Goodwill donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual s taxes A donor is responsible for valuing the donated items and it s important not to abuse or overvalue such items in the event of a tax audit

https://vivintsystems.com/create-good-will-tax-receipt

Your receipt can the only record of your tax deductible donation No stuff or services were provided to aforementioned donor by Goodwill are Southwestern Pennsylvania int exchange forward this donation

https://www.goodwill.org/donors/donation-receipts

A limited number of local Goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax purposes If you donated to a Goodwill in the following areas and need to obtain your donation receipt please use the contact information below

https://pettingzooecolilawyer.com/goodwill-donation-form-template

Will receipt is the only record of your taxing deductible donation No goods or services were provided on the donor by Goodwill of Southwestern Pennsylvania inbound exchange for this present

https://www.gogoodwill.org//2015/11/NewName_Online-Prin…

Print Complete Thanks for donating to Goodwill If you itemize deductions on your Federal tax return you are entitled to claim a charitable deduction for your Goodwill donations Use this receipt when filing your taxes

Your receipt is to only record of your irs deductible donation No goods or services were provided to the donor by Goodwill of Southwestern Pennsylvania in exchange for this donation Read the guidelines for donating to Goodwill

Tax Valuation Guide The U S Internal Revenue Service IRS requires donors to value their items To help guide you Goodwill Industries International has compiled a list providing price ranges for items commonly sold in Goodwill stores Download the PDF