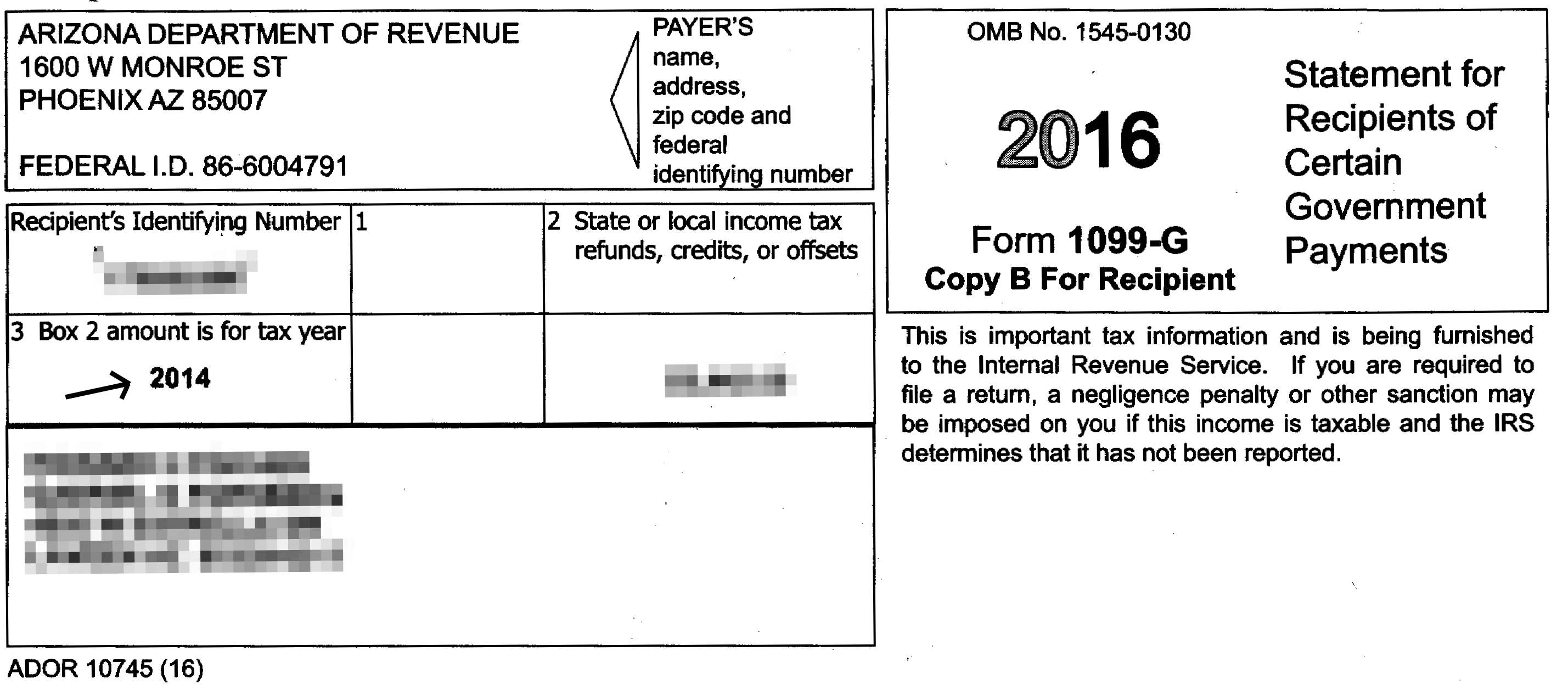

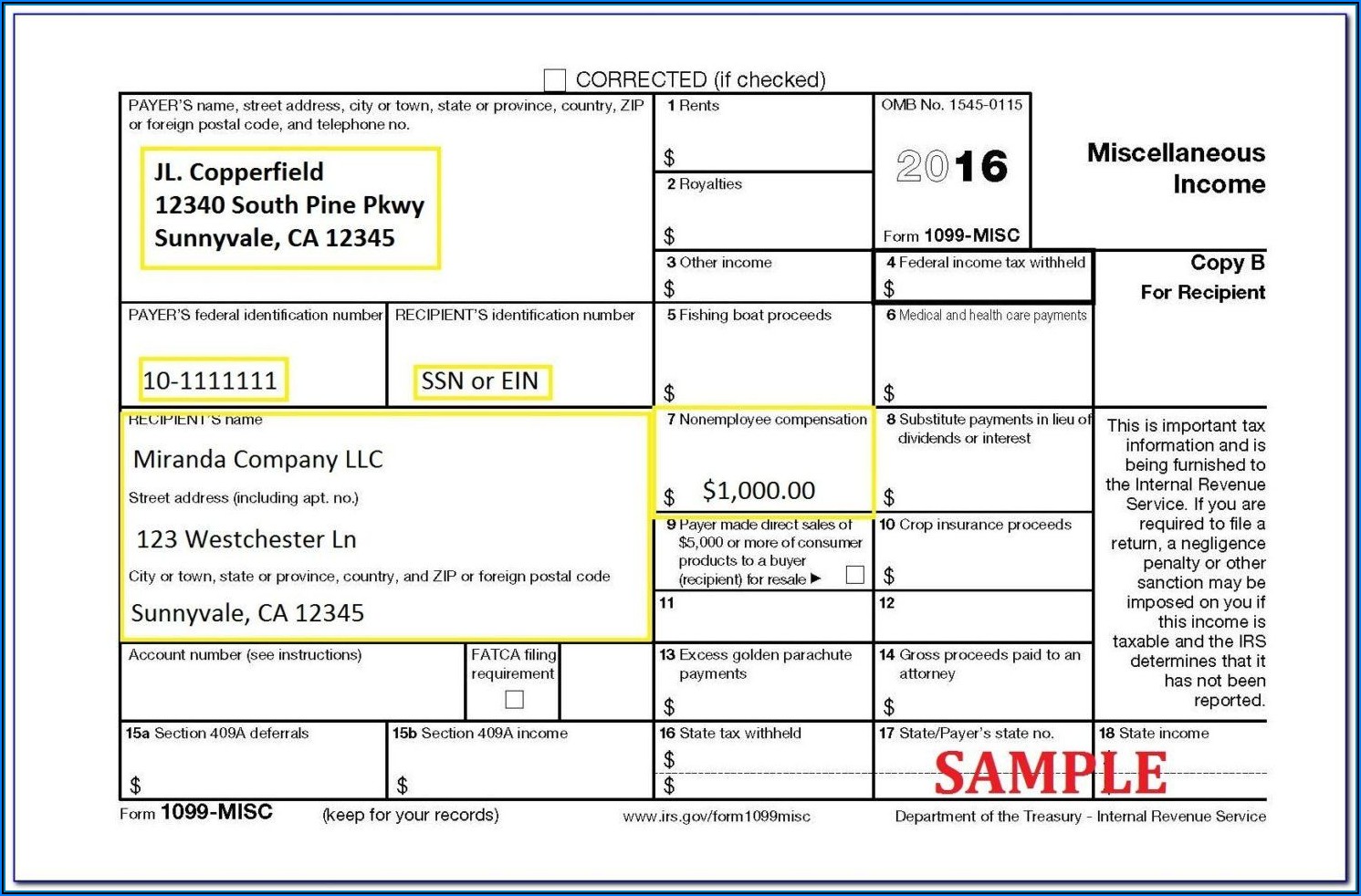

Az 1099 Form Printable Form 1099 G Now Online for Individuals January 31 2023 News Phoenix AZ Taxpayers can now search download and print their Form 1099 G online through www AZTaxes gov by clicking on the View My 1099 G

State of Arizona 1099 MISC Correction Form 09 29 2022 GAO 94NEC State of Arizona 1099 NEC Correction Form 09 29 2022 GAO 99A Request to Process Manual Warrant 04 01 2020 GAO AAC Administrative Adjustments Checklist 09 29 2023 GAO AAR Administrative Adjustment Request Form 1099 G Now Available for Reporting State Income Payment January 26 2022 News Phoenix AZ Form 1099 G is now available online to search download and print by going to www AZTaxes gov clicking on the View My 1099 G link and providing the necessary information

Az 1099 Form Printable

Az 1099 Form Printable

Az 1099 Form Printable

http://www.contrapositionmagazine.com/wp-content/uploads/2021/01/arizona-1099-r-form.jpg

TUCSON Ariz KOLD News 13 Taxpayers who need to print out their 1099 G forms can now go online to access them These forms serve as confirmation of the previous year s state tax refund For eligibility taxpayers must have itemized on their federal return and received an Arizona income tax refund for the previous year

Pre-crafted templates provide a time-saving service for developing a varied variety of files and files. These pre-designed formats and layouts can be utilized for different personal and expert tasks, consisting of resumes, invites, flyers, newsletters, reports, discussions, and more, improving the content creation process.

