Fil In Printable 1099 Misc You can e file any Form 1099 with IRIS Form 1099 A Acquisition or Abandonment of Secured Property Form 1099 B Proceeds from Broker and Barter Exchange Transactions Form 1099 C Cancellation of Debt Form 1099 CAP Changes in Corporate Control and Capital Structure

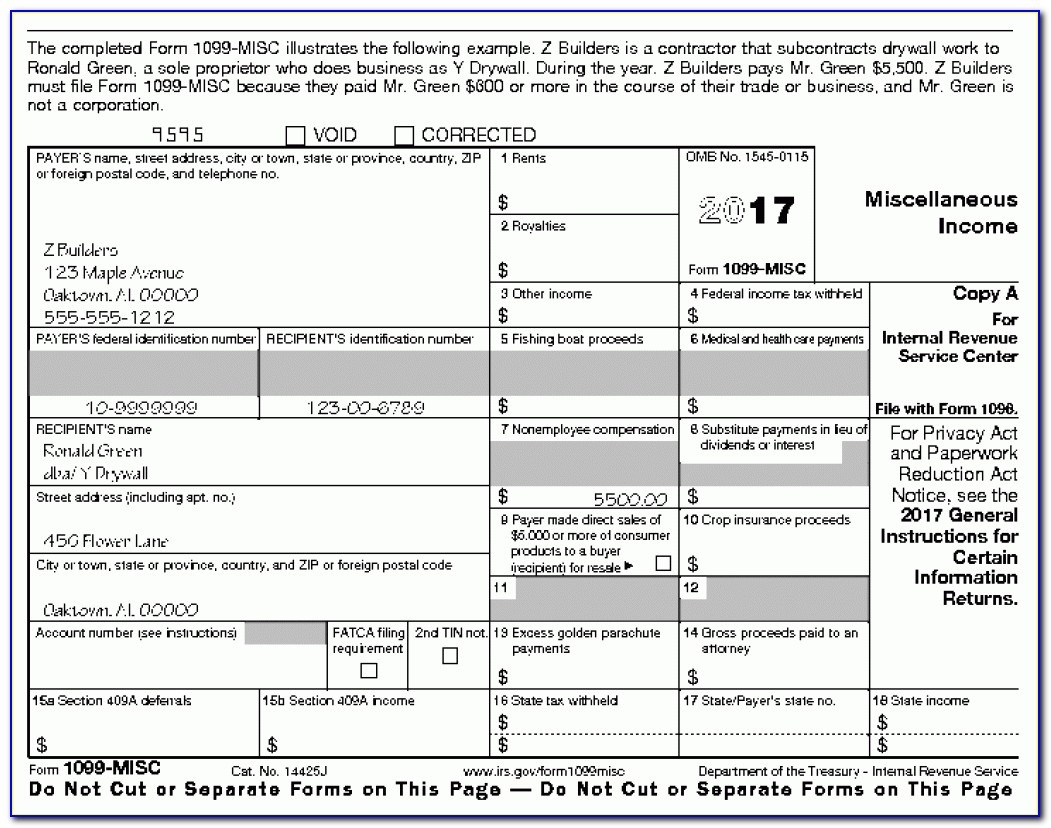

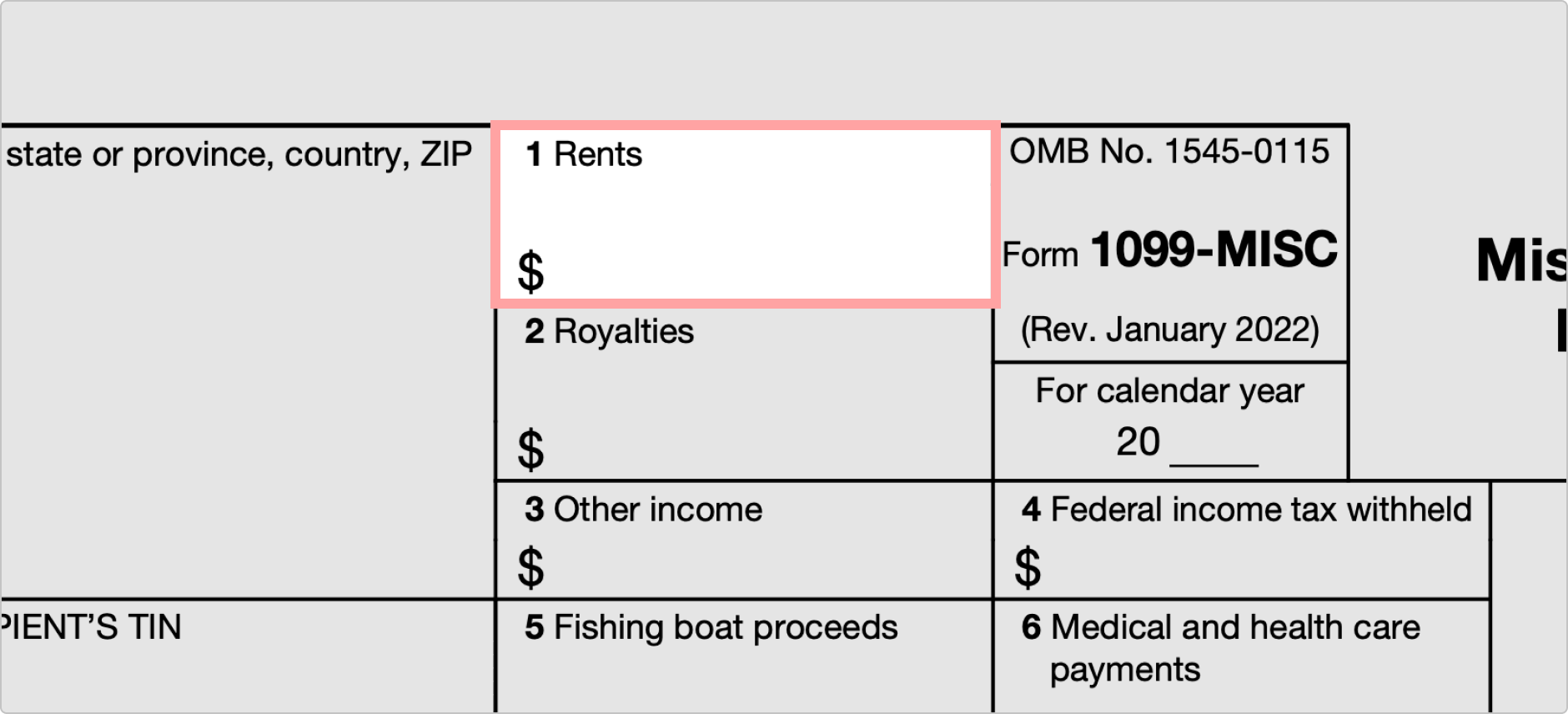

You may either file Form 1099 MISC box 7 or Form 1099 NEC box 2 to report sales totaling 5 000 or more of consumer products to a person on a buy sell a deposit commission or other commission basis for resale Dec 27 2021 Cat No 74614G https www irs gov form1099misc https www irs gov Form1099nec Form 1099 Misc is a tax form that reports the year end summary of all non employee compensation The 1099 Misc form covers rent royalties self employment and independent contractor income crop

Fil In Printable 1099 Misc

Fil In Printable 1099 Misc

Fil In Printable 1099 Misc

http://www.contrapositionmagazine.com/wp-content/uploads/2021/02/irs-form-1099-misc.jpg

