Employer Quarterly Unemployment Tax Report Ky Printable Please be prepared to provide the specifics of the information you are reporting in order for the phone contact to document for investigation By Mail You may print complete and submit the attached document to Office of Unemployment Insurance Tax Audit Branch P O Box 948 Frankfort Ky 40601

OV An Official Website of the Commonwealth of Kentucky Office of Unemployment Insurance Carneer Center Career Training Employer Home I Close Employer Account Submit Quarterly Report Employer Registration TPA Registration Close Employer Account Request a Refund Pay by EFT Credit Card Address Update Report Select the Employees or On the Fly menu then select State Tax Wage Forms Make sure KY is selected then select UI 3 from the Forms droplist Select the applicable quarter Review the form and make any necessary entries or edits Make sure the e File checkbox is marked then select Save Print

Employer Quarterly Unemployment Tax Report Ky Printable

Employer Quarterly Unemployment Tax Report Ky Printable

Employer Quarterly Unemployment Tax Report Ky Printable

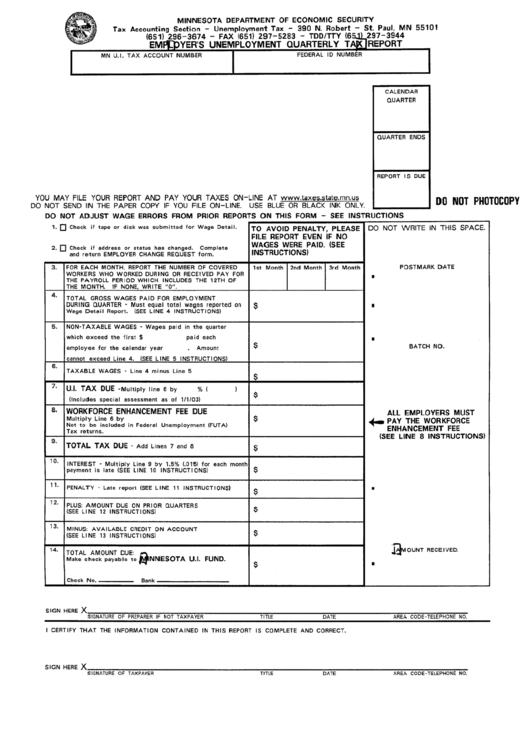

https://www.newhireform.net/wp-content/uploads/2022/08/employer-s-unemployment-quarterly-tax-report-minnesota-department-of-14.png