Az 1099 Form Printable

Az 1099 Form Printable Printable World Holiday

Hold Up On Doing Your Taxes Arizona Tax Form 1099 G Is Flawed The

Free Printable 1099 Int Form Form Resume Examples

Arizona Form 1099 G Form Resume Examples MW9pB7W7VA

What Is A 1099 Tax Form Printable Form Resume Examples

Free Printable 1099 Int Form Form Resume Examples

https://azdor.gov/news-center/form-1099-g-now-available-online

News Taxpayers receiving Form 1099 G which serves as a confirmation of the previous year s state tax refund can now go online to access and print the form To be eligible for a Form 1099 G a taxpayer must have itemized on their federal return and received an Arizona income tax refund

https://azdor.gov/individuals/income-tax-filing-assistance/filing-documents

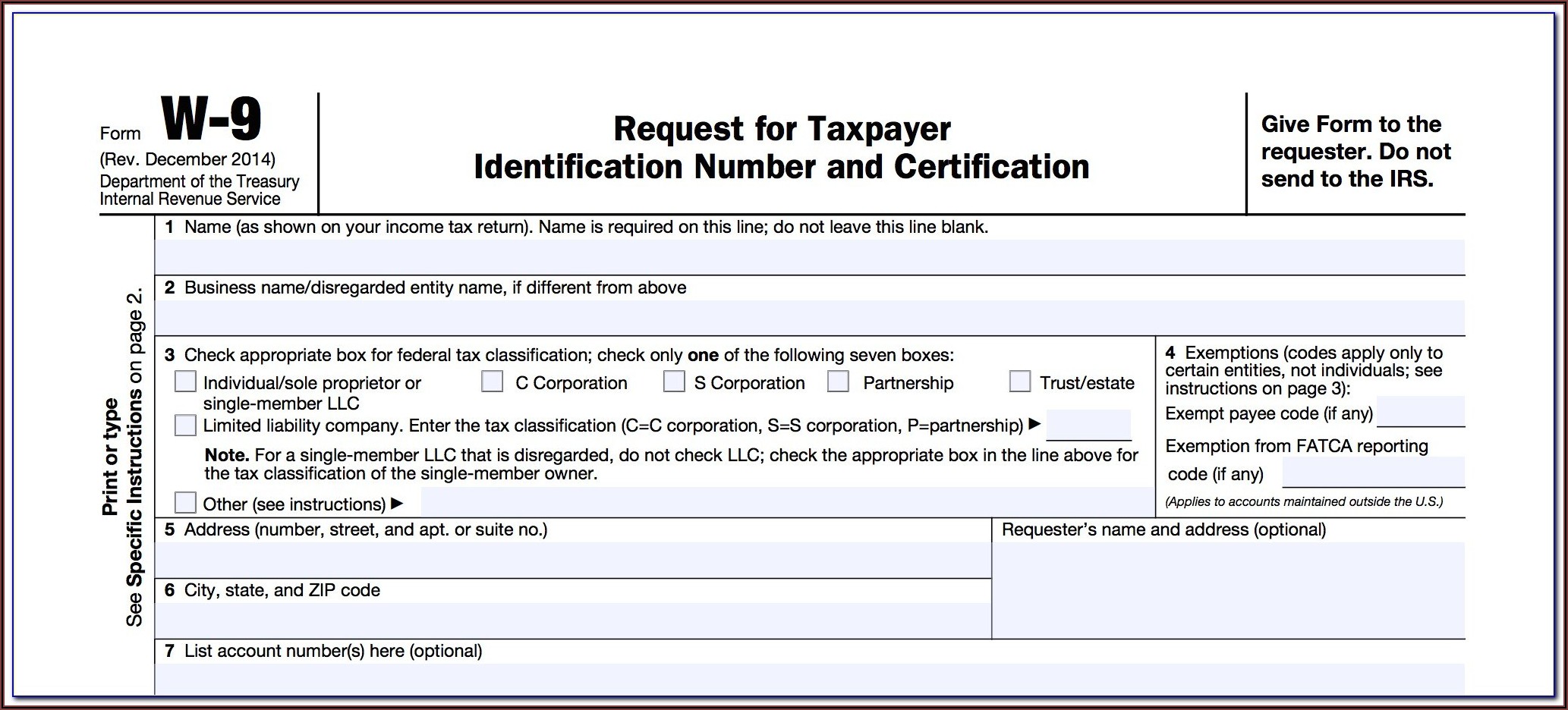

They can go to www AZTaxes gov click the View My 1099 G provide the necessary information and download the forms In addition to Form 1099 G taxpayers can confirm the previous year s state tax refund by reviewing their previous year s Arizona individual income tax return For frequently asked questions see the FAQs page W 2 from Employer

https://azdor.gov/forms

Home Forms Your Responsibilities as a Tax Preparer Penalty Abatement Request Use Form 290 to request an abatement of non audit penalties Approved Tax Software Vendors Booklet X E File and E Pay Requirements and Penalties Forms Technical Information