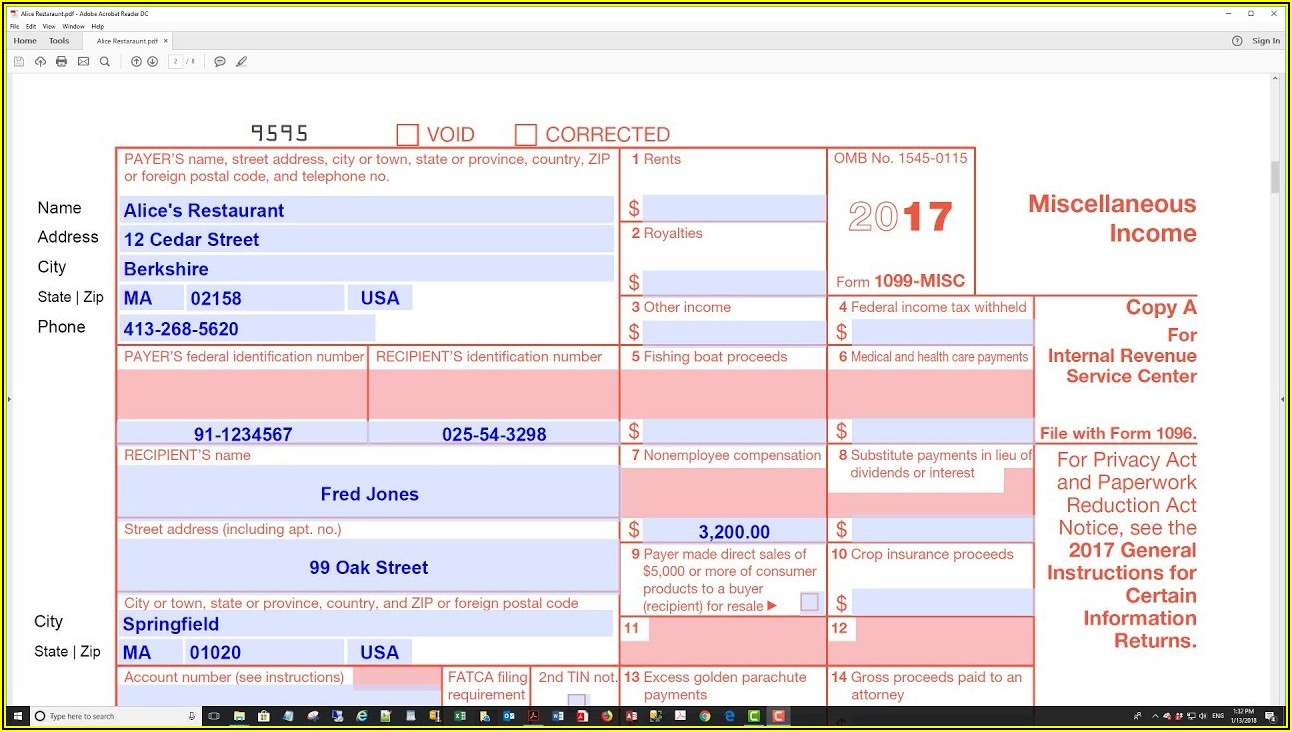

How to accomplish a Form 1099 MISC on the internet On the web site with all the type simply click Start Now and go to your editor Use the clues to fill out the applicable fields Include your individual facts and make contact with knowledge Make certain that you simply enter correct details and figures in ideal fields

Pre-crafted templates use a time-saving service for developing a diverse variety of files and files. These pre-designed formats and designs can be used for various individual and professional jobs, including resumes, invites, leaflets, newsletters, reports, presentations, and more, streamlining the content development procedure.