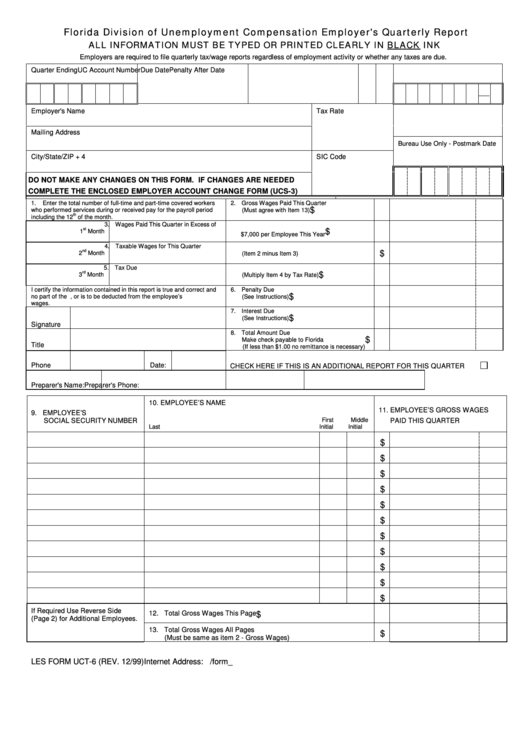

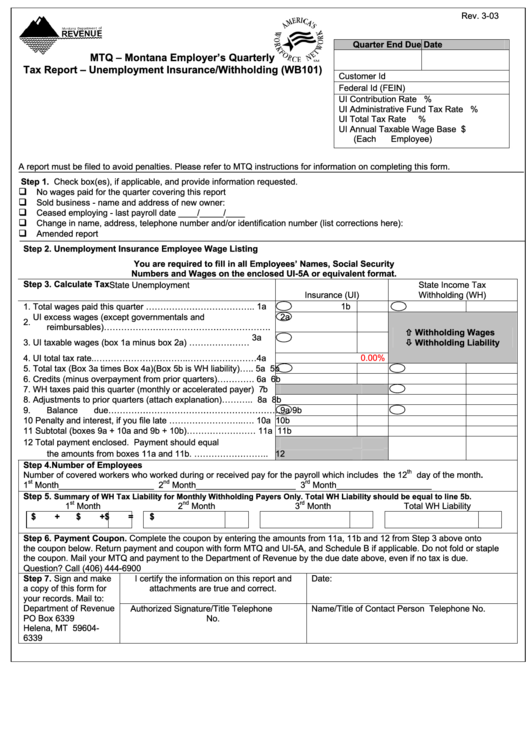

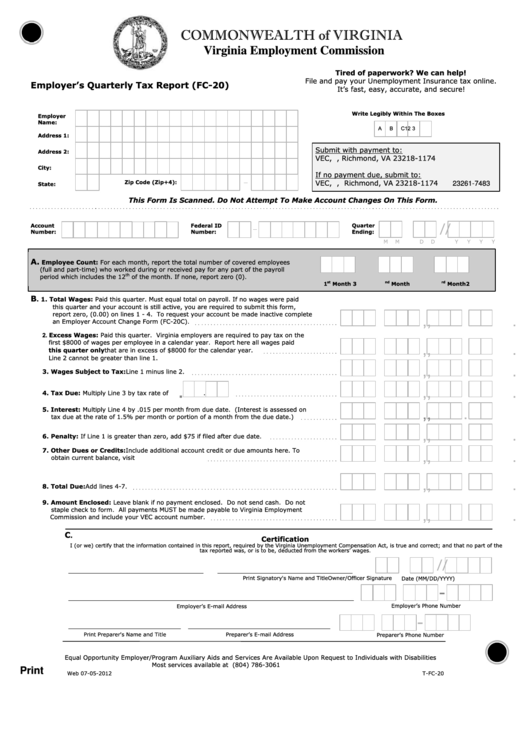

Employer s Quarterly Unemployment Wage and Tax Report Number of Employees How many workers earned wages in the pay period including the 12th of each month AAAAAAAAAABADollars Cents UI 3 AAAB1 Gross KEIN RateWages 1STMo FEINCCCD2 Excess Qtr YrWages 2NDMo Due DateCCCD3 Taxable Wages 3RDMo CCCD4 Tax

Templates are pre-designed documents or files that can be used for different purposes. They can conserve time and effort by providing a ready-made format and design for developing various sort of material. Templates can be utilized for individual or expert projects, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

