Free Blank Printable 5013c Applications For Texas Exemption applications for organizations applying under provisions other than Code section 501 c 3 Where Is My Exemption Application Most organizations seeking recognition of ex emption from federal income tax must use spe cific application forms prescribed by the IRS

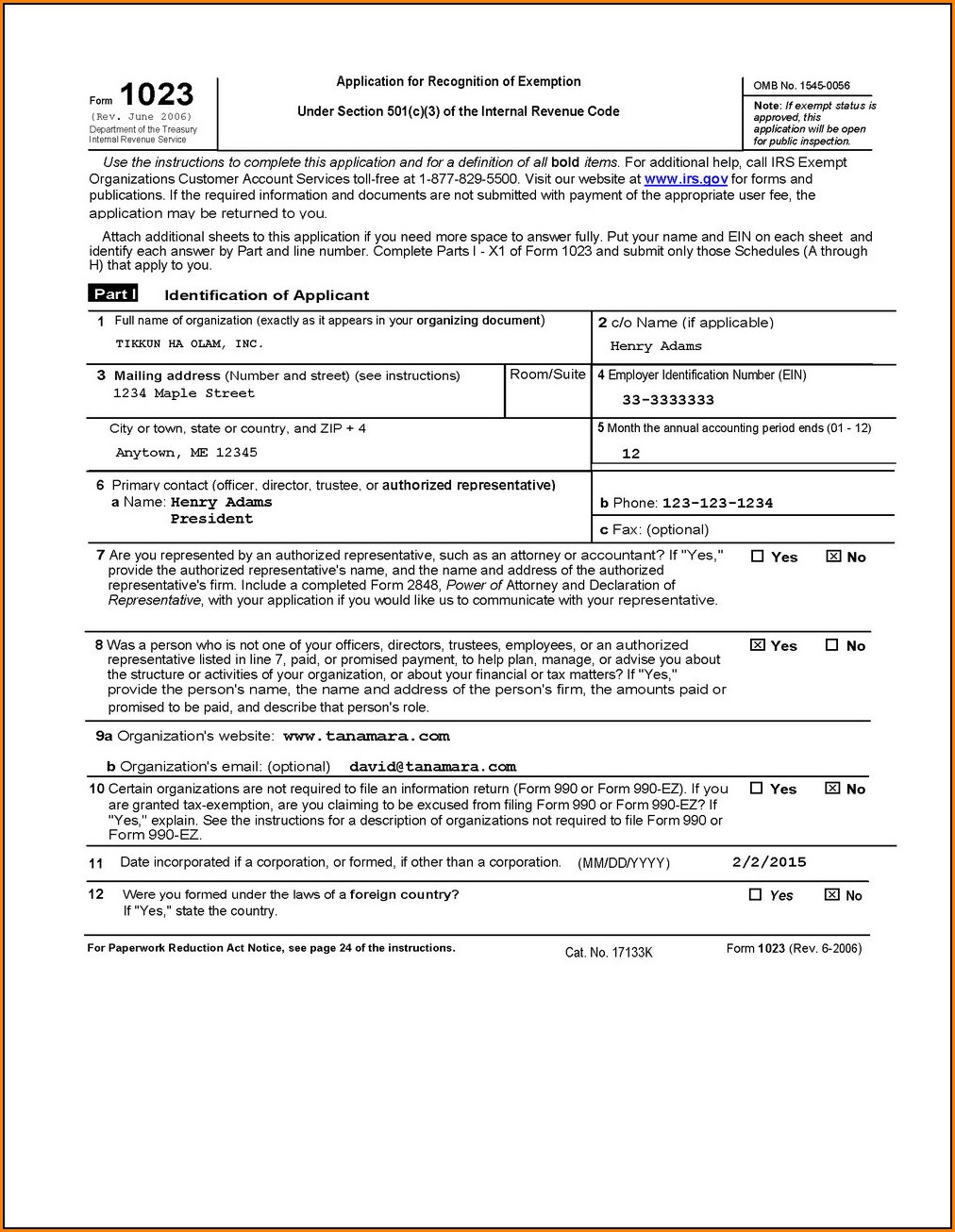

Business and Nonprofit Forms Formation of Business Entities and Nonprofit Corporations Under the Texas Business Organizations Code Registering Out of State Entities to Transact Business In Texas Under the Texas Business Organizations Code To apply for recognition by the IRS of exempt status under IRC Section 501 c 3 you must use either Form 1023 or Form 1023 EZ All organizations seeking exemption under IRC Section 501 c 3 can use Form 1023 but certain small organizations can apply using the shorter Form 1023 EZ

