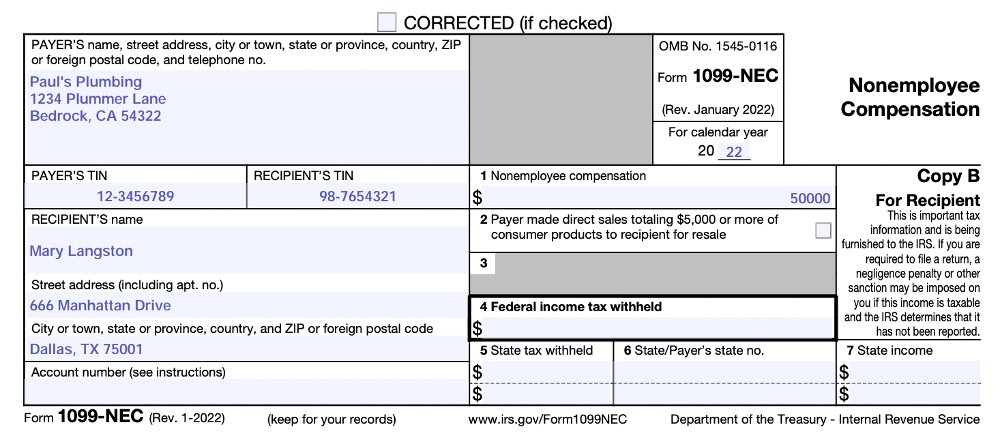

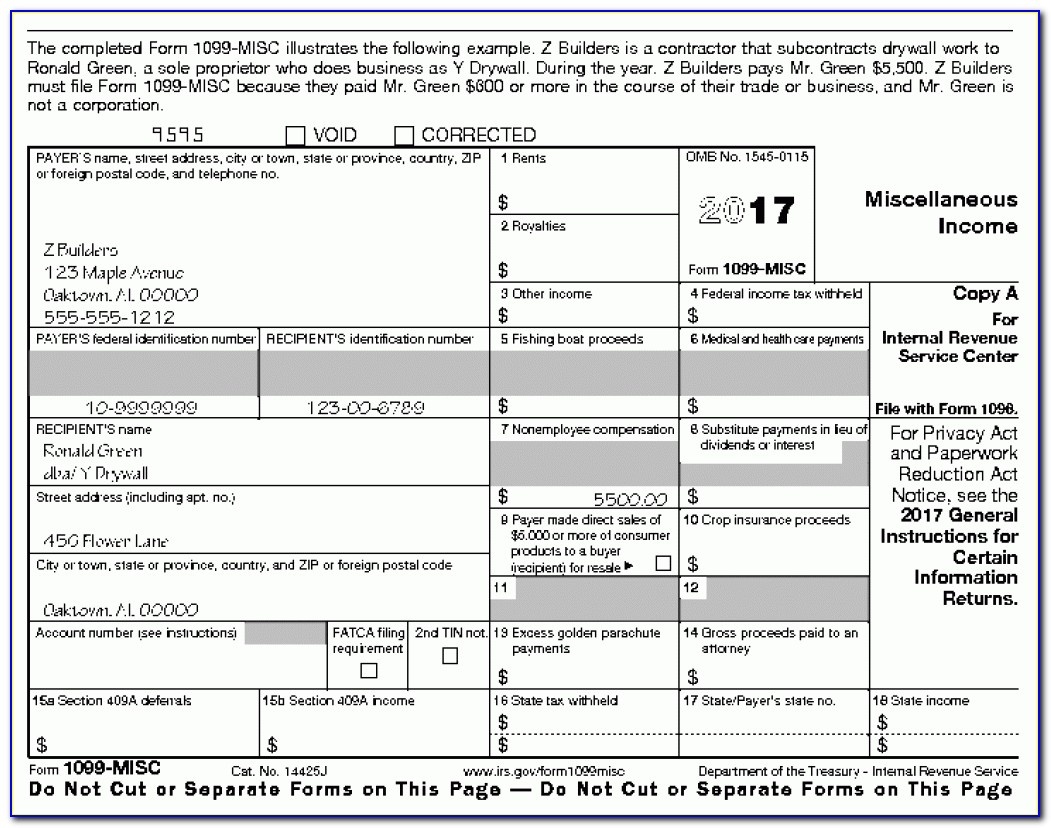

Federal 1099 Printable Form What is a 1099 Form The IRS 1099 Form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn t your employer The payer fills out the form with the appropriate details and sends copies to you and the IRS reporting payments made during the tax year