Employer Quarterly Unemployment Tax Report Ky Printable

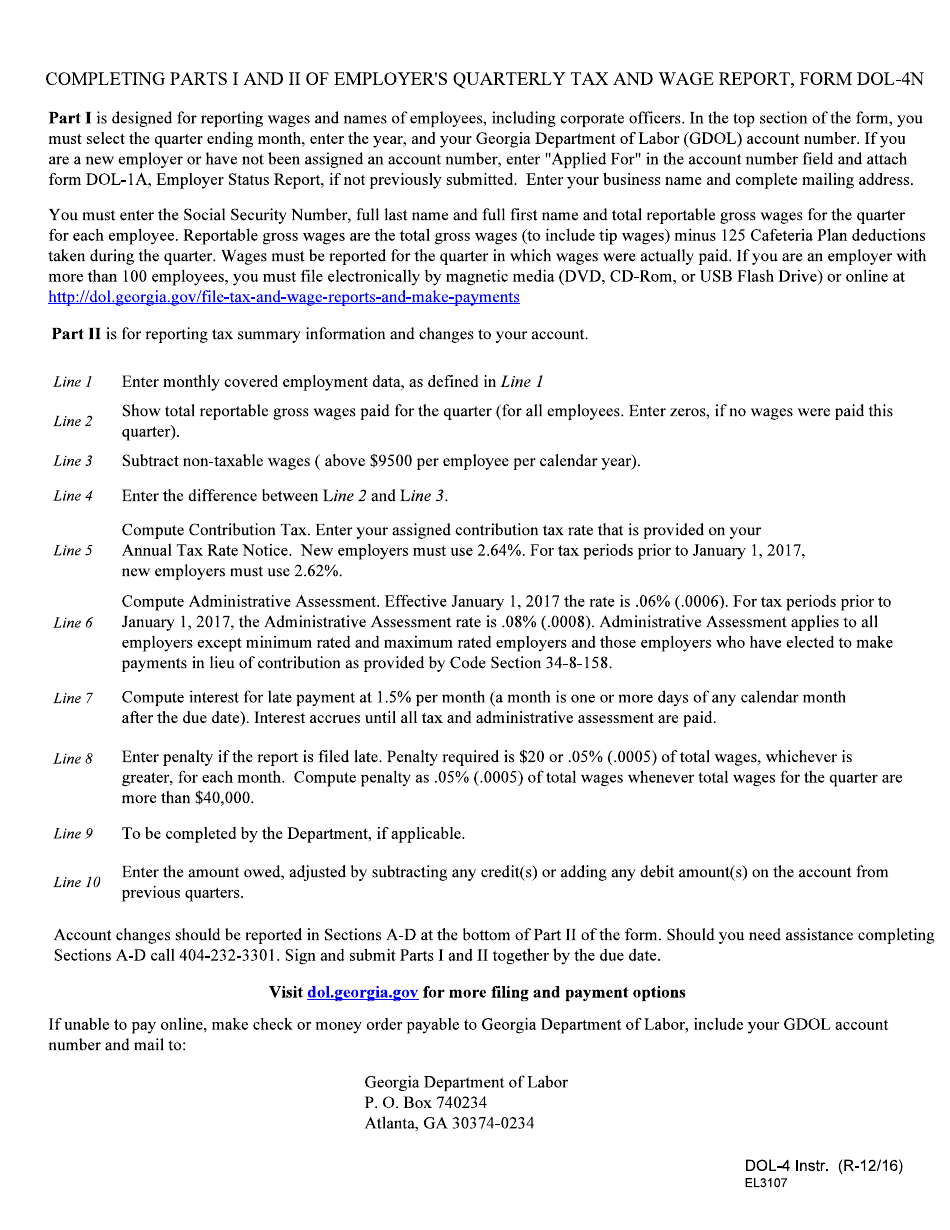

Employer Unemployment Tax Rate Georgia NEMPLOY

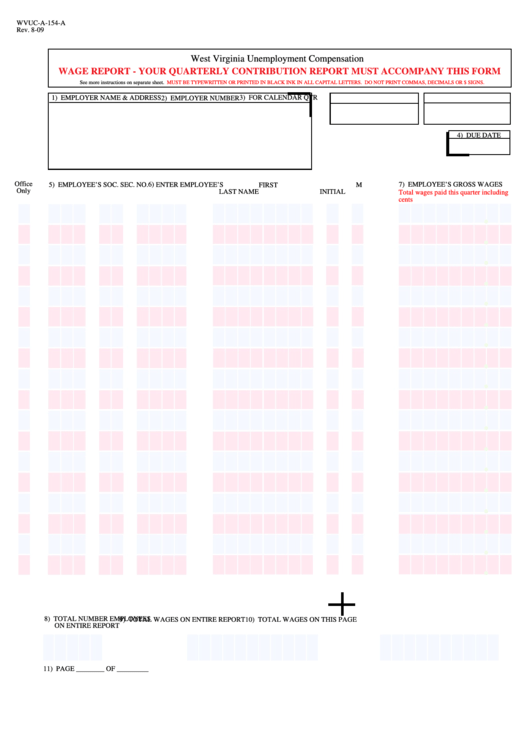

Wv Unemployment Compensation Contribution Report UNEMPLOYMENT KLO

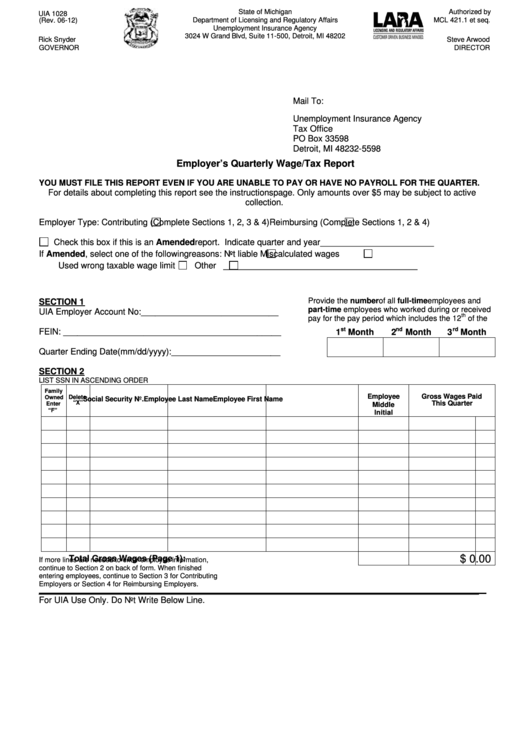

Uia 6347 Form Printable Printable Templates

