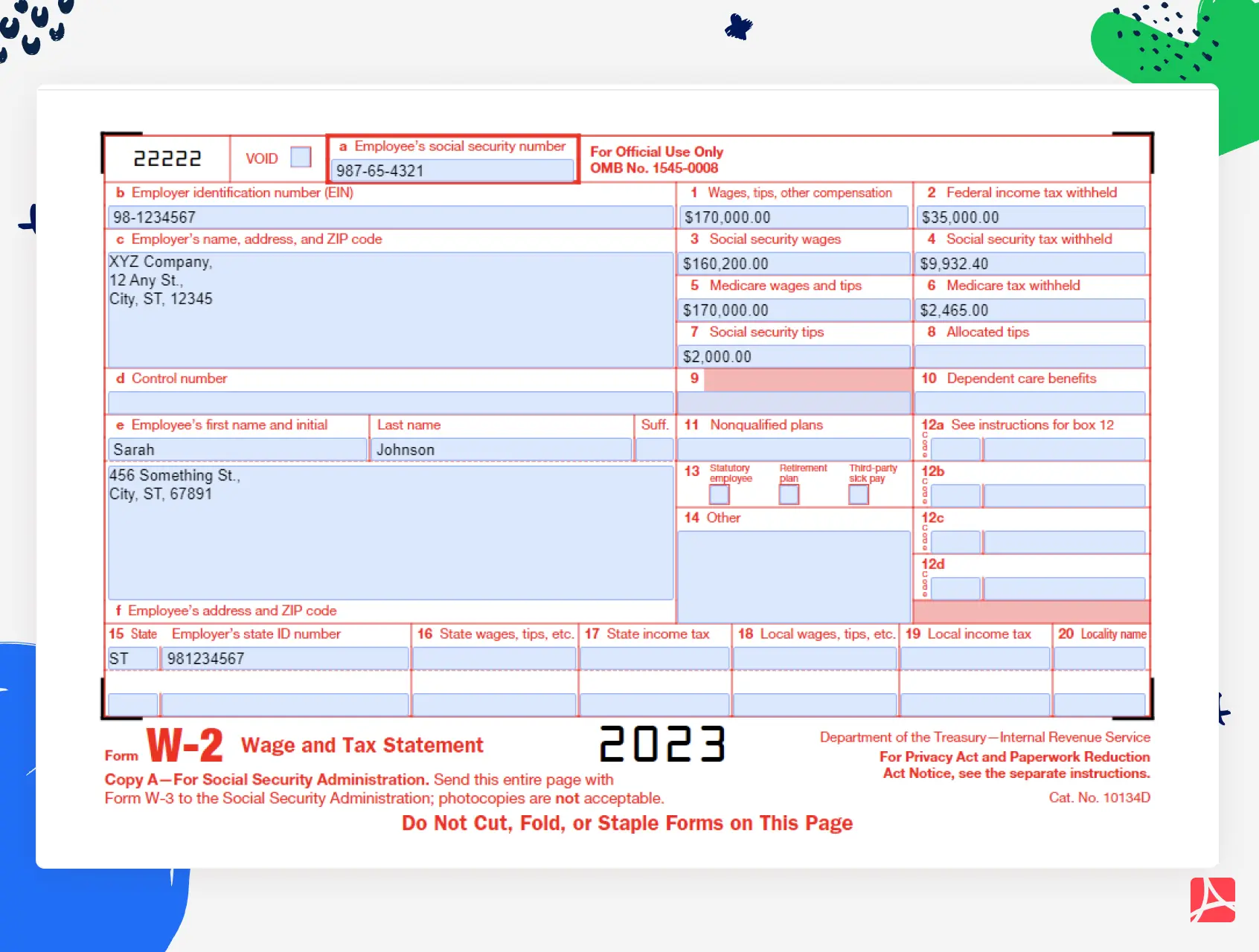

218 W2 Form Printable Download the 2023 Form W 2 Above is a fillable Form W 2 that you can print or download If you need a W 2 form from the previous year it is available to download below Download the 2022 version of Form W 2

Codes for box 12 Form W 2 Code BB Designated Roth contributions under a section 403 b plan Codes for box 12 Form W 2 Code B Uncollected Medicare tax on tips Codes for box 12 Form W 2 Code C Taxable cost of group term life insurance over 50 000 Follow the simple instructions below Confirming your earnings and filing all the vital taxation documents including IRS W 2 is a US citizen s sole responsibility US Legal Forms makes your tax control more transparent and precise You will find any juridical samples you want and complete them digitally How to prepare IRS W 2 on the web

218 W2 Form Printable

218 W2 Form Printable

218 W2 Form Printable

https://pdfliner.com/ckeditor/images/5LvXDiGYnlPTuXZQYDVpfgfsSIpWkpBEHBLz1wxN.webp