Free Blank Printable 5013c Applications For Texas

Free Blank Printable 5013c Applications For Texas

Free Blank Printable 5013c Applications For Texas

https://www.pdffiller.com/preview/100/63/100063950/large.png

Form 1023 Application for Recognition of Exemption under Section 501 c 3 of the Internal Revenue Code 2 Instructions for Form 1023 PDF Form 1023 EZ Streamlined Application for Recognition of Exemption Under Section 501 c 3 Instructions for Form 1023 EZ Form 1024 Application for Recognition of Exemption under Section 501 a or

Templates are pre-designed documents or files that can be used for different purposes. They can conserve time and effort by providing a ready-made format and design for producing various kinds of material. Templates can be utilized for personal or professional jobs, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

Free Blank Printable 5013c Applications For Texas

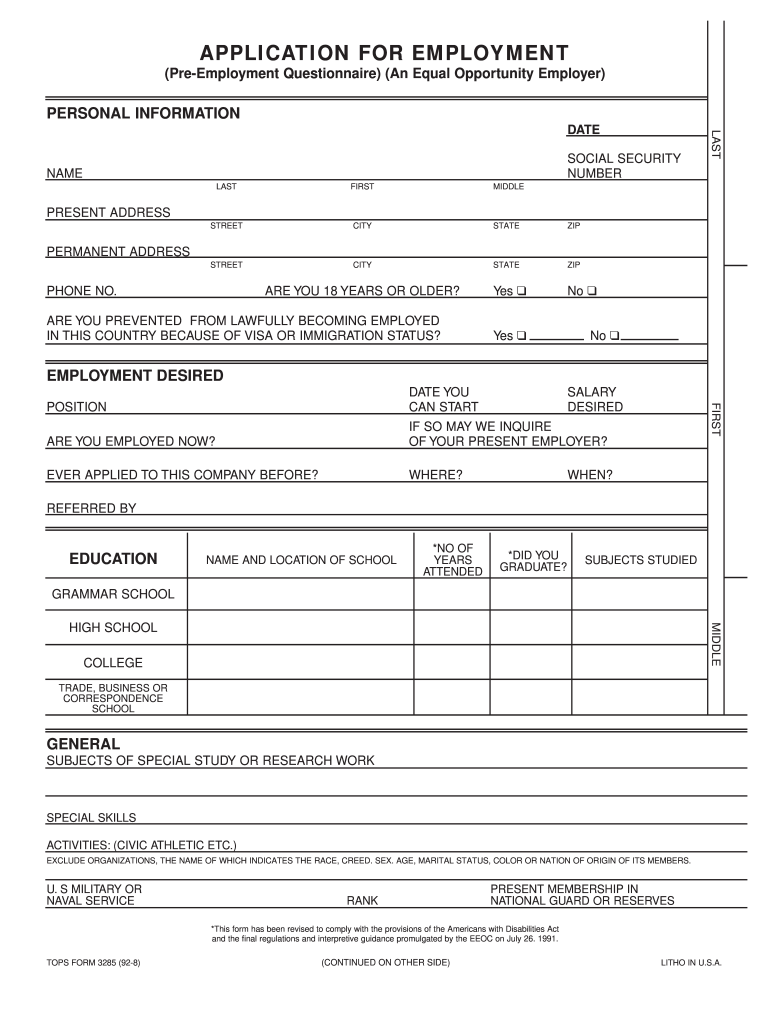

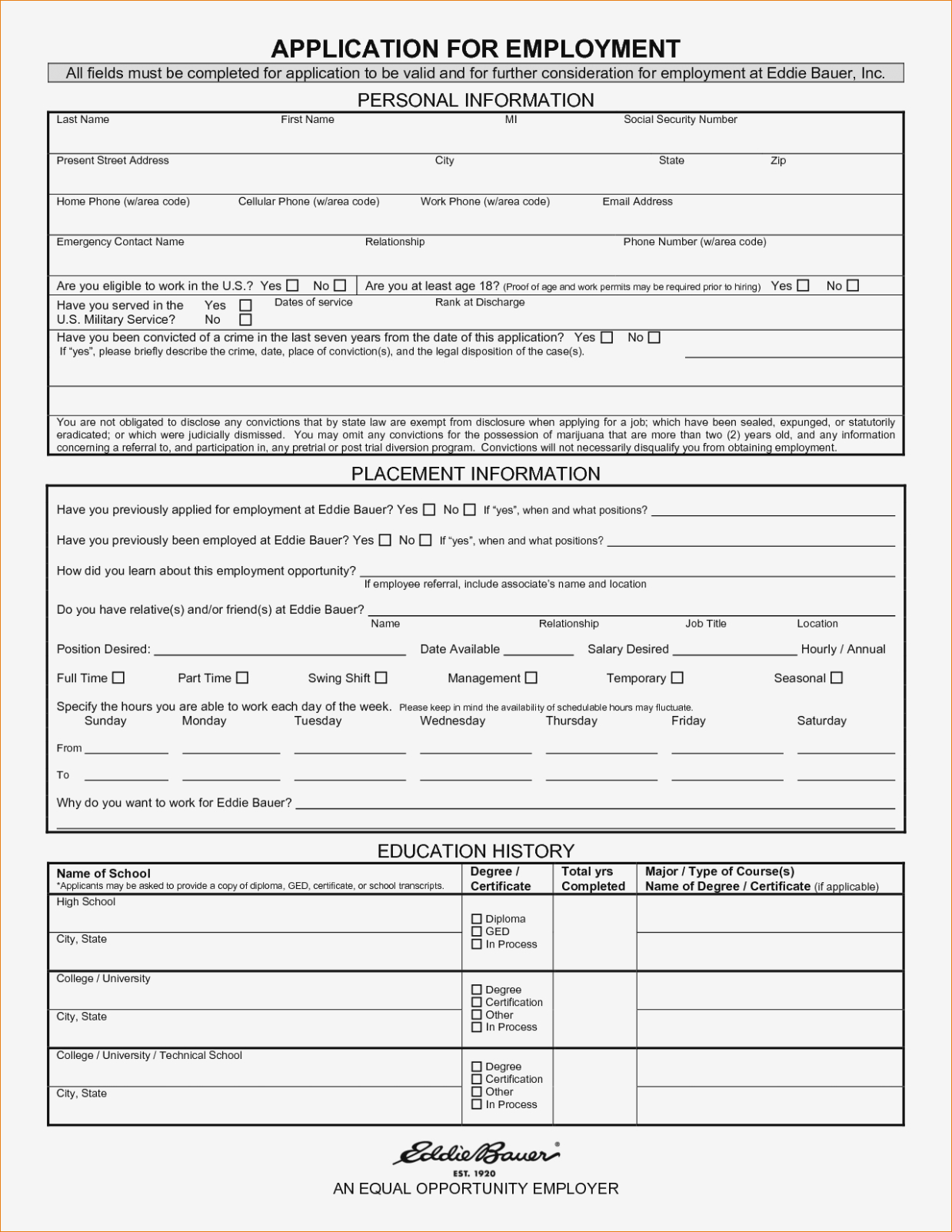

Printable Employment Applications

Printable 501C3 Form

Printable 5013c Forms Printable Forms Free Online

Printable 5013c Forms Printable Forms Free Online

Printable 5013c Forms Printable Forms Free Online

Printable 501C3 Application

https://www.sos.texas.gov/corp/nonprofit_org.shtml

The Texas Business and Public Filings Division cannot provide you with legal advice or legal referrals If you are seeking answers to legal questions you will need to find a private attorney For information on choosing and working with a lawyer you may wish to visit the State Bar of Texas

https://comptroller.texas.gov/taxes/exempt/501(c)-exemptions-1.php

To apply for franchise and sales tax exemptions complete and submit Form AP 204 Texas Application for Exemption Federal and All Others PDF to the Comptroller s office Include a copy of the IRS issued exemption determination letter with any addenda

