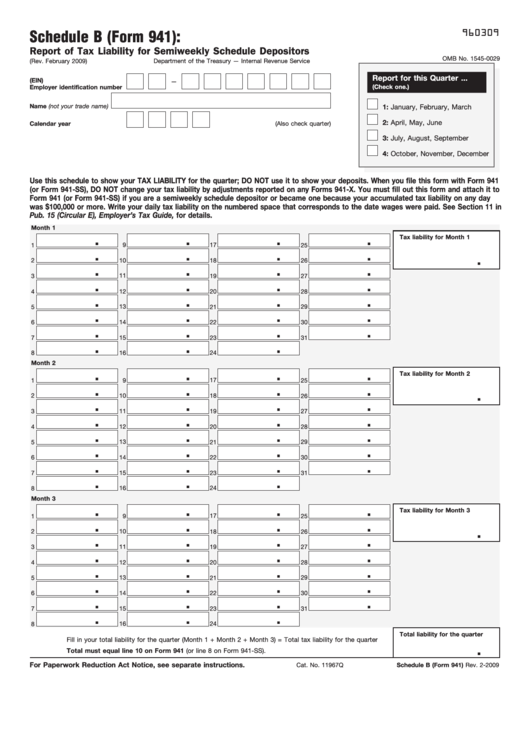

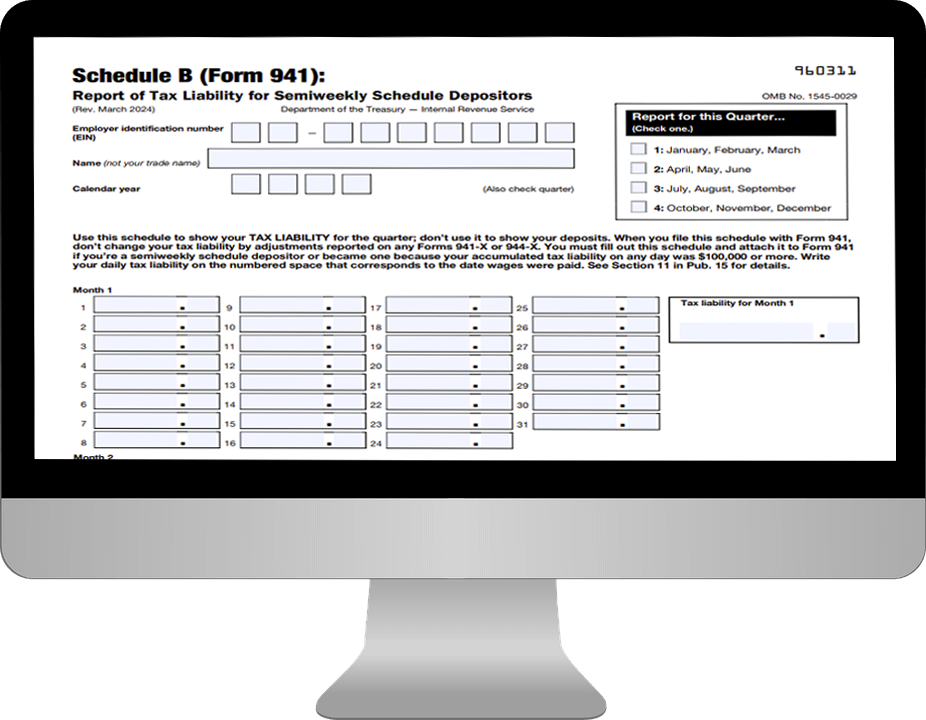

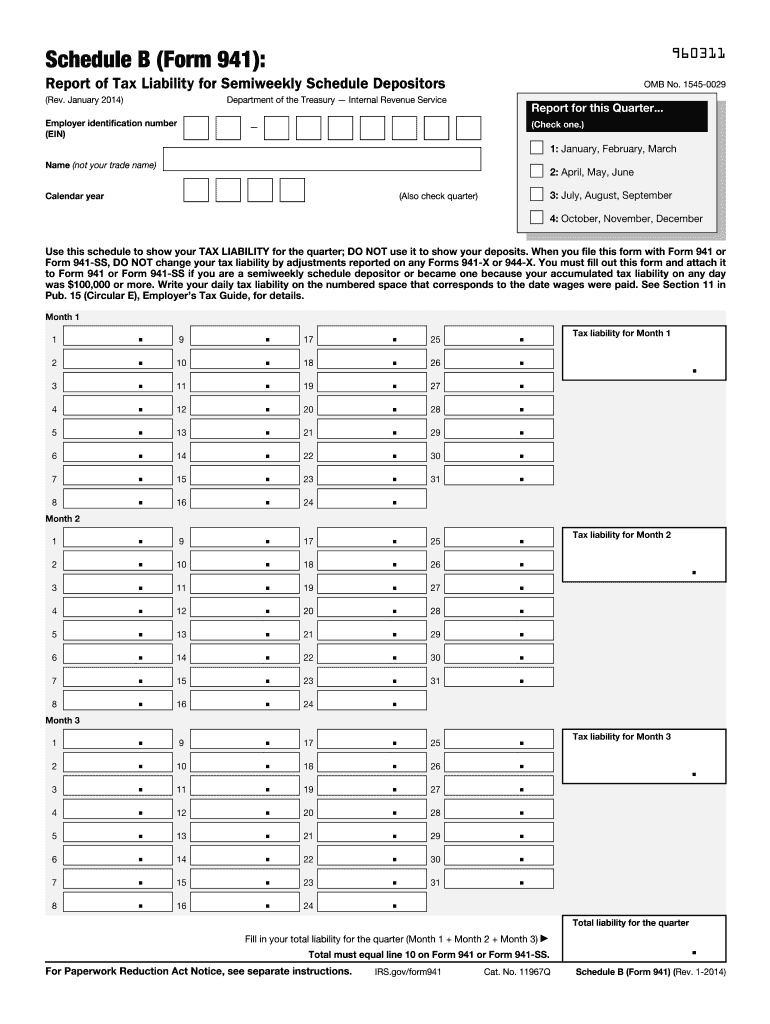

Free Printable Form 941 Schedule B Form 941 Schedule B Filling out Schedule B Form 941 is relatively easier than you might think Your business information deposit claims and specific calendar dates are all you need to fill out Schedule B Form 941 We have curated a simple 3 step guide to help you furnish the required information in an easier manner Let s take a look

