Childcare Printable Worksheet For Childcare Expenses You can claim child care expenses that were incurred for services provided in 2022 These include payments made to any of the following individuals or institutions caregivers providing child care services day nursery schools and daycare centres

Child care expenses Child care is not taxable only if all of the following conditions are met the services are provided at your place of business the services are managed directly by you the services are provided to all of the employees at minimal or no cost Generally the person with the lower net income including zero income must claim the child care expenses However if your spouse or common law partner has the higher net income and one of the conditions below apply he can make the claim for child care expenses at line 21400 a You are enrolled in an educational program that is offered by

Childcare Printable Worksheet For Childcare Expenses

Childcare Printable Worksheet For Childcare Expenses

Childcare Printable Worksheet For Childcare Expenses

https://i.pinimg.com/originals/ca/43/e0/ca43e0d9e04562c9fe549f7e609ef8b9.jpg

This free downloadable daycare invoice template offers room to provide parents with specific information about your charges to maximize your chances of on time payments Here s a look at some vital information you should include to ensure you send professional invoices Download a Customizable Daycare Invoice Now Word Template

Pre-crafted templates offer a time-saving solution for producing a varied series of documents and files. These pre-designed formats and layouts can be utilized for different personal and professional jobs, including resumes, invitations, leaflets, newsletters, reports, discussions, and more, enhancing the content development procedure.

Childcare Printable Worksheet For Childcare Expenses

Health Insurance Quote Pattern Worksheet Childcare Activities People

Claiming Childcare Expenses In Canada Blueprint Accounting

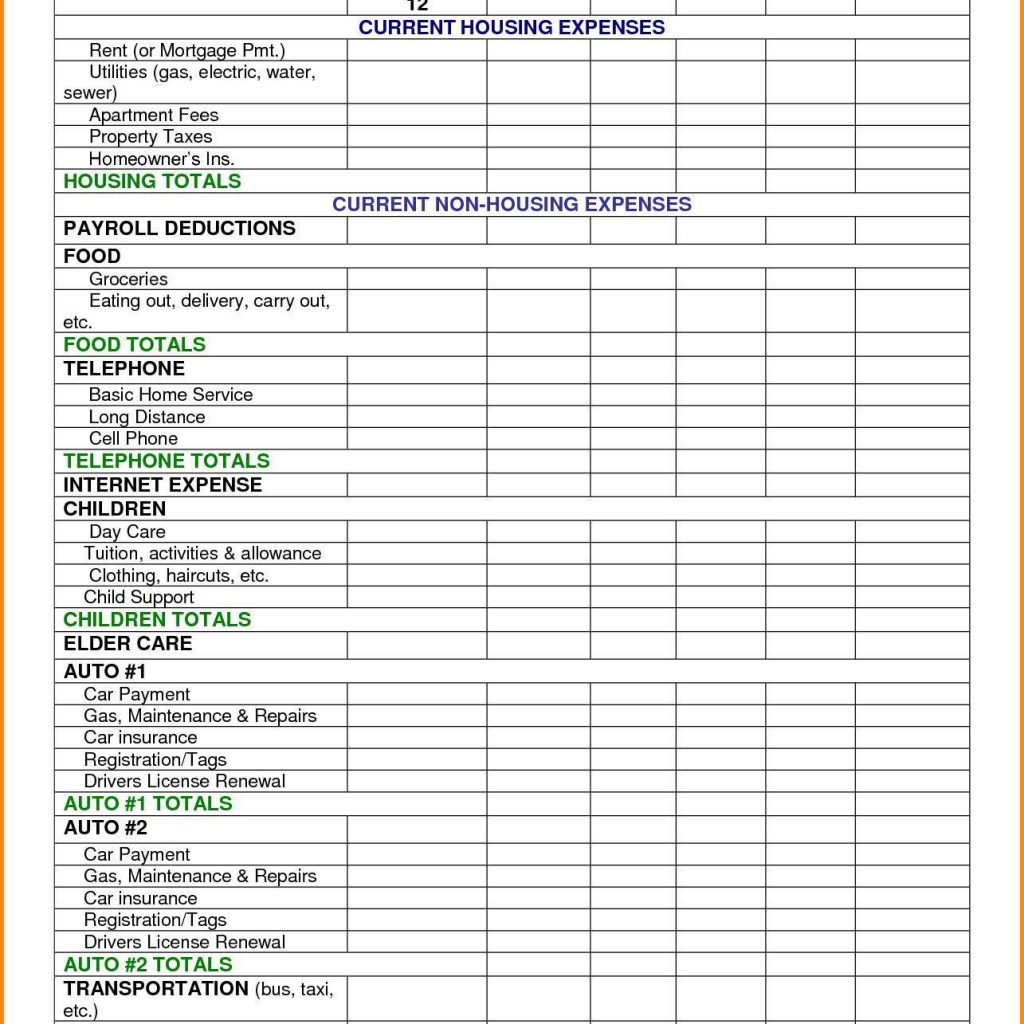

Daycare Expense Spreadsheet Within Child Care Center Budget Template

Parents Could Be Eligible For 2 000 Off Childcare Costs As Inflation

Premium Vector Childcare Expenses Abstract Concept Vector Illustration

Home Daycare Income And Expense Worksheet Nacedero riourederra

https://www.canada.ca/en/revenue-agency/services/forms-publications/

T778 Child Care Expenses Deduction for 2022 For best results download and open this form in Adobe Reader See General information for details You can view this form in PDF t778 22e pdf

