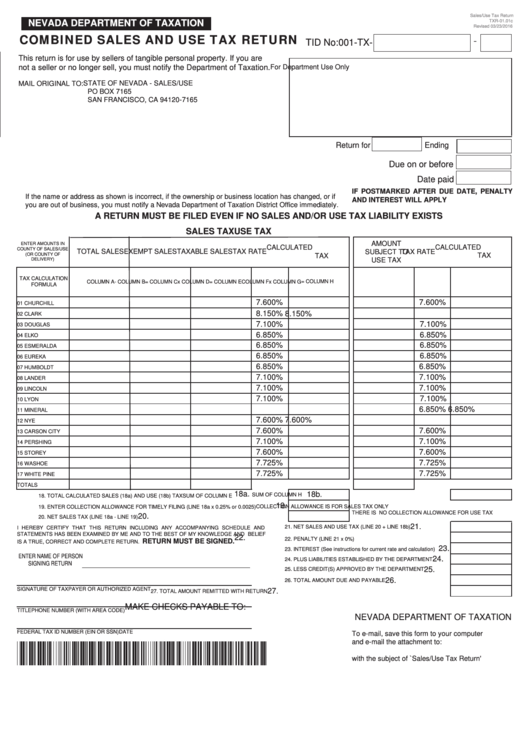

Combined Sales And Use Tax Return Printable Fillable Form Txr 01 01 Combines Sales And Use Tax Return Nevada Department Of Taxation printable pdf download View download and print fillable Txr 01 01 Combines Sales And Use Tax Return Nevada Department Of Taxation in PDF format online Browse 146 Nevada Department Of Taxation Forms And Templates collected for any of

