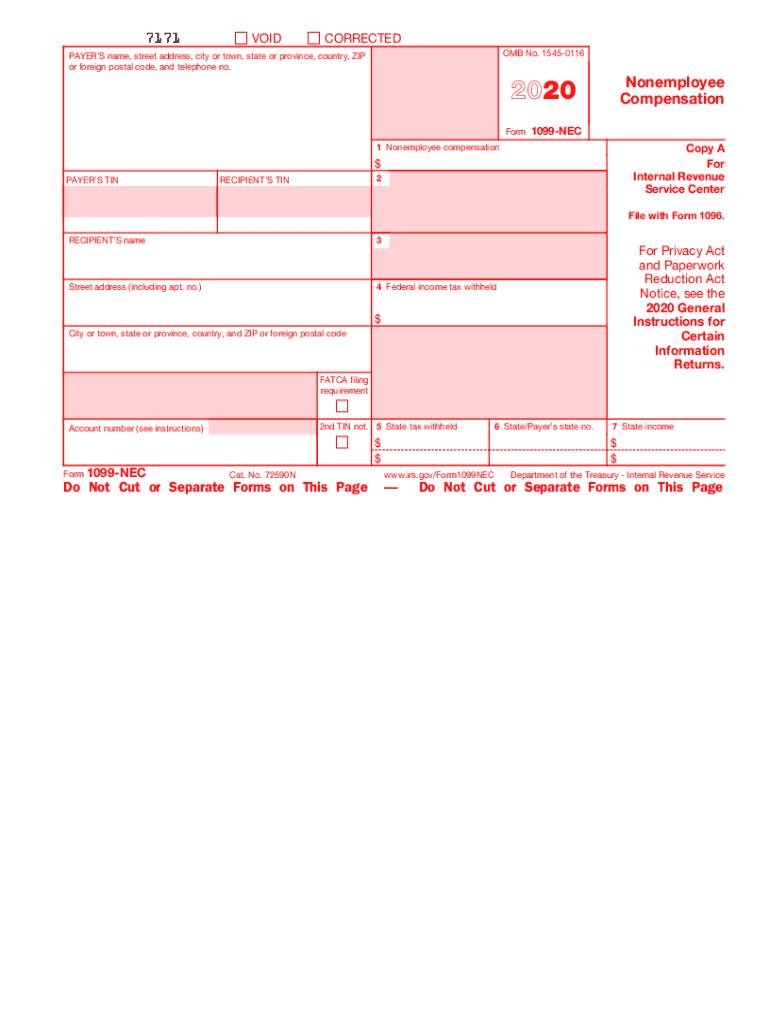

Fillable And Printable 1099 Here are the instructions for how to complete a 1099 NEC line by line Box 1 Nonemployee compensation Post the nonemployee compensation and Payer s TIN List your company s taxpayer identification number TIN as Payer s TIN Payer s information List your business s name and address in the top left section of the form

