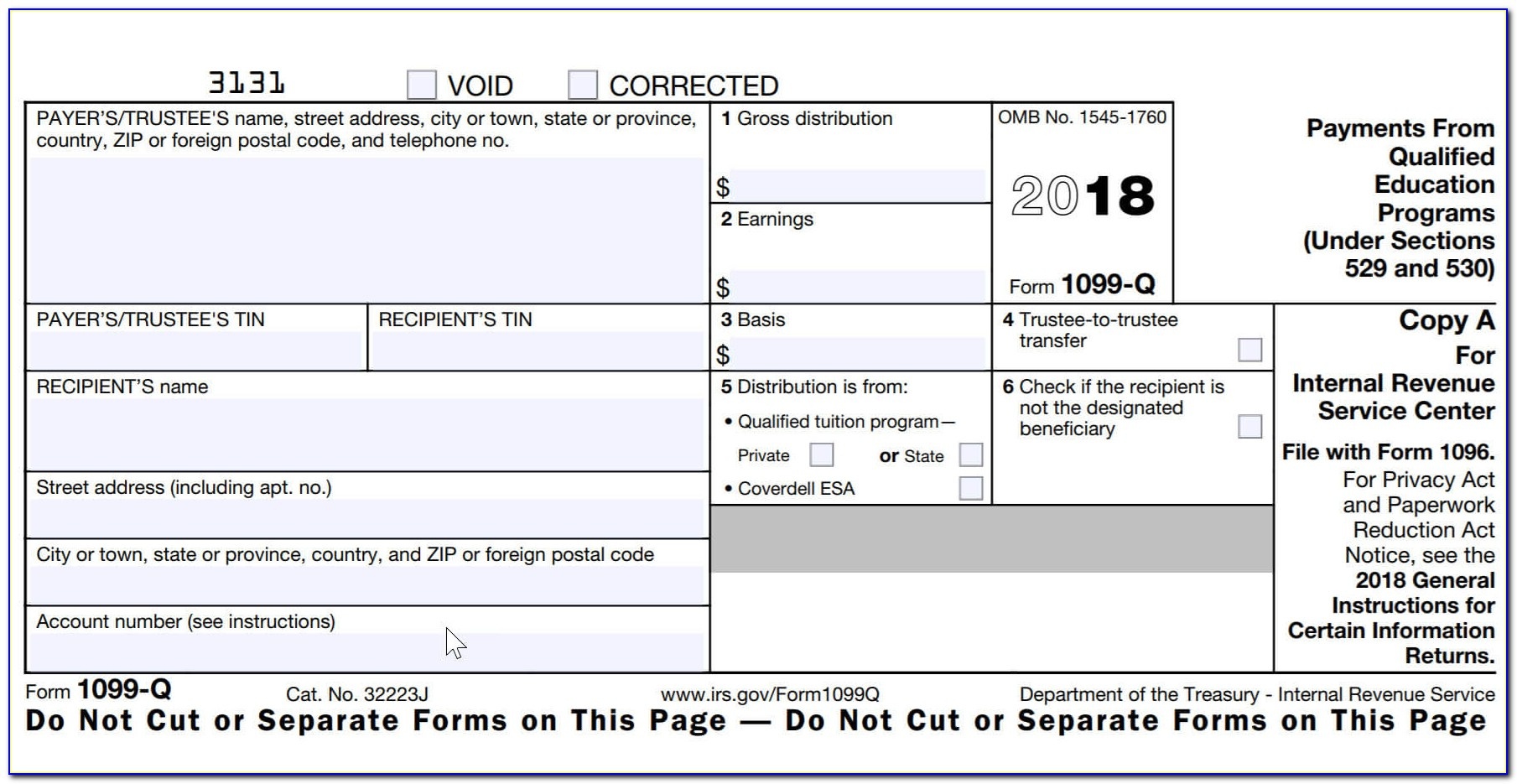

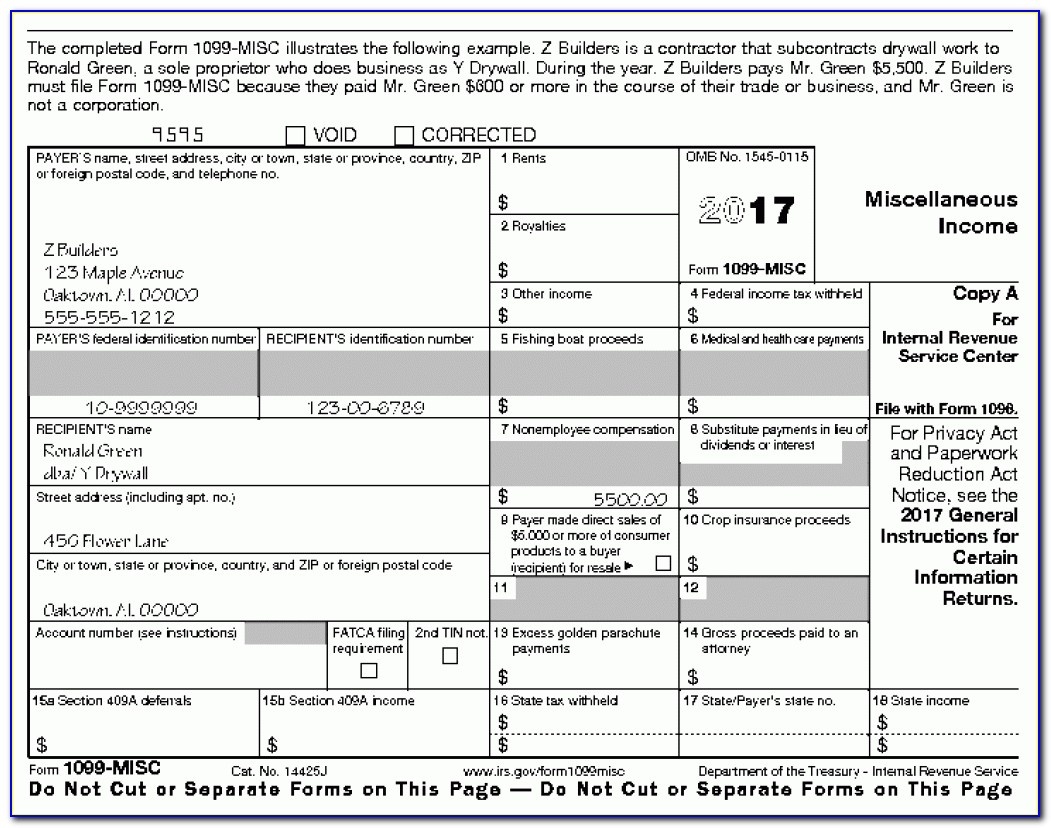

1099 Misc Form Printable Free Form 1099 MISC An IRS Form 1099 MISC is used to report payments other than employee compensation made by a business across a tax year Use this free 1099 MISC template to take the hassle out of the filing process Simply hit download fill in your details and send it in to the IRS

Those who need to send out a 1099 MISC can acquire a free fillable form by navigating the website of the IRS which is located at www irs gov Once you ve received your copy of the form you ll want to familiarize yourself with the various boxes that must be completed A 1099 form is a record of income you received from an entity or person other than your employer A 1099 Misc form is a specific version of this that is used to report miscellaneous payments that a company made for the reporting tax year

1099 Misc Form Printable Free

1099 Misc Form Printable Free

1099 Misc Form Printable Free

https://fundsnetservices.com/wp-content/uploads/Lost-your-1099-Form.png

A 1099 MISC is a form used by businesses to