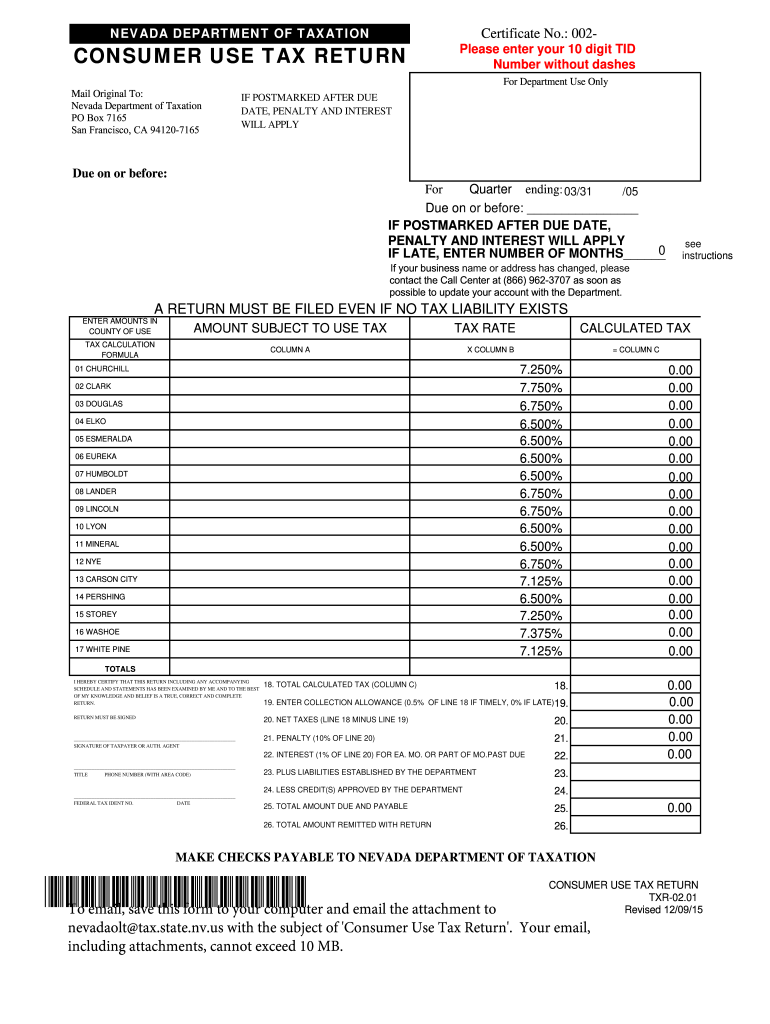

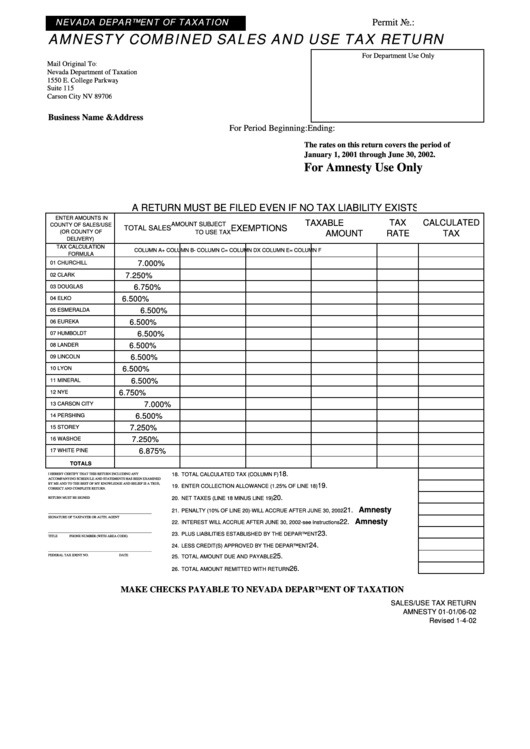

The Washington Department of Revenue DOR Oct 23 released the October Combined Excise Tax Return for excise and sales and use tax purposes The return has sections for business and occupation taxes state and local retail sales taxes other excise taxes and credits The DOR explains that 1 the due date for the return is Combined sales and use tax return mail original to state of nevada sales use po box 7165 san francisco ca 94120 7165 for department use only permit number 001 return for ending due on or before if postmarked after due date penalty and interest will apply if late enter number of months