https://www.canada.ca//topics/daycare-your-home/issuing-receipts.html

Daycare in your home Issuing receipts for daycare You are expected to issue receipts to the parents of the children in your care You should do this as soon as possible to give them time to file their income tax returns Receipts you issue have to include all of the following information

https://support.hrblock.ca//T778_ChildcareExpensesDeduction.htm

You can use form T778 Child care expenses deduction to claim child care expenses you paid for your child ren in 2022 You can claim child care expenses if you or your spouse or common law partner paid someone to look after an eligible child so that you or both of you can Earn income from employment

https://www.canada.ca/en/revenue-agency/services/tax/technical

The annual child care expense amount for each child is determined with reference to the child s age physical and mental condition 1 38 1 For 2015 and subsequent tax years see 1 38 2 for 2014 and previous tax years the annual child care expense amount is determined as follows

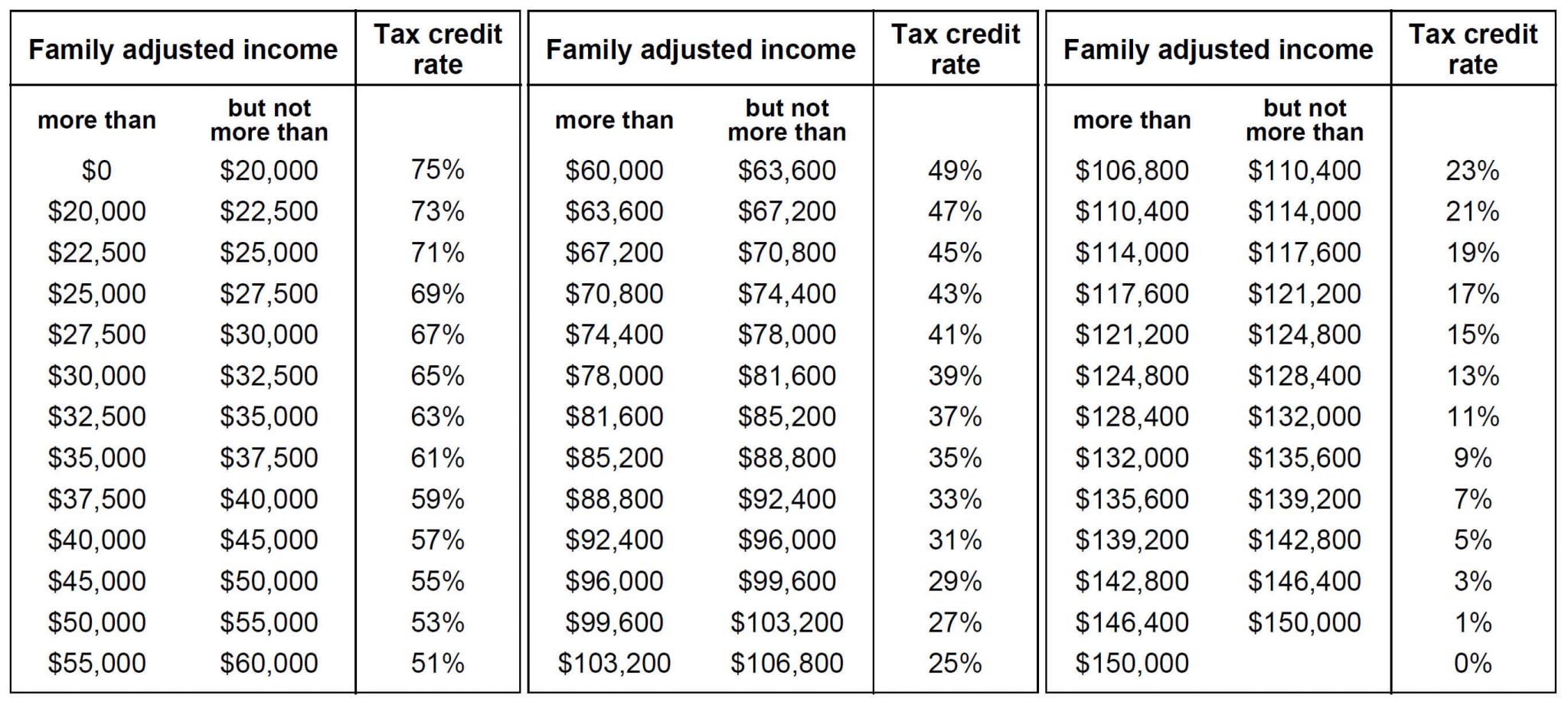

https://www.ontario.ca/page/ontario-child-care-tax-credit

The Ontario Child Care Tax Credit is calculated as a percentage of your Child Care Expense Deduction The Child Care Expense Deduction provides provincial and federal income tax relief toward eligible child care expenses The top up is calculated as an additional 20 per cent to the credit entitlement

Free and printable tools for childcare and preschool businesses Download lesson plan templates interview questions supply list and more Day Care hours per day TOTAL HOURS PER DAY IN CASE OF AN AUDIT THESE RECORDS WILL BE REQUIRED AUTO EXPENSE Keep records of mileage for day care meetings shopping for supplies groceries or to events etc If you take expense on mileage basis complete the following lines Auto 1 Auto 2 Auto 3 Year make of auto bring in

The childcare expenses category includes what you have to spend on to directly take care of the children that are enrolled at your daycare The 3 main subcategories of childcare expenses are food educational supplies and equipment emergency supplies and employee labor