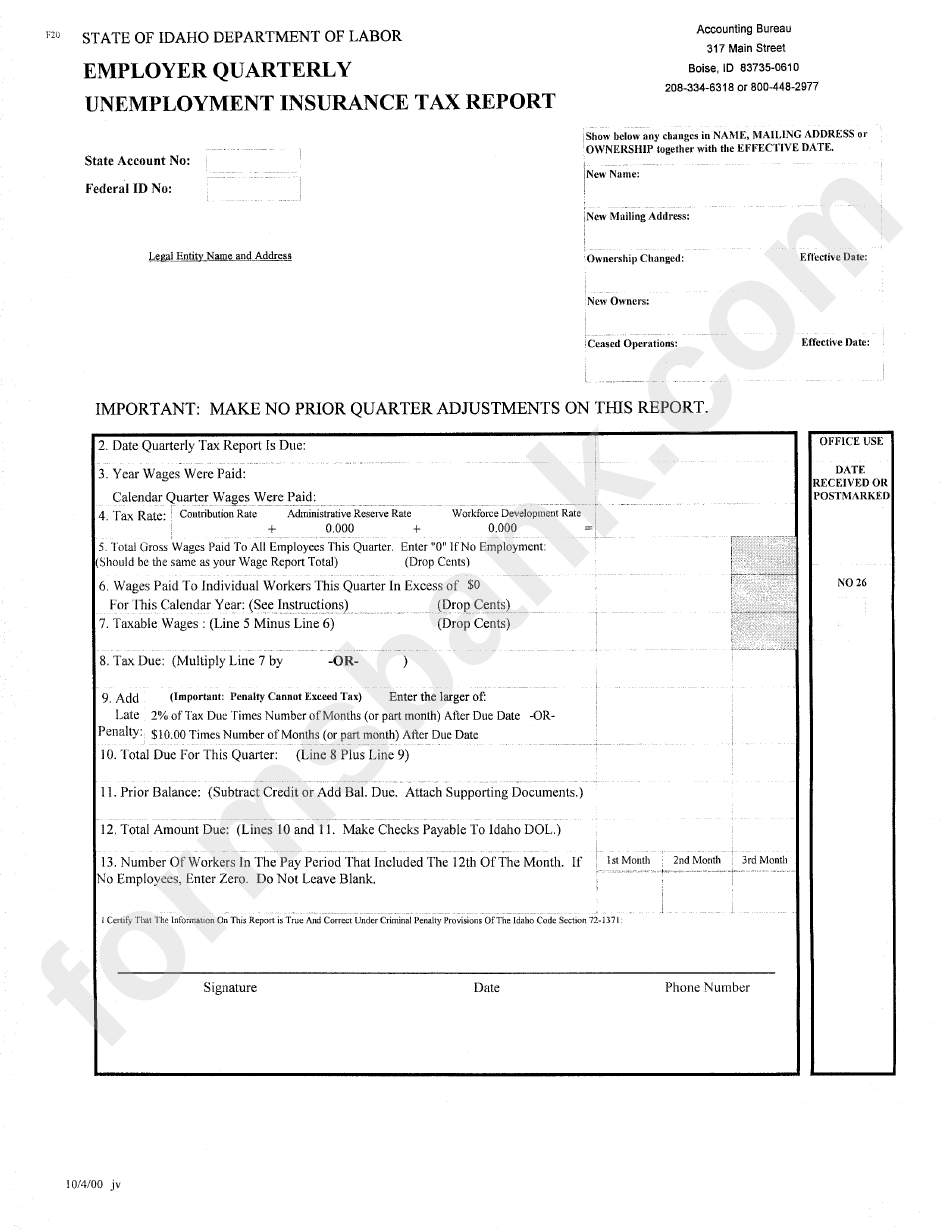

Employer Quarterly Unemployment Insurance Tax Report Form 2000

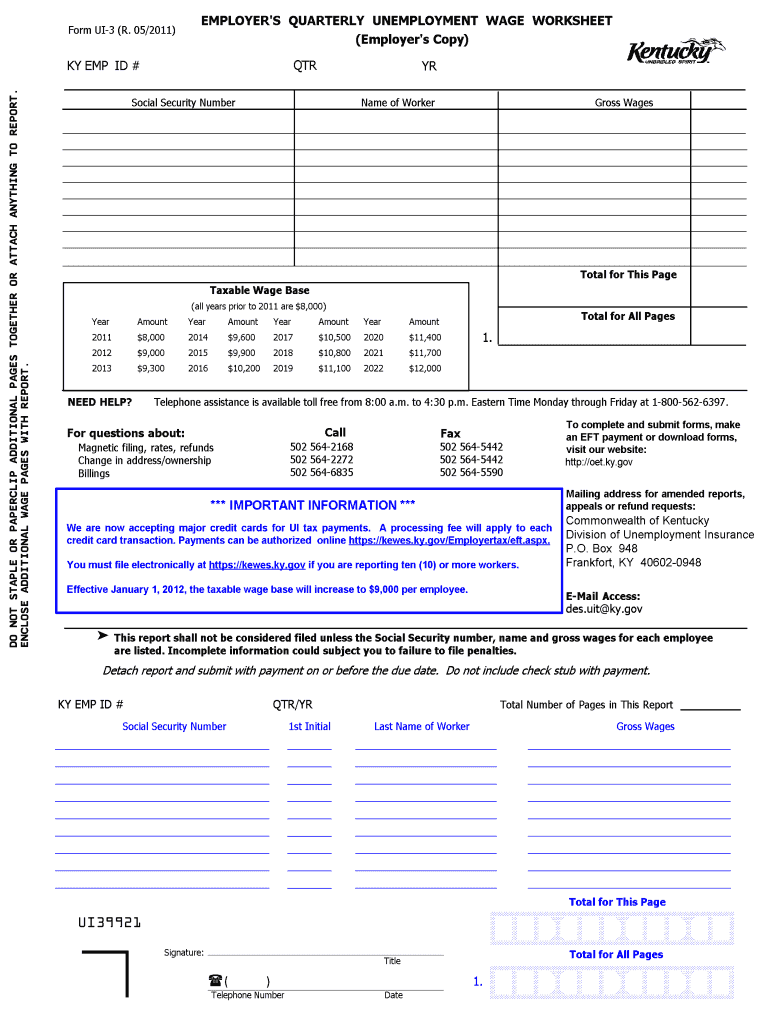

2011 2023 Form KY UI 3 Fill Online Printable Fillable Blank PdfFiller

Fillable Form For Worker S Compensation Quarterly Taxes Printable

https://apps.kcc.ky.gov/employer/UnemploymentInsurance.aspx

To submit quarterly tax reports over the Internet through either an on screen form or a file upload option retrieve information about the Kentucky unemployment insurance program pay taxes by Electronic Funds Transfer EFT or establish a new UI account please go to Kentucky s Unemployment Insurance Self Service site