This form report the amount shown in box 1 on the line for Wages salaries tips etc of Form 1040 1040 SR or 1040 NR You must also complete Form 8919 and attach it to your return For more information see Pub 1779 Independent Contractor or Employee The IRS compares data reported on 1099 forms with the income reported on an individual s Form 1040 the tax form used for personal federal income tax returns and information included on other

Federal 1099 Printable Form

Federal 1099 Printable Form

Federal 1099 Printable Form

https://i2.wp.com/universalnetworkcable.com/wp-content/uploads/2019/03/florida-1099-form-online.png

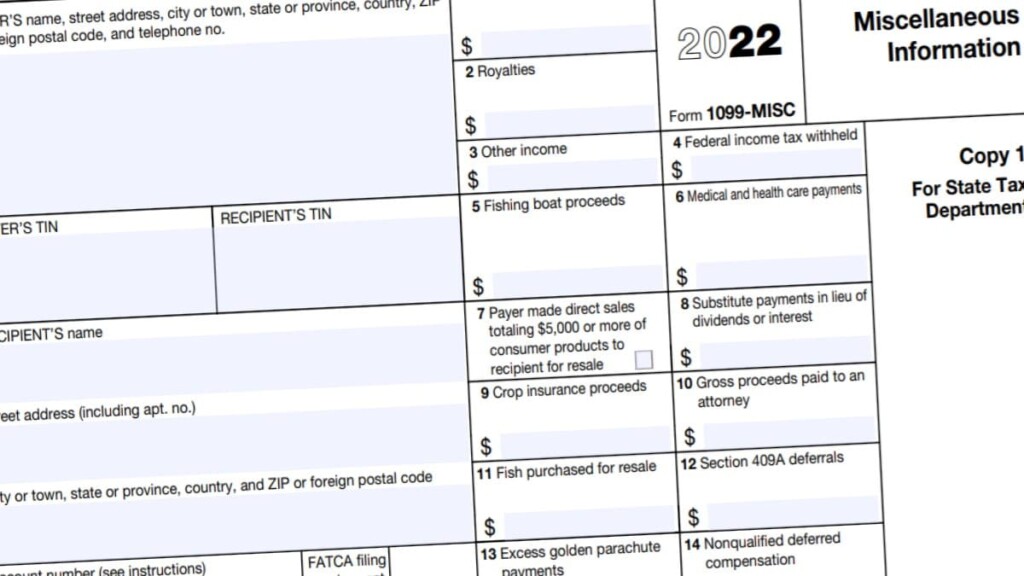

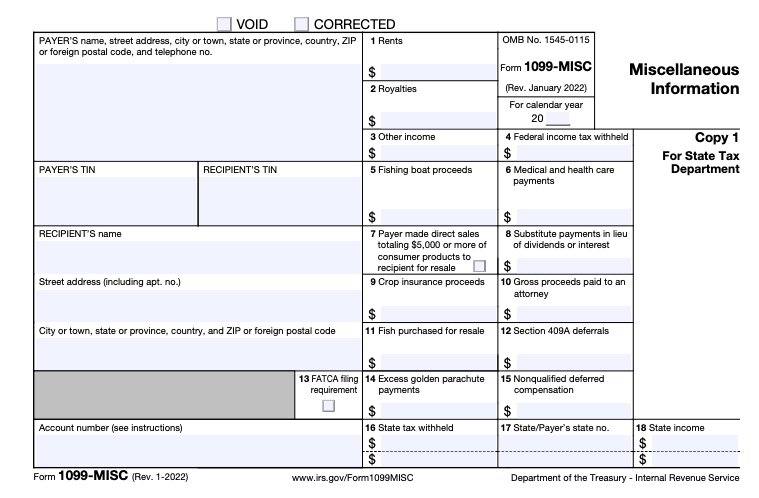

What is a 1099 MISC Form The 1099 MISC is used to report certain types of non employee income As of the 2020 tax year the 1099 MISC is now only used to report the following types of income worth at least 600 Rents Prizes and

Templates are pre-designed files or files that can be used for various functions. They can save time and effort by providing a ready-made format and layout for producing various kinds of material. Templates can be used for personal or professional projects, such as resumes, invitations, flyers, newsletters, reports, presentations, and more.