Combined Sales And Use Tax Return Printable

Combined Sales And Use Tax Return Printable

Combined Sales And Use Tax Return Printable

https://i.ytimg.com/vi/M3AMWWyom5g/maxresdefault.jpg

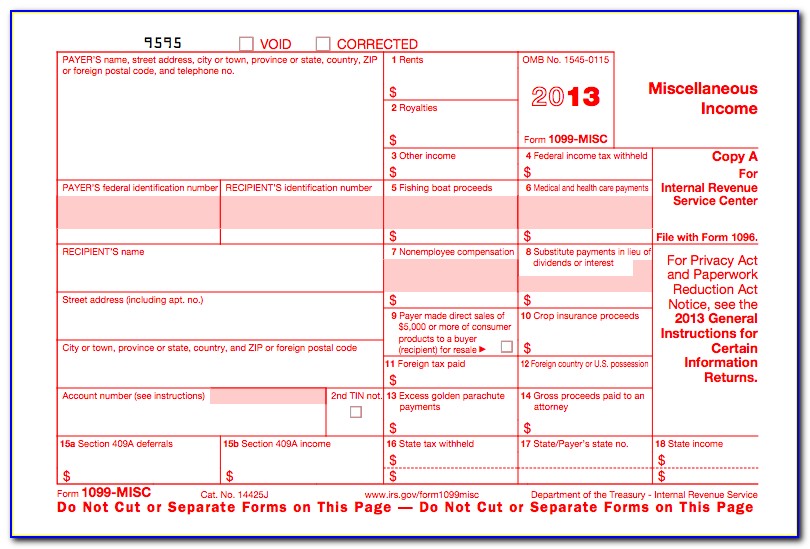

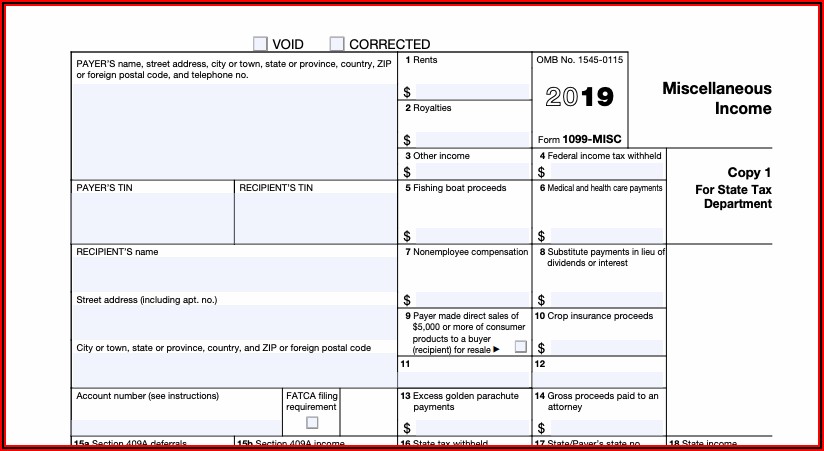

Personal use property When you sell personal use property such as cars and boats in most cases you do not end up with a capital gain This is because this type of property usually does not increase in value over the years As a result you may end up with a loss Although you have to report any gain on the sale of personal use property

Pre-crafted templates use a time-saving solution for creating a varied variety of files and files. These pre-designed formats and designs can be utilized for numerous personal and expert projects, consisting of resumes, invites, flyers, newsletters, reports, discussions, and more, enhancing the material development procedure.