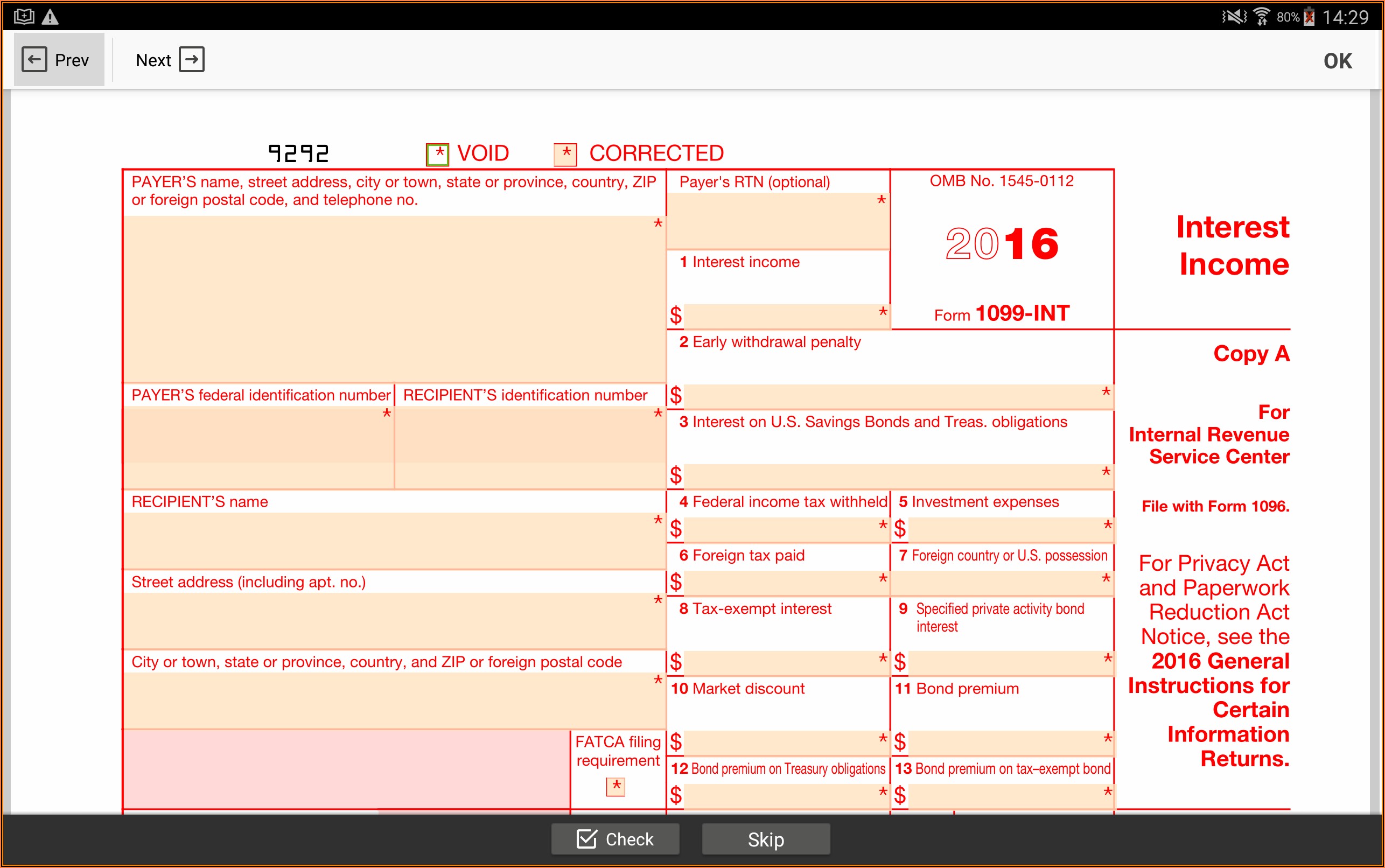

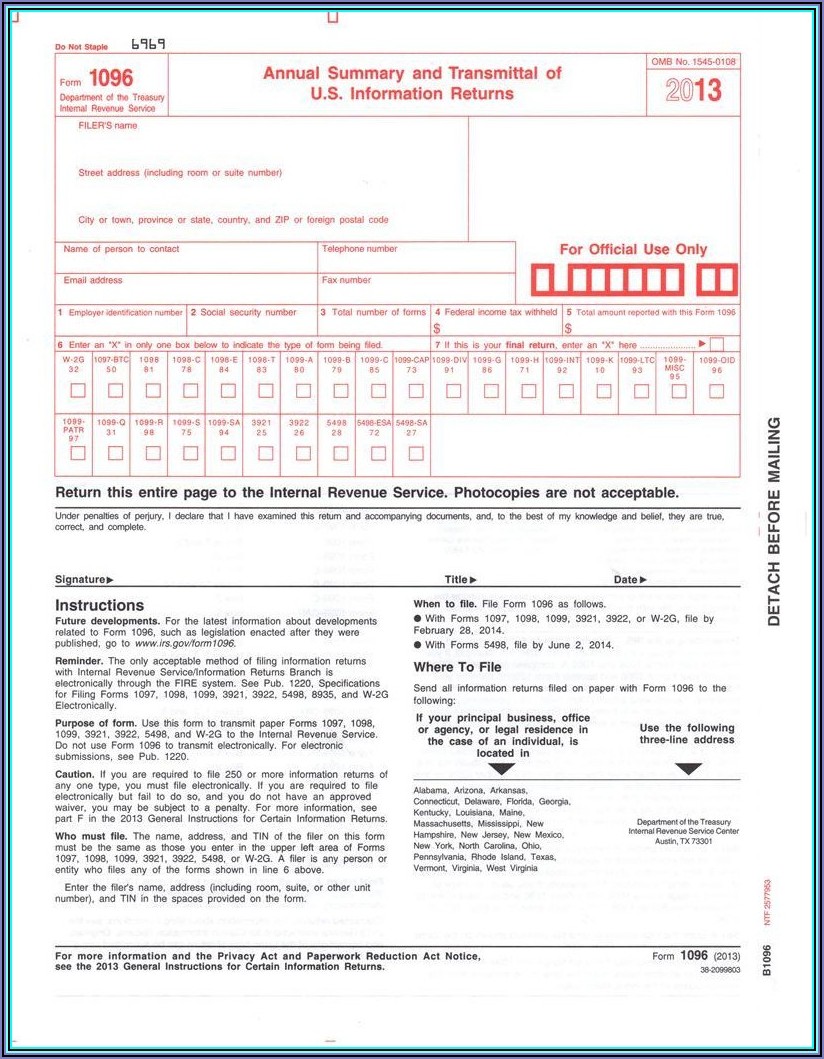

Besides the things mentioned above one rule is simple if you pay U S freelancers or contractors 600 or more during the year you must issue them a Form 1099 MISC by January 31 of the following year Accounting software such as QuickBooks Online makes the process seamless by walking you through each step of the process Instructions for Forms 1099 INT and 1099 OID 01 2022 Internal Revenue Service About Form 1099 R Distributions From Pensions Annuities Retirement or Profit Sharing Plans IRAs Insurance

