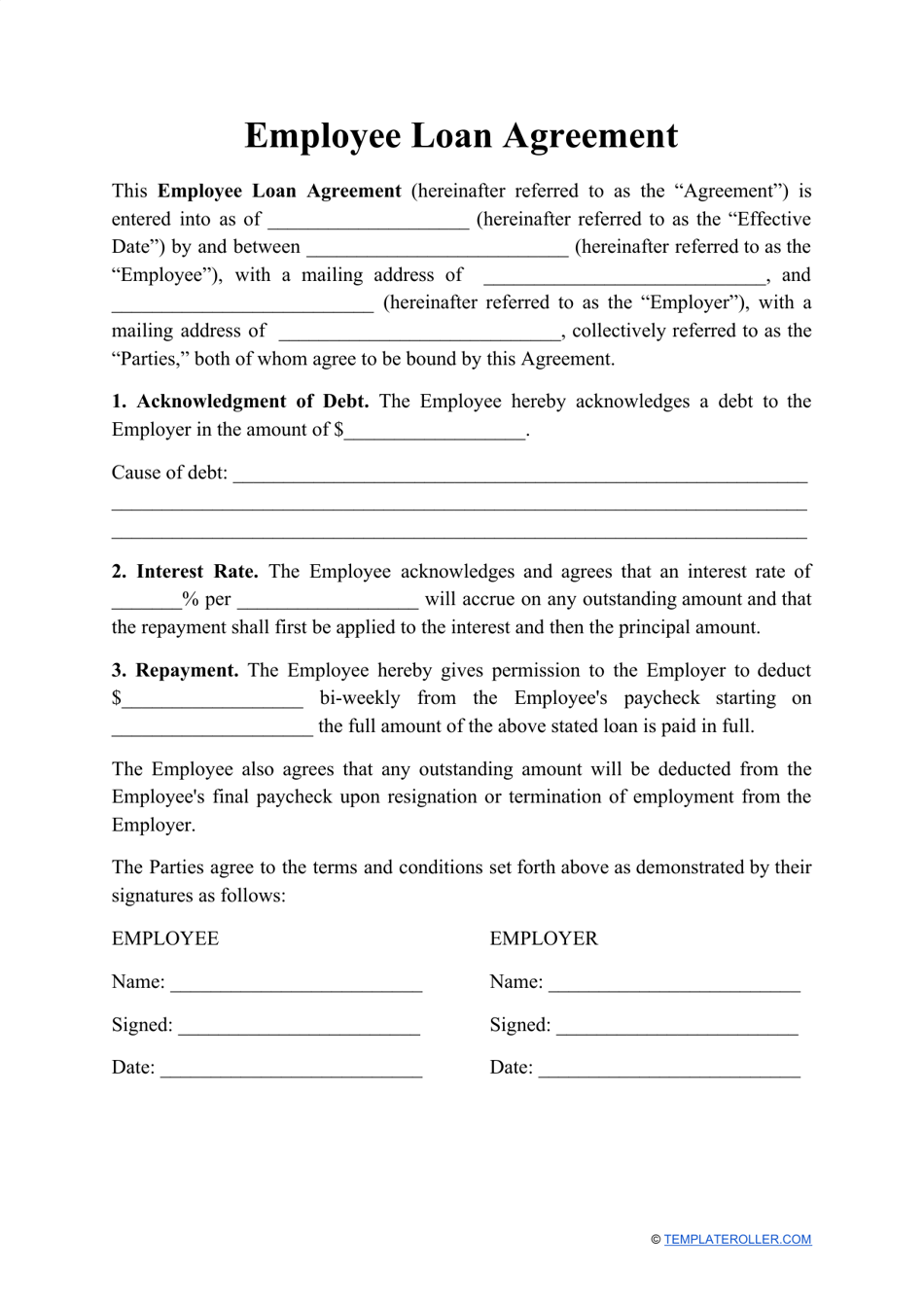

Employer Payday Loan Advance Agreement Printable If an employee resigns or is terminated before they repay their payroll advance HR is responsible for reaching a new agreement with the employee or deducting the entire remaining amount from the final paycheck Any relevant legal requirements whether national or local must be followed

An employee advance form is a document that an employee uses to get an advance payment for the services that he or she is to render in the future It includes the information about the cash advance being asked for and other data British Columbia Residents iCash offers payday loans in British Columbia license number 67639 Ontario Residents The maximum allowable cost of borrowing under the payday loan agreement is 15 for every 100 advanced On a 500 loan of 14 days the total cost of borrowing is 75 with a total payback amount of 575 and an APR of 391 07