https://www.irs.gov/charities-non-profits/

Application for Recognition of Exemption To apply for recognition by the IRS of exempt status under section 501 c 3 of the Code use a Form 1023 series application The application must be submitted electronically on Pay gov and must including the appropriate user fee

https://www.sos.state.tx.us/corp/forms/202_boc.pdf

A nonprofit corporation is governed by titles 1 and 2 of the Texas Business Organizations Code BOC Title 1 chapter 3 subchapter A of the BOC governs the formation of a nonprofit corporation and sets forth the provisions required or permitted to be contained in the certificate of formation Nonprofit

https://www.irs.gov/forms-pubs/about-form-1023

Enter 1023 in the search box and select Form 1023 Complete the form Instructions for Form 1023 Print Version PDF Recent Developments LLC Applying for Tax exempt Status under Section 501 c 3 Must Submit Information Described in Notice 2021 56

A 501c 3 application is a document nonprofit organizations file with the Internal Revenue Service IRS to request tax exempt status as a charitable organization IRS Form 1023 is the document you must complete to apply for tax exempt status with the IRS as a 501c 3 Get a 501c3 application pdf template with signNow and complete it in a few simple clicks Show details How it works Browse for the printable 501c3 form Customize and eSign 501c3 application form Send out signed 501c3 printable application or print it What makes the 501c3 form legally binding

Applications for nonprofit status must be submitted online to the IRS If an organization is eligible to apply for nonprofit status with Form 1023 EZ the process can take as little as four weeks