Assets Liabilities Equity Printable Explaintation Liabilities Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company This is a list of what the company owes With liabilities this is obvious you owe loans to a bank or repayment of bonds to holders of debt etc

The basic equation underlying the balance sheet is Assets Liabilities Equity Analysts should be aware that different types of assets and liabilities may be measured differently For example some items are measured at historical cost or The accounting equation states that a company s total assets are equal to the sum of its liabilities and its shareholders equity This straightforward relationship between assets

Assets Liabilities Equity Printable Explaintation

Assets Liabilities Equity Printable Explaintation

Assets Liabilities Equity Printable Explaintation

https://i.pinimg.com/736x/37/fb/a8/37fba809d1a3a02bb52106a75234d231.jpg

From the accounting equation we see that the amount of assets must equal the combined amount of liabilities plus owner s or stockholders equity Liabilities are a company s obligations amounts the company owes Examples of liabilities include notes or loans payable accounts payable salaries and wages payable interest payable and

Pre-crafted templates offer a time-saving option for creating a varied series of documents and files. These pre-designed formats and designs can be used for various personal and professional jobs, consisting of resumes, invites, leaflets, newsletters, reports, discussions, and more, improving the content development procedure.

Assets Liabilities Equity Printable Explaintation

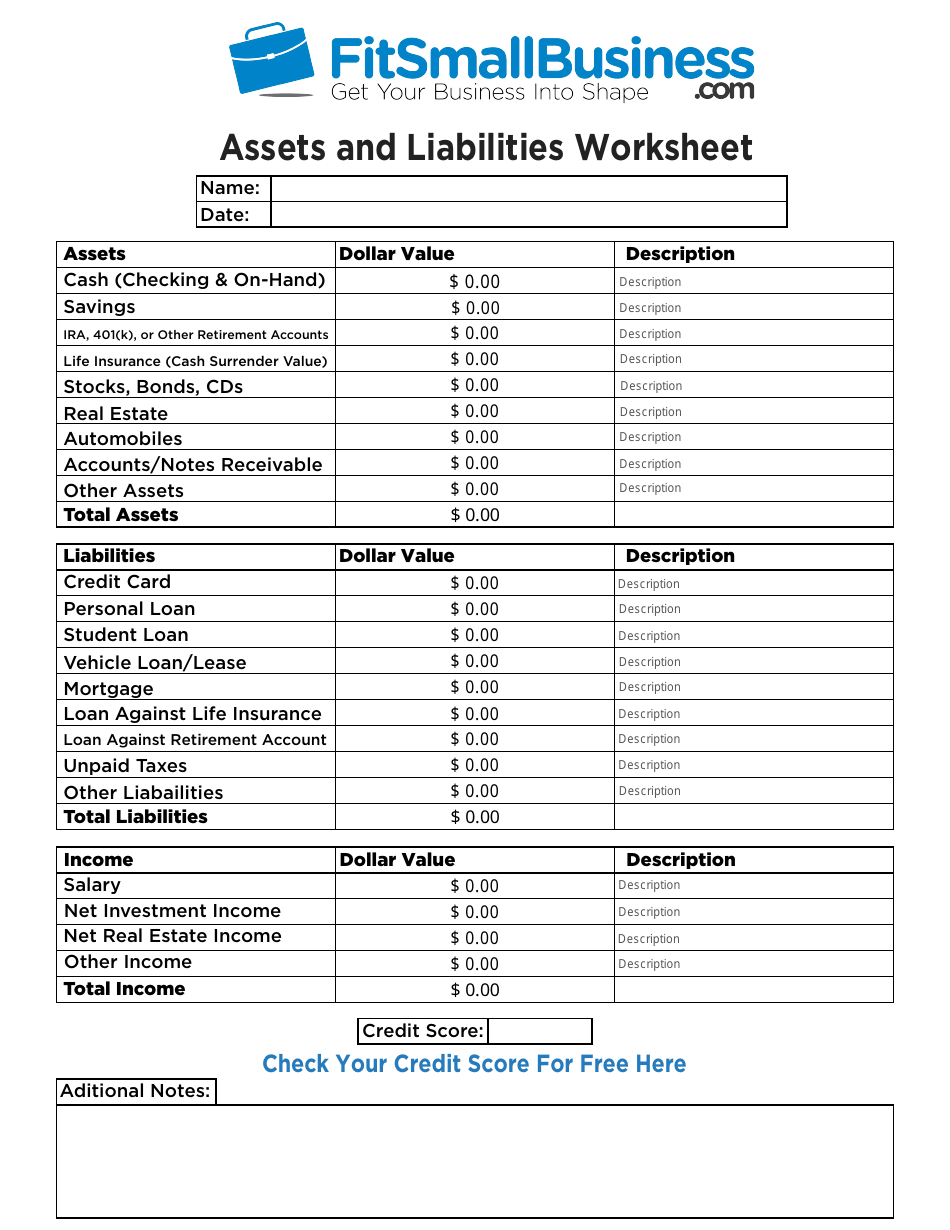

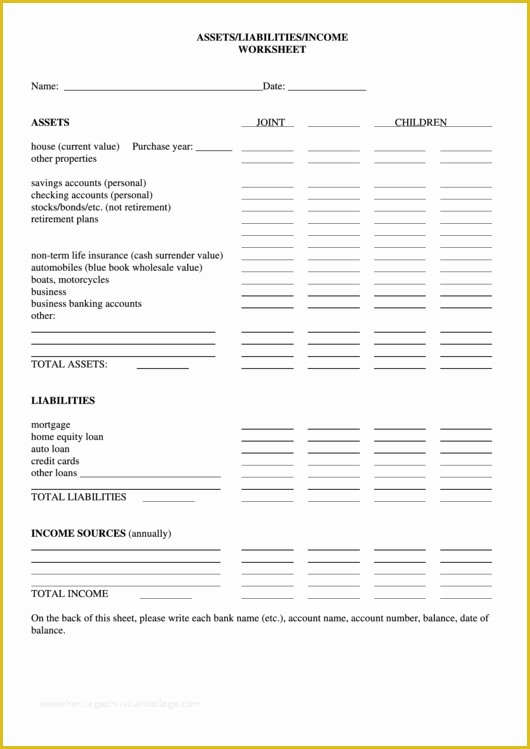

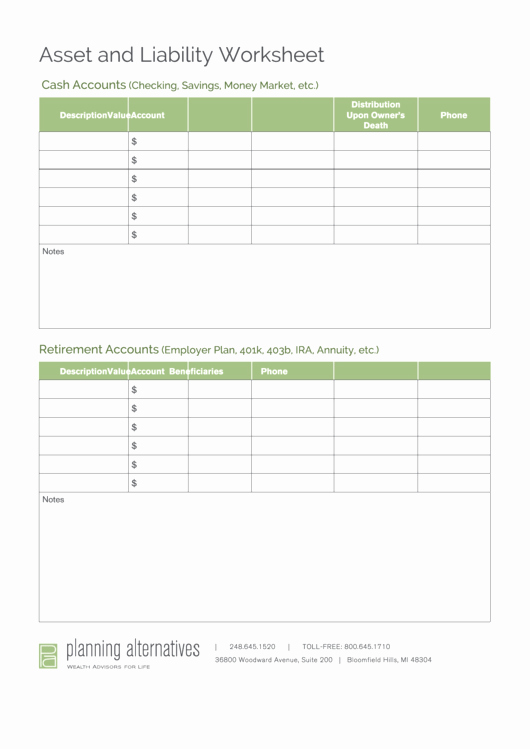

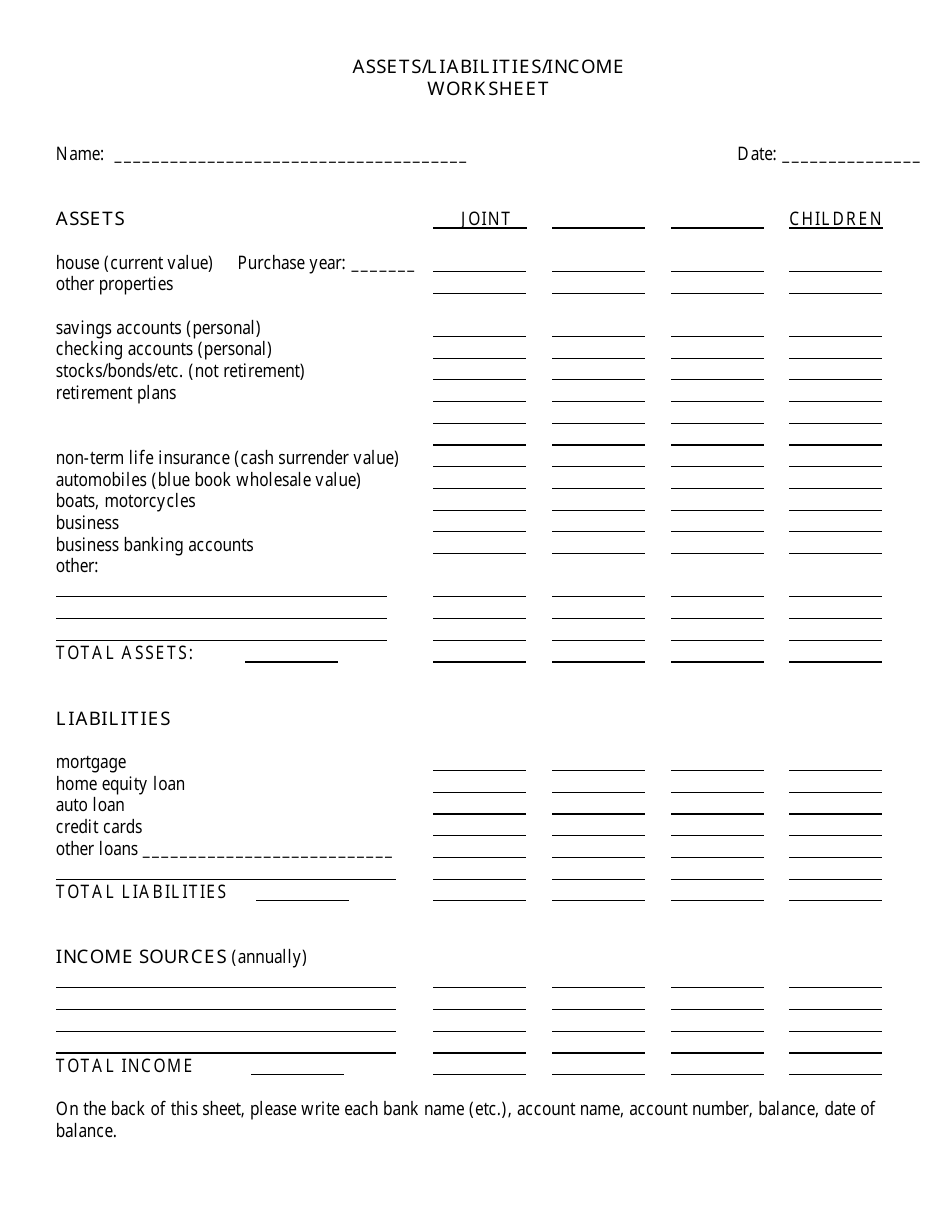

Assets And Liabilities Worksheet Worksheets For Home Learning

Accounting Assets And Liabilities Balance Sheet Esmeralda has Mccoy

Assets And Liabilities Template Free Download Of Assets Liabilities In

Balance Sheet Format Etsy

Sworn Statement Assets Liabilities Fill Online Printable Fillable

50 Assets And Liabilities Worksheet

https://www.bench.co/blog/accounting/assets-liabilities-equity

Let s take the equation we used above to calculate a company s equity Assets Liabilities

https://uwaterloo.ca/school-of-accounting-and-finance/sites/ca.s…

The fundamental accounting equation states that assets liabilities owner s equity assets liabilities drawings assets liabilities net income assets liabilities net income owner s equity assets liabilities owner s equity If Net Income is 25 600 Gross Income is 32 505 and Revenue is 45 500 then

https://online.hbs.edu/blog/post/balance-sheets-101-understanding

The Balance Sheet Equation Balance sheets are typically organized according to the following formula Assets Liabilities Owners Equity The formula can also be rearranged like so Owners Equity Assets Liabilities or Liabilities Assets Owners Equity A balance sheet must always balance therefore this equation should

https://www.investopedia.com/terms/b/balancesheet.asp

The term balance sheet refers to a financial statement that reports a company s assets liabilities and shareholder equity at a specific point in time Balance sheets provide the basis for

https://fundbox.com/blog/assets-liabilities-equity

Date November 25 2020 In this explanation of the ABCs of Accounting we will discuss assets liabilities and equity including the Owner s Equity Formula the Statement of Owner s Equity the Balance Sheet Formula and other helpful equations Fundamentally accounting comes down to a simple equation Assets Liabilities Equity

Assets Liabilities Owner s Equity Assets go on one side liabilities plus equity go on the other The two sides must balance hence the name balance sheet It makes sense you pay for your company s assets by either borrowing money i e increasing your liabilities or getting money from the owners equity The balance sheet formula is Assets Liabilities Shareholders Equity The formula reflects the fundamental accounting principle that the total value of a company s assets equals the sum of its liabilities and shareholders equity

Assets Liabilities Equity Assets An asset is a resource the business has purchased in the past from which future economic benefits are expected to flow They are items which a business owns and has control of such as inventory or motor vehicles