Employer Payday Loan Advance Agreement Printable

Employer Payday Loan Advance Agreement Printable

Employer Payday Loan Advance Agreement Printable

https://esign.com/wp-content/uploads/Employee-Loan-Agreement.png

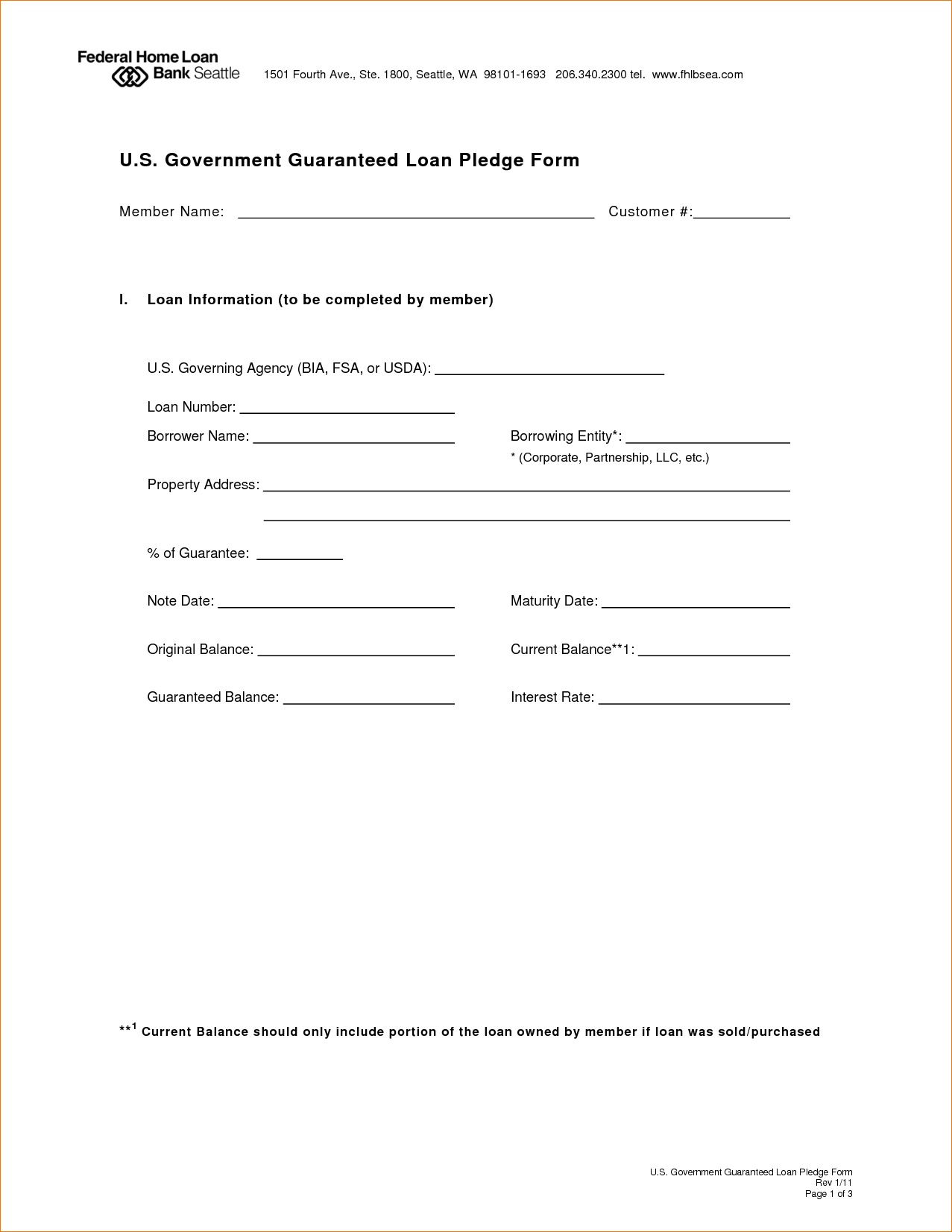

Any advance or loan you make that is more than the amount awarded under the claim any advance or loan not repaid to you a top up amount you pay your employee after a claim is decided that is in addition to the benefits paid by a workers compensation board

Pre-crafted templates offer a time-saving service for creating a diverse series of files and files. These pre-designed formats and designs can be used for numerous individual and professional jobs, including resumes, invitations, flyers, newsletters, reports, presentations, and more, enhancing the material production process.