http://storage.cloversites.com/elev8consulting2/documents/KY …

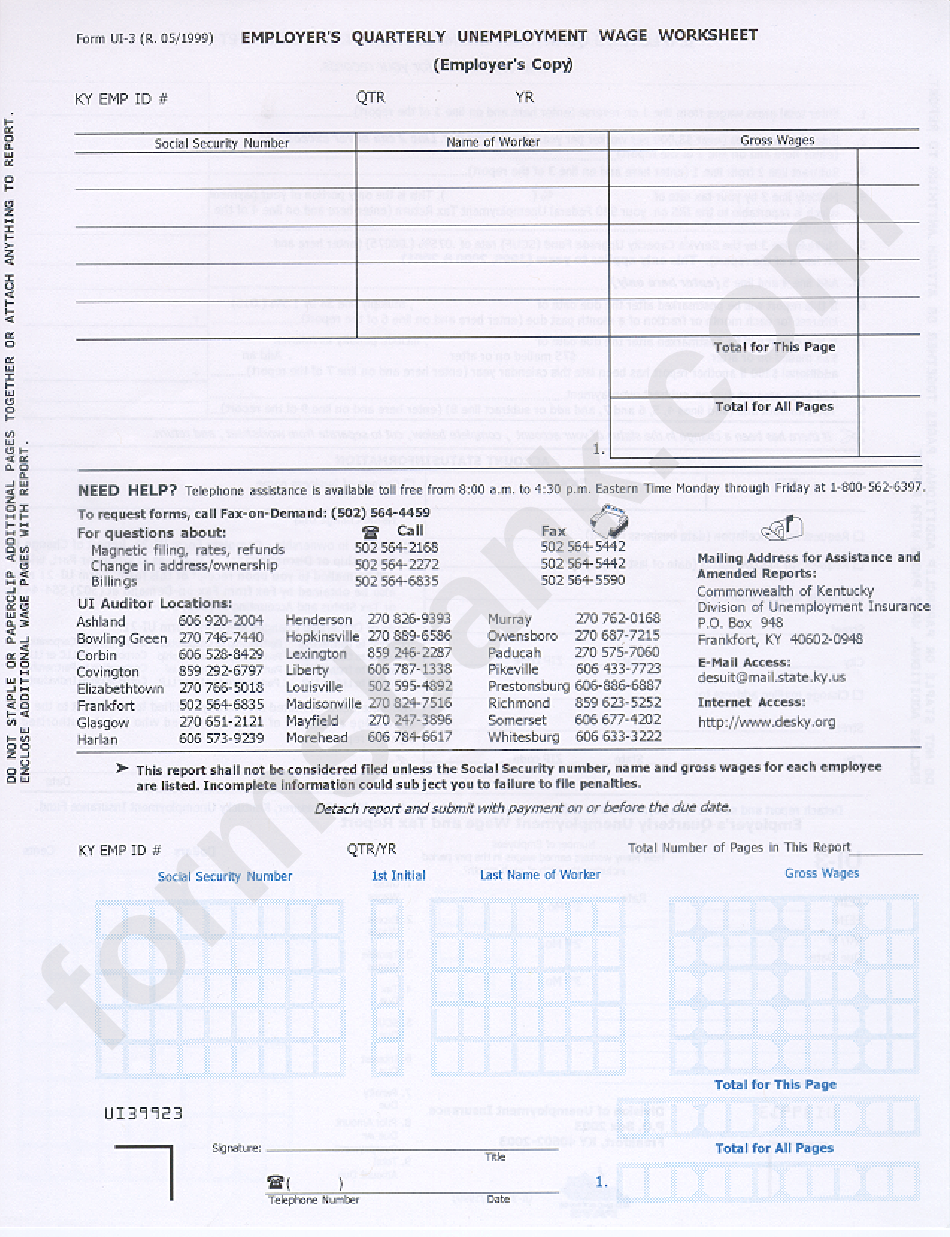

Kentucky Form UI 3 Front This is a multi page report Page two must be printed on the back of page one The form in the bottom 1 3 of the page must be separated from the rest of the first page by cutting along the dotted line before mailing Cut Here

https://kcc.ky.gov/Documents/UI-3, 11.20.pdf

Title UI3 002 pdf Author bdearborn Created Date 5 3 2021 7 45 47 AM

https://kcc.ky.gov/Documents/UI-1.pdf

In order to apply for an employer reserve account you must have begun employment in Kentucky and met liability Enter the dates of your first employment and payroll in Kentucky below and then the date in which you first met the liability test s

https://www.nolo.com/legal-encyclopedia/employers-guide-unemploym…

UI tax is paid on each employee s wages up to a maximum annual amount That amount known as the taxable wage base increases slightly yearly in Kentucky In 2023 it is 11 100 The state UI tax rate for new employers also is subject to

Determine the taxable wage amount by calendar year using the chart on the right The amount over this taxable wage limit is called EXCESS WAGES You must report each worker s entire gross wage each quarter However your tax is computed only on the taxable wage amount The following example illustrates how excess wages are calculated and 1 Enter total gross wages from line 1 on reverse enter here and on line 1 of the report 2 Enter excess wages over 8 000 per worker per year for this quarter Line 2 can never exceed line 1 enter here and on line 2 of the report 3

Site Enhancements and Electronic Reporting Dear Employer To eliminate paperwork and make reporting and payments secure fast and easier for you the Kentucky Office of Unemployment Insurance UI has made several exciting enhancements to our Employer Self Service website at https kewes ky gov Please take a few minutes to visit the self