Federal 1099 Printable Form

Form 1099 Deadline 2023 Printable Forms Free Online

Blank 1099 Form Printable

Free Printable 1099 Nec Form 2022 Printable Word Searches

1099 Printable Form Word Template Printable Forms Free Online

Federal 1099 Printable Form Printable Forms Free Online

1099 R Form 2023 Printable Forms Free Online

https://eforms.com/irs/form-1099/misc

A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal exchanges and several other specific transactions must be reported to the IRS using this form

https://www.irs.gov/forms-pubs/about-form-1099-misc

Information about Form 1099 MISC Miscellaneous Information including recent updates related forms and instructions on how to file Form 1099 MISC is used to report rents royalties prizes and awards and other fixed determinable income

https://www.irs.gov/pub/irs-prior/f1099msc--2020.pdf

Instructions for Recipient Recipient s taxpayer identification number TIN For your protection this form may show only the last four digits of your social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number EIN

https://www.canada.ca/en/revenue-agency/services/forms-publications/fo…

2023 10 19 This site provides a list of Canada Revenue Agency CRA tax forms listed by form number

https://www.irs.gov/form

Access IRS forms instructions and publications in electronic and print media

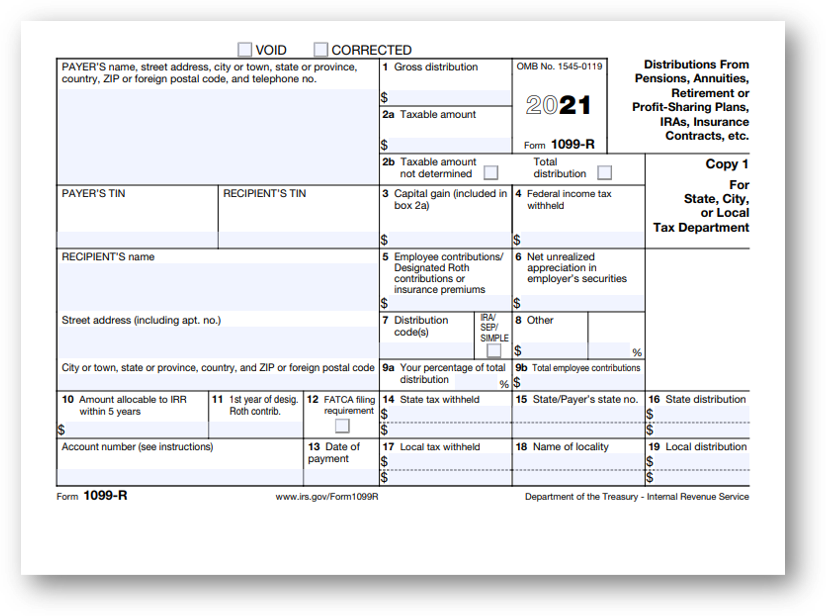

Print and file copy A downloaded from this website a penalty may be imposed for filing with the IRS federal tax return If this form shows federal income tax withheld in box 4 attach this copy to insurance contracts etc are reported to recipients on Form 1099 R Qualified plans and section 403 b plans If your annuity starting 2023 Pre Printed 1099 NEC Kits Starting at 58 99 Use federal 1099 NEC tax forms to report payments of 600 or more to non employees contractors These continuous use forms no longer include the tax year QuickBooks will print the year on the forms for you Learn more about the IRS e filing changes

Form 1099 is one of several IRS tax forms see the variants section used in the United States to prepare and file an information return to report various types of income other than wages salaries and tips for which Form W 2 is used instead