Combined Sales And Use Tax Return Printable

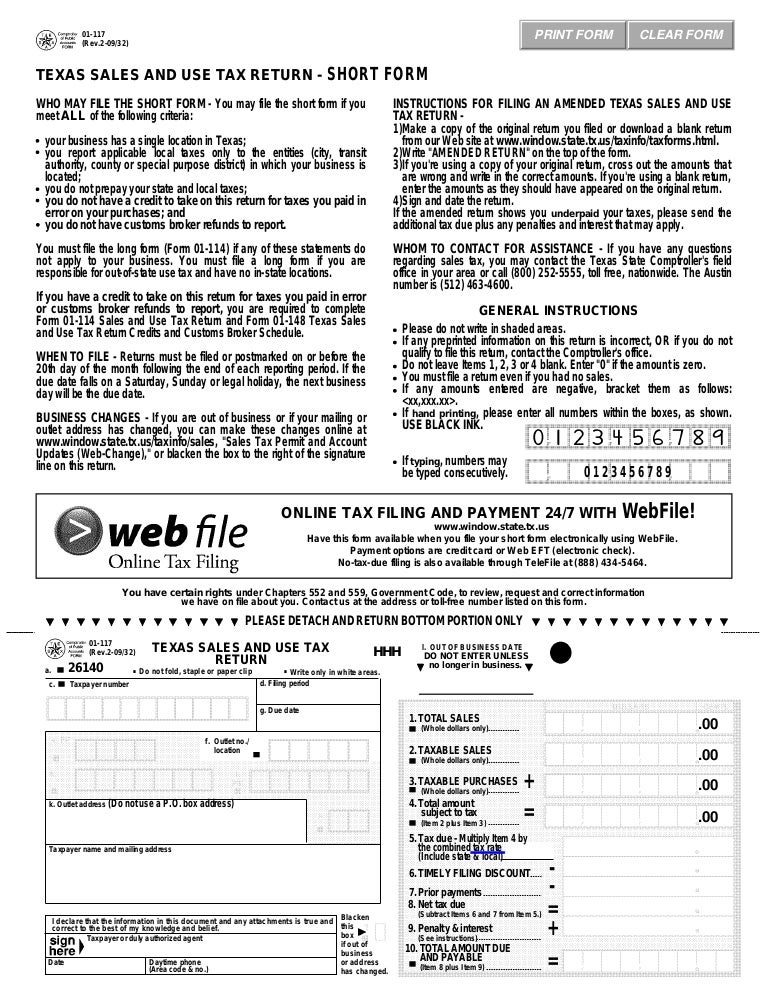

Texas Fireworks Tax Forms 01 117 Texas Sales Use Tax Return Short

Combined Sales And Use Tax Return Printable Pdf Download

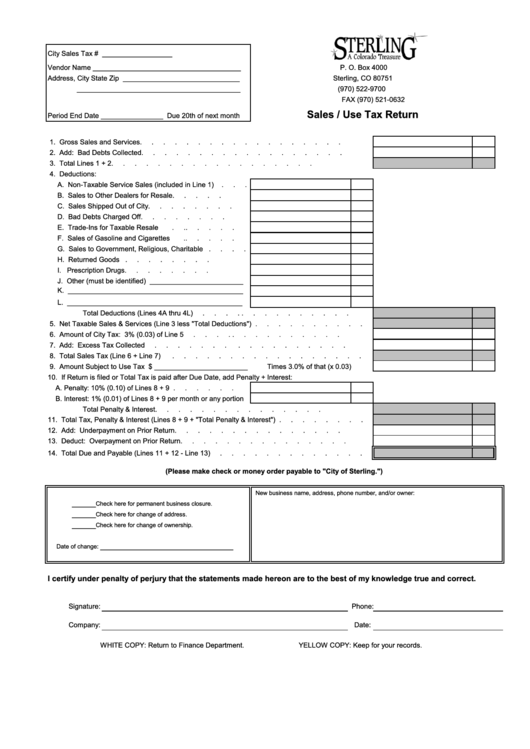

Sales Use Tax Return Form Printable Pdf Download

Nevada Combined Sales And Use Tax Return Form Form Resume Examples

State Of Nevada Combined Sales And Use Tax Return Form Form Resume

Nevada Use Tax Fill Out And Sign Printable PDF Template SignNow

https://tax.nv.gov/Forms/Sales___Use_Tax_Forms

Effective January 1 2020 the Clark County sales and use tax rate increased to 8 375 This is an increase of 1 8 of 1 percent on the sale of all tangible personal property that is taxable In the 2011 Legislative Session reduced the interest rate to 0 75 or 0075 from 1 or 01 effective 7 1 2011

https://www.formsbank.com//combined-sales-and-use-tax-return.html

TXR 01 01c NEVADA DEPARTMENT OF TAXATION Revised 03 23 2016 COMBINED SALES AND USE TAX RETURN TID No 001 TX This return is for use by sellers of tangible personal property If you are not a seller or no longer sell you must notify the Department of Taxation For Department Use Only MAIL ORIGINAL TO STATE OF

https://www.tax.nv.gov//Forms/Sales_and_Use_Tax_Return…

COMBINED SALES AND USE TAX RETURN This return is for use by sellers of tangible personal property If you are not a seller or no longer sell you must notify the Department of Taxation For Department Use Only MAIL ORIGINAL TO STATE OF NEVADA SALES USE PO BOX 52609 PHOENIX AZ 85072 2609

https://www.formsbank.com//form-txr-01-01-sales-use-tax-return.html

Download a blank fillable Form Txr 01 01 Sales Use Tax Return in PDF format just by clicking the DOWNLOAD PDF button Open the file in any PDF viewing software Adobe Reader or any alternative for Windows or MacOS are required to

https://www.signnow.com//37768-state-of-nevada-tax-forms-2016-2019

Document history and detailed Audit Trail Extended threat defense Disaster Recovery plan These features make completing the nevada combined sales use tax with signNow much more secure than filling a paper version Check it

State printing Combined Sales and Use Tax Return Author State of Nevada Subject Graduated Penalty and Interest and Collection Allowance reflects change in collection allowance rate for the first 6 months of 2009 r nValid from Period End Date of 4 30 07 Created Date 3 1 2021 12 23 32 PM The form has sections for the state business and occupation tax the state sales and use tax the local city and or county sales and use tax other excise taxes credits and deductions The form includes 1 the tax return is due on April 17 2023 2 penalties are assessed based on how late the return is filed 3 deductions taken but not

Print Form NEVADA DEPARTMENT OF TAXATION COMBINED SALES AND USE TAX RETURN 001 TID No 001 TXFor Department Use Only This return is for use by sellers of fringe benefit statement Fringe Benefit Statement COMPANY INFORMATION Company Name Date Street Address Suite Unit City State Zip License Number Issuing