Fillable And Printable 1099

Fillable And Printable 1099

Fillable And Printable 1099

http://www.contrapositionmagazine.com/wp-content/uploads/2021/08/form-1099-nec-pdf-fillable.jpg

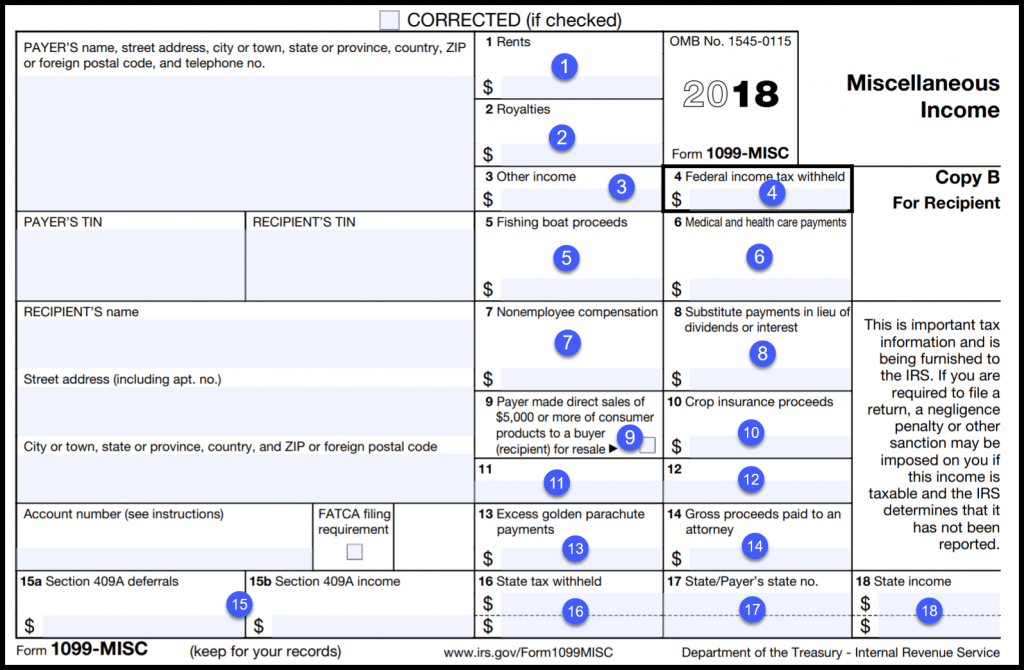

Fill out Form 1099 MISC in minutes not hours Save your time required to printing putting your signature on and scanning a paper copy of Form 1099 MISC Keep productive online

Templates are pre-designed files or files that can be utilized for numerous functions. They can save effort and time by providing a ready-made format and layout for producing different type of content. Templates can be used for personal or professional projects, such as resumes, invitations, leaflets, newsletters, reports, presentations, and more.

Fillable And Printable 1099

IRS Form 1099 Int 2018 Fillable Forms Irs Forms Irs

1099 Nec Form 2020 Printable Fill Out And Sign Printable PDF Template

Blank 1099 Form Blank 1099 Form 2021 ESign Genie

Fillable Form 1099 Int Form Resume Examples A19XKw324k

Free Fillable 1099 Form Form Resume Examples Bw9j7O3Y7X

What Is A 1099 5498 UDirect IRA Services LLC

https://eforms.com/irs/form-1099/misc

A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal exchanges and several other specific transactions must be reported to the IRS using this form

https://formswift.com/1099-misc

Create My Document Starting with the tax year of 2020 a 1099 MISC Form is meant to be filed for every person i e non employee you have paid over 600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099 MISC form is featured below

https://www.irs.gov/pub/irs-prior/f1099msc--2020.pdf

Federal income tax withheld Nonqualified deferred compensation Copy B For Recipient This is important tax information and is being furnished to the IRS If you are required to file a return a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported

https://www.irs.gov/forms-pubs/about-form-1099-misc

File Form 1099 MISC for each person to whom you have paid during the year At least 10 in royalties or broker payments in lieu of dividends or tax exempt interest At least 600 in Rents Prizes and awards Other income payments Medical and health care payments Crop insurance proceeds

https://www.irs.gov/pub/irs-pdf/f1099nec.pdf

Print and file copy A downloaded from this website a penalty may be imposed for filing with the IRS information return forms that can t be scanned See part O in the current General Instructions for Certain Information Returns available at www irs gov form1099 for more information about penalties

1099 Form Printing How to Fill Out and Print 1099 MISC Forms for Contractors and IRS Step 1 Start ez1099 software Step 2 Add a new 1099 MISC form Step 3 Enter 1099 MISC form information Step 4 Print 1099 MISC form City or town state or province country and ZIP or foreign postal code withheld Copy A For Internal Revenue Service Center File with Form 1096 For Privacy Act and Paperwork Reduction Act Notice see the 2020 General Instructions for Certain Information Returns Account number see instructions 2nd TIN not Cat No 72590N

Starting at 58 99 Use federal 1099 NEC tax forms to report payments of 600 or more to non employees contractors These continuous use forms no longer include the tax year QuickBooks will print the year on the forms for you Learn more about the IRS e