Fil In Printable 1099 Misc

Printable Irs Form 1099 Printable Forms Free Online

Where To Get Blank 1099 Misc Forms Form Resume Examples EZVgexk9Jk

1099 Form Online Printable Printable Forms Free Online

Fillable 1099 S Forms Printable Forms Free Online

1099 Form Online Printable Printable Forms Free Online

Free Irs 1099 Misc Income Form Printable Printable Forms Free Online

https://eforms.com/irs/form-1099/misc

What Is It Used For If you make certain types of payments in the course of your trade or business you must issue a 1099 MISC to the payment recipient and file it with the IRS Common reportable payments include 1 Royalties or broker payments 10 or more Rents 600 or more Prizes and awards 600 or more

https://formswift.com/1099-misc

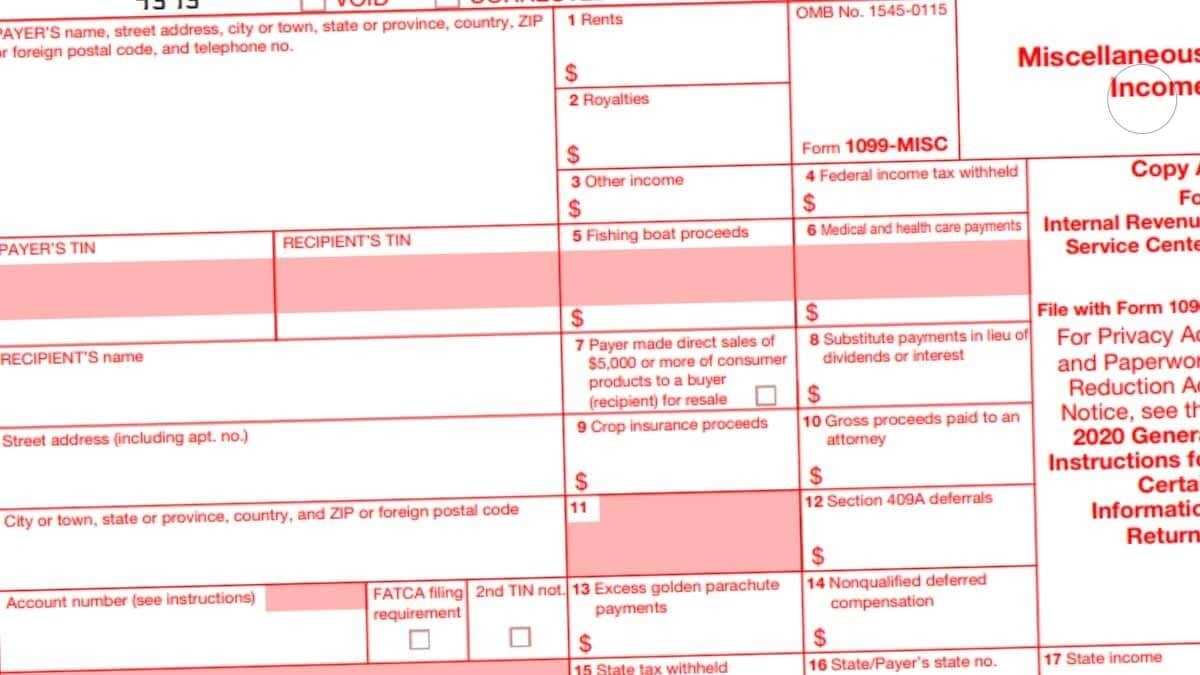

Starting with the tax year of 2020 a 1099 MISC Form is meant to be filed for every person i e non employee you have paid over 600 for an assorted list of miscellaneous business payments The list of payments that require a business to

https://www.irs.gov/forms-pubs/about-form-1099-misc

About Form 1099 MISC Miscellaneous Information File Form 1099 MISC for each person to whom you have paid during the year At least 10 in royalties or broker payments in lieu of dividends or tax exempt interest

https://www.irs.gov/instructions/i1099mec

If you make payments to members of Indian tribes from the net revenues of class II or class III gaming activities conducted or licensed by the tribes you must withhold federal income tax on such payments File Form 1099 MISC to report the

https://www.expressefile.com/free-printable-1099-misc-forms-online

Quick Secure Online Filing Instant Filing Status Postal Mail Recipient Copies Create 1099 MISC Now Pricing starts as low as 2 75 form You can no longer report nonemployee compensation in Box 7 of Form 1099 MISC If you want to report nonemployee compensation you will have to file Form 1099 NEC