Employer Payday Loan Advance Agreement Printable

Long Term Loan Agreement Template

Beautiful Advance Salary In Balance Sheet Audit Report Of A Company Pdf

Free Unpaid Wages Demand Letter Sample PDF Word EForms

Personal Loan Repayment Contract K 1 Fiancee Visa Immigration Kit

Free Loan Agreement Form Download Payday Loans Available Online

Delta Cash Wise Payday Loans Online In Canada

https://resources.workable.com/payroll-advance-policy

The Payroll Advance Policy outlines the company s guidelines for providing short term emergency loans to employees It defines eligibility criteria legitimate reasons for requesting an advance repayment terms and the process for application The policy ensures fairness transparency and adherence to legal requirements

https://www.atyourbusiness.com/salaryadvance.php

Templates to create a salary advance agreement for employees who need extra cash until a future payday The generic policy agreement letter and form provided below may be downloaded and edited to include the terms you want to put in place for an employee receiving and also repaying the loan agreement

https://www.canada.ca//workers-compensation-claims/advances-loans.…

Advances or loans An employer may continue to pay an injured employee while the employee is off work If there is wording in the employee s collective agreement that link the payments to a workers compensation board decision then the employer can treat them as an advance or loan

https://esign.com/loan-agreement/employee

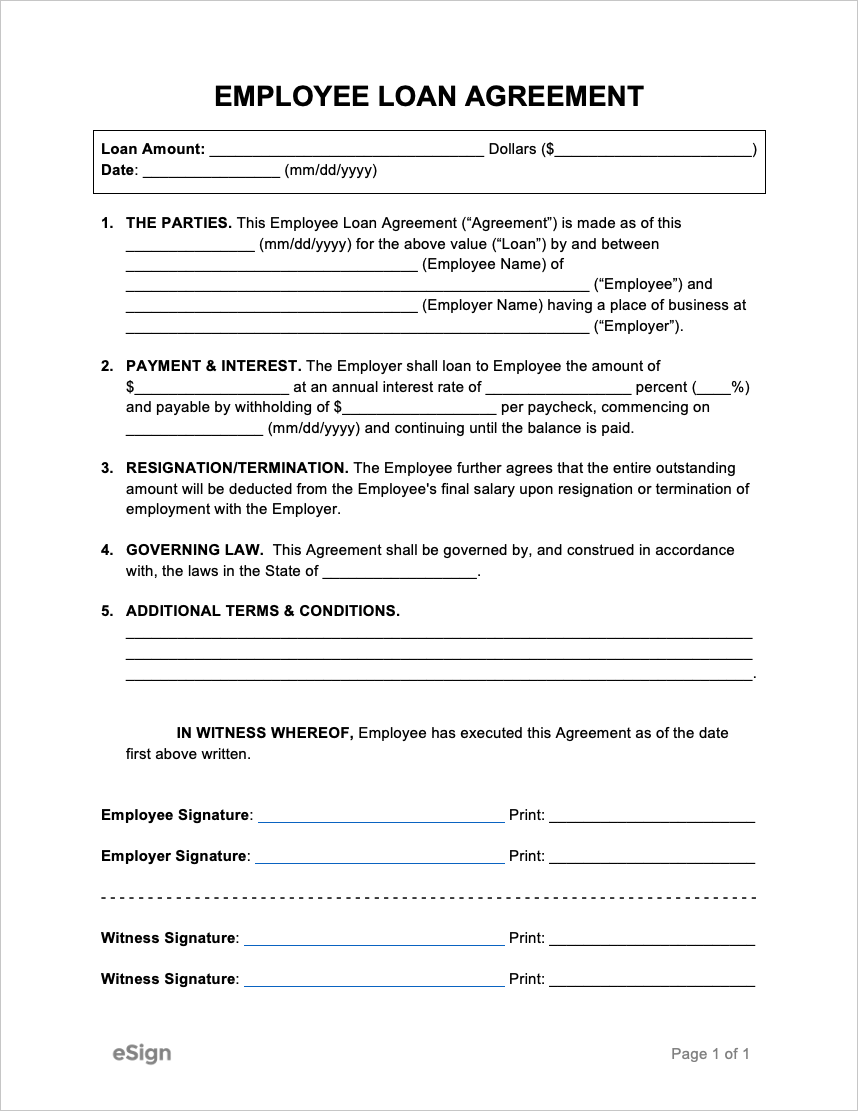

The amount the employer will deduct from the employee s paycheck to pay for the loan The date of the first payment What happens should the employee default on the loan The signatures of the employer and employee The employer should keep a version of the loan agreement as a template

https://atyourbusiness.com/employeeloan.php

Templates to create a salary advance agreement for employees who need extra cash until a future payday Employee Loan Agreement An agreement that was drawn up for employees taking out a loan from their employer

Quick steps to complete and e sign Cash advance agreement template online Use Get Form or simply click on the template preview to open it in the editor 22 Free Employee Loan Agreement Templates PDF DOC An employee loan agreement template is a legal document that outlines an agreement between an employer and an employee for a loan to be provided

A payroll advance is a short term loan an employer may offer employees based on wages they ve already earned usually only a few days ahead of the scheduled payday The employees then repay the advance out of their next paycheck or in installments over several paychecks