https://des.az.gov//employment/unemployment-individual/1099-g-tax-fo…

Beginning February 1 2023 if you received UI benefits in the calendar year 2022 you can log in to the Weekly Claims portal and view and print your 1099 G information in the View Benefits Paid 1099 tab If you received PUA benefits in the calendar year 2022 you can log in to the PUA portal and access your 1099 G document through the My

https://form1099g.aztaxes.gov/Home/View1099-G

Welcome to Arizona Department of Revenue 1099 G lookup service Form 1099 G will be available on or before January 31 each year For more information about Form 1099 G review the Frequently Asked Questions Arizona income tax payments for the tax year exceeded the actual tax liability

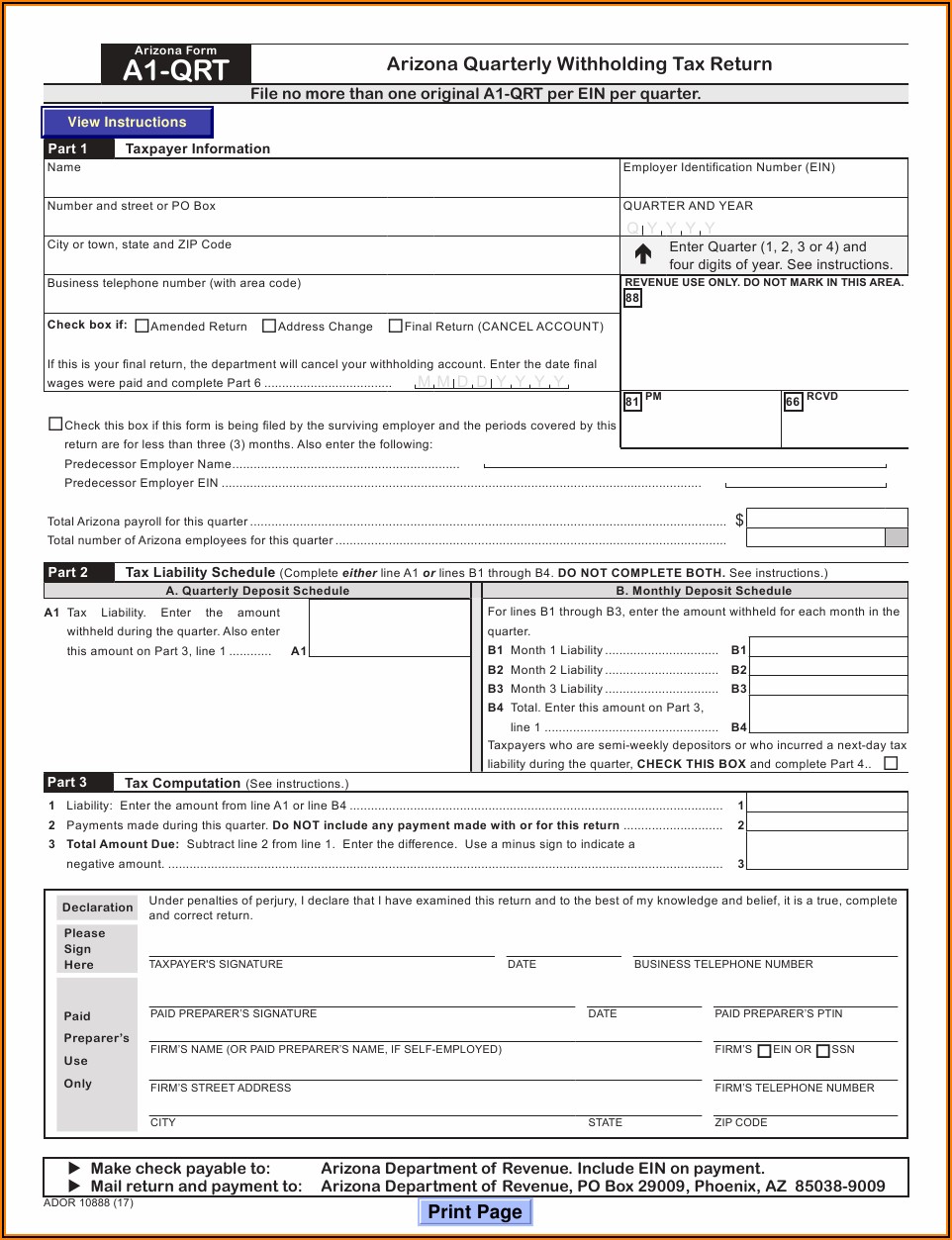

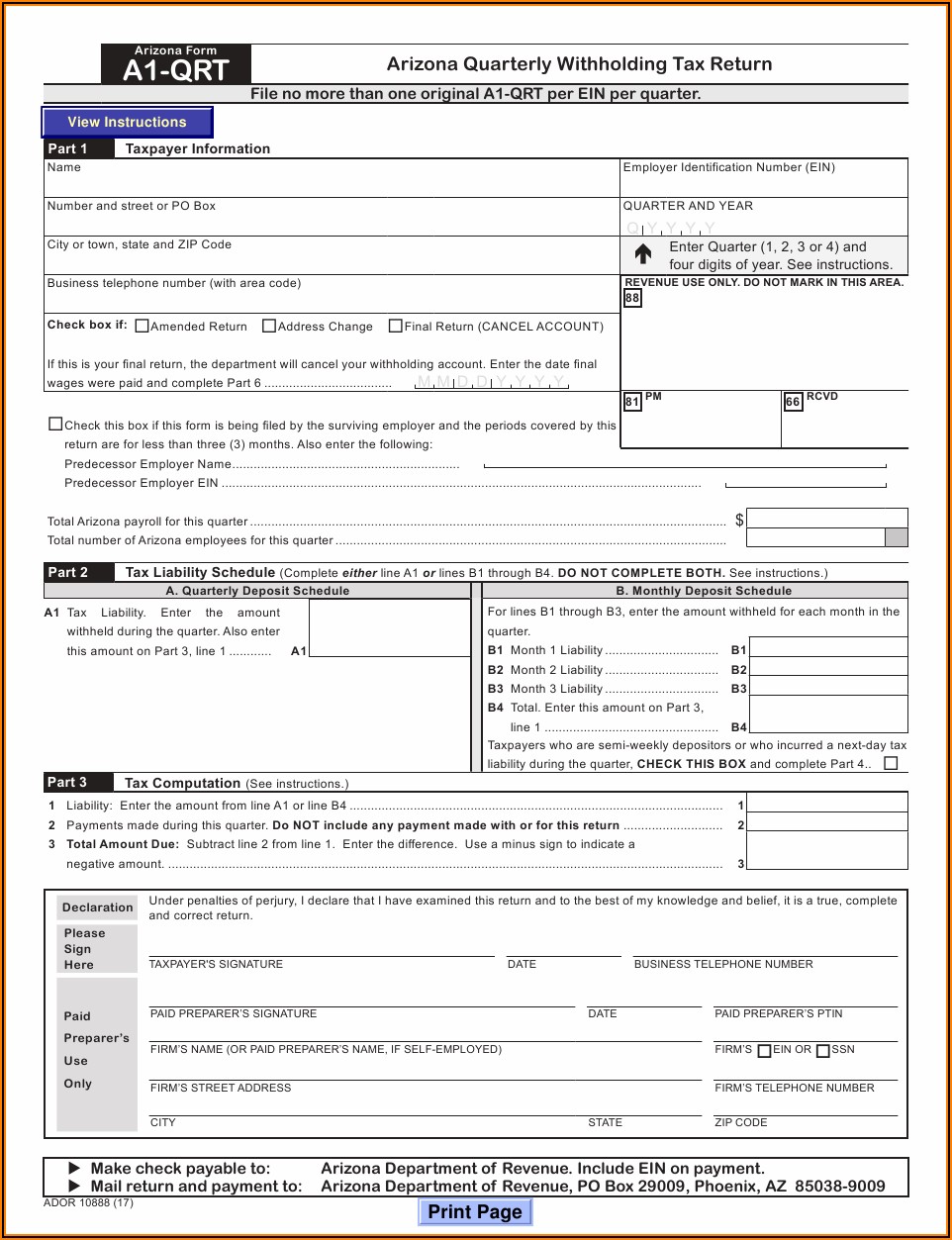

Home Forms Individual Income Tax Forms The Arizona Department of Revenue will follow the Internal Revenue Service IRS announcement regarding the start of the 2022 electronic filing season Download 1099 E File Software File the following forms with the state of Arizona 1099 R Filing due dates File the state copy of form 1099 with the Arizona taxation agency by February 28 2021 January 31 in some cases Reporting threshold If you file 250 or more 1099 forms with Arizona you must file electronically

E file Now Complete your State e filing for 0 50 form when you e file your Federal form with us No Annual Subscription No Reconciliation Charges No Hidden Charges Arizona 1099 State Filing Requirements Guide Know your filing requirements Understand special fields Arizona 1099 filing methods Arizona 1099 deadlines