With a blank 1099 form for 2022 printable on our website users can fill out their information directly and conveniently In addition to this the website provides printable 1099 MISC form guidelines and examples to make the process even easier It s precious for self employed individuals who are responsible for their tax management Download your fillable IRS Form 1099 MISC in PDF Table of Contents What Is the Form 1099 Used For Does It Differ From Form W 2 What Will Happen If an Individual Fails to Submit the Form What Details Does the Form Contain How To Fill Out The Form Frequently Asked Questions

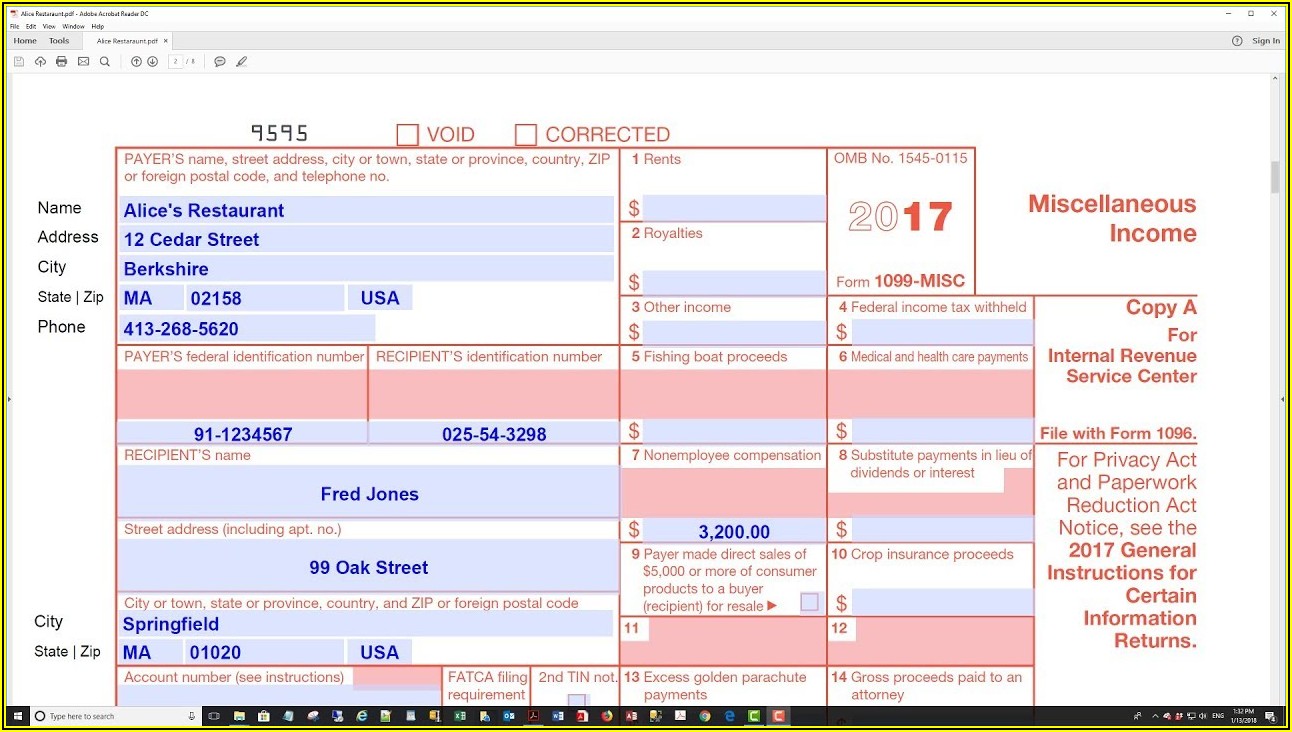

You will need the following information to fill out a 1099 MISC form payer s name address and tax identification number recipient s name address and tax identification number and the total amount paid to the recipient during the tax year