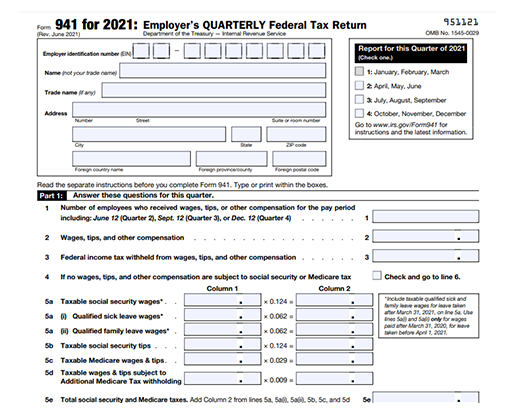

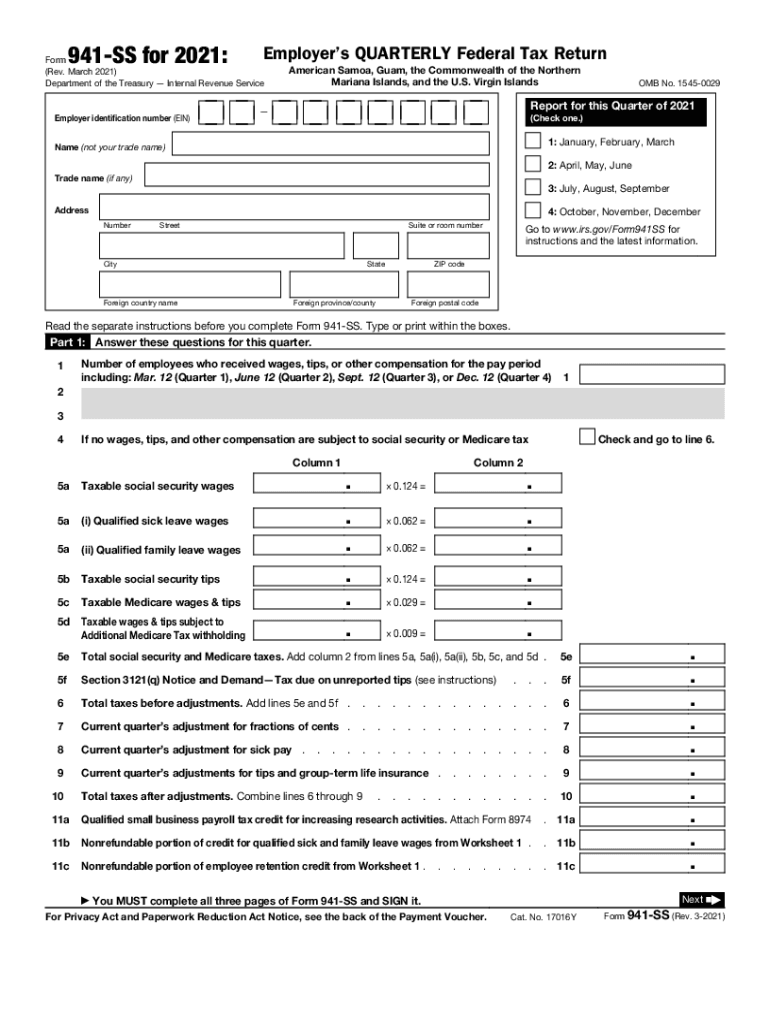

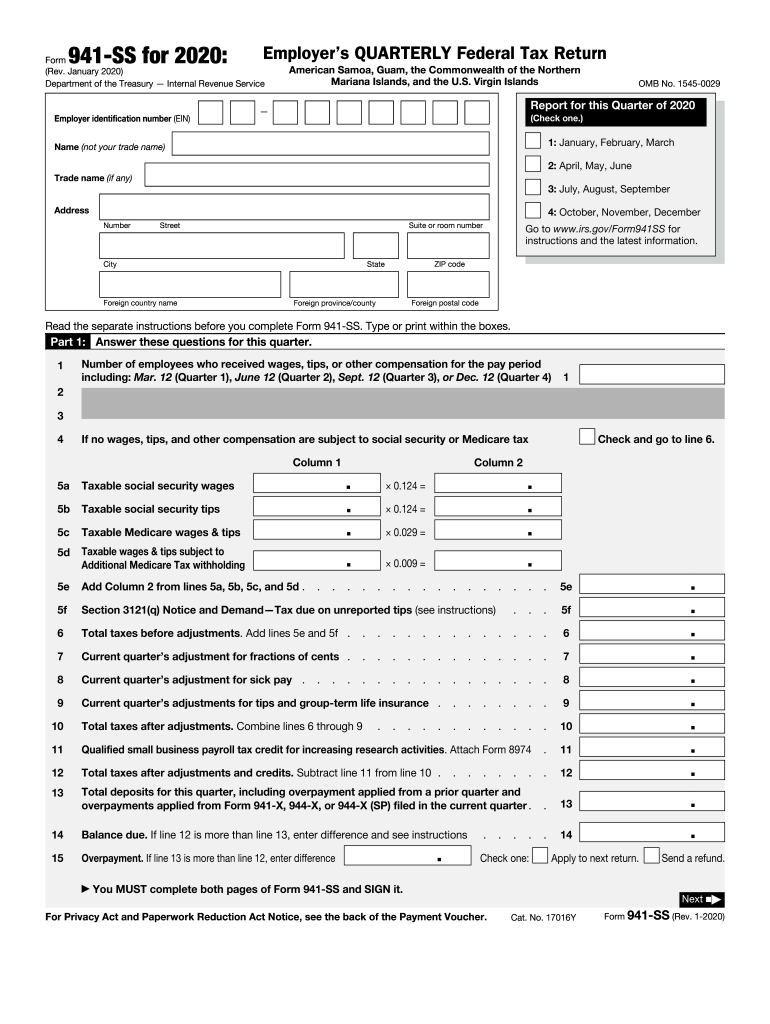

2022 Form 941 Author W CAR MP FP Subject Employer s QUARTERLY Federal Tax Return Created Date 8 23 2023 2 41 09 PM The updated Form 941 Employer s Quarterly Federal Tax Return was released on June 19 2020 The IRS released two drafts of the 941 instructions and released the final instructions on June 26 The instructions are 19 pages long The prior version was 12 pages The instructions include a worksheet Worksheet 1 to help with the

Free Printable Form 941 Schedule B

Free Printable Form 941 Schedule B

Free Printable Form 941 Schedule B

https://www.pdffiller.com/preview/6/955/6955056/large.png

File Form 941 Schedule B with TaxBandits at 5 95 form IRS Form 941 Schedule B for 2023 2022 is to report Tax Liability for Semiweekly Schedule Depositors Only 4 Business days left to file Form 941 for Q3 2023

Templates are pre-designed files or files that can be utilized for numerous purposes. They can save time and effort by providing a ready-made format and design for developing different sort of content. Templates can be used for personal or professional jobs, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

Free Printable Form 941 Schedule B

Fillable Schedule B Form 941 Report Of Tax Liability For Semiweekly

Irs Fillable Form 941 Schedule B Printable Forms Free Online

2023 Form 941 Schedule B Printable Forms Free Online

Fillable Form 941 Schedule B 2020 Download Printable 941 For Free

Form 941b 2023 Printable Forms Free Online

Fillable Form 941 2023 Printable Forms Free Online

https://www.irs.gov/instructions/i941sb

The IRS uses Schedule B to determine if you ve deposited your federal employment tax liabilities on time If you re a semiweekly schedule depositor and you don t properly complete and file your Schedule B with Form 941

https://www.irs.gov/pub/irs-pdf/f941.pdf