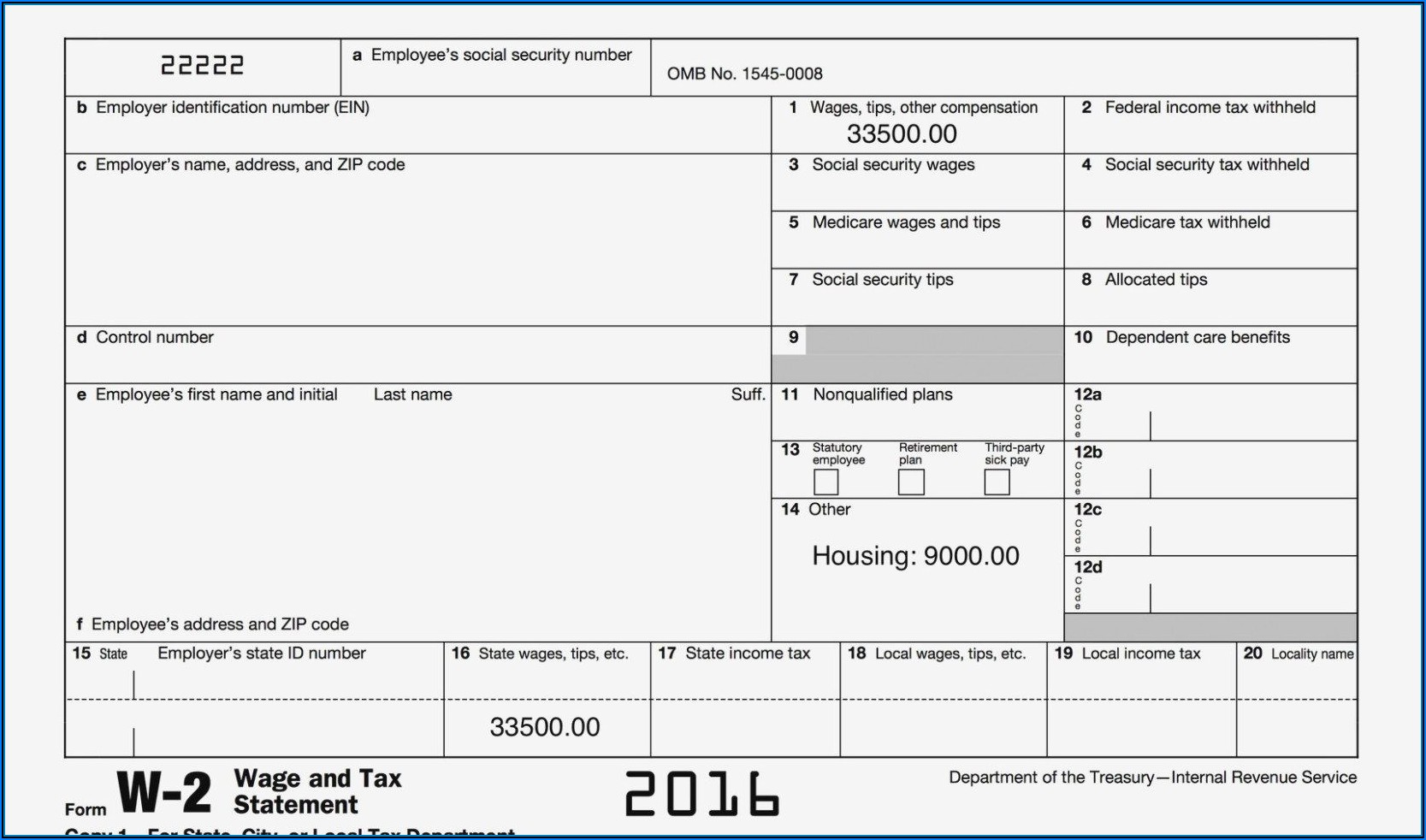

How to fill out Form W 2 Box A Employee s Social Security number Box B Employer Identification Number EIN Box C Employer s name address and ZIP code Box D Boxes E and F Employee s name address and ZIP code Box 1 Wages tips other compensation Box 2 Federal income tax withheld Box 3 Social Security

Pre-crafted templates use a time-saving service for developing a diverse variety of documents and files. These pre-designed formats and layouts can be utilized for various individual and professional tasks, consisting of resumes, invitations, leaflets, newsletters, reports, presentations, and more, enhancing the content production procedure.

218 W2 Form Printable

California W2 Form Fill Online Printable Fillable Blank

2023 W2 Form Pdf Printable Forms Free Online

W2 Form 2012 Fill Online Printable Fillable Blank PdfFiller

W2 Form 2013 Printable Form Resume Examples

Printable 2021 W2 Form Printable Form 2023

Npma 33 Printable Form Form Resume Examples gq96Nppl9O

https://www.irs.gov/pub/irs-prior/fw2--2022.pdf

Forms W 2 and W 3 for filing with SSA You may also print out copies for filing with state or local governments distribution to your employees and for your records Note Copy A of this form is provided for informational purposes only Copy A appears in red similar to the official IRS form

https://www.irs.gov/forms-pubs/about-form-w-2

Page Last Reviewed or Updated 14 Jul 2023 Information about Form W 2 Wage and Tax Statement including recent updates related forms and instructions on how to file Form W 2 is filed by employers to report wages tips and other compensation paid to employees as well as FICA and withheld income taxes

https://w2-form-printable.net

Get Printable IRS Form W 2 for the 2022 tax year Download the W 2 form in PDF DOC or fill it out online with a fillable template The most detailed instructions samples Save your time with our helpful materials

https://www.irs.gov/instructions/iw2w3

How to complete Form W 2 Form W 2 is a multi part form Ensure all copies are legible Do not print Forms W 2 Copy A on double sided paper Send Copy A to the SSA Copy 1 if required to your state city or local tax department and Copies B

https://eforms.com/irs/w2

2022 IRS Form W 2 Used for payments made to the employees in 2022 Download PDF Important Facts and Deadlines W 2s are information returns filled out by an employer and submitted to the Social Security Administration and employees

This form must be completed by employers in order for their employees to deduct employment expenses from their income 22222 Void Copy 1 For VI Bureau of Internal Revenue Department of the Treasury Internal Revenue Service Wages tips other compensation VI income tax withheld Social security wages 9 See instructions for box 12 Department of the Treasury Internal Revenue Service Copy B To Be Filed With Employee s VI Tax Return

W2 Form 2018 is a wage tax statement to be created by employers for their full time employees This legal document records the taxes or deductions withheld from each employee s paystubs for every pay period Employers must declare the withheld amounts with the SSA before 31st January every year