1 January February March 2 April May June 3 July August September 4 October November December Go to www irs gov Form941 for instructions and the latest information Read the separate instructions before you complete Form 941 Type or print within the boxes Part 1 Answer these questions for this quarter

https://www.irs.gov/forms-pubs/about-form-941

File Schedule B Form 941 if you are a semiweekly schedule depositor You are a semiweekly depositor if you Reported more than 50 000 of employment taxes in the lookback period

https://www.irs.gov/pub/irs-prior/i941sb--2020.pdf

Sep 24 2020 Amended Schedule B If you have been assessed a failure to deposit FTD penalty you may be able to file an amended Schedule B See Correcting Previously Reported Tax Liability later General Instructions Purpose of Schedule B These instructions tell you about Schedule B

https://formswift.com/schedule-b-form-941

What is a 941 Schedule B This is a supplemental form for the Form 941 It is known as a Report of Tax Liability for Semiweekly Schedule Depositors A Schedule B Form 941 is used by the Internal Revenue Service for tax filing and reporting purposes

The IRS Form 941 Schedule B is a tax form for the reporting of tax liability for semi weekly pay schedules The employer is required to withhold federal income tax and payroll taxes from the employee s paychecks The 941 form reports the total amount of tax withheld during each quarter June 9 2022 8 51 PM UTC Draft Instructions for Form 941 Schedules Issued by IRS Jazlyn Williams Editor Writer Draft instructions for Form 941 s Schedule B and Schedule R were released The March 2022 version of Schedule R must be filed with Form 941 X to claim the COBRA premium assistance credit

The IRS Form 941 Schedule B is a tax form for reporting employer s tax liabilities for semiweekly pay schedules Schedule B must be filed along with Form 941 Employers who report more than 50 000 of employment taxes in the previous period or have accumulated 100 000 or more in tax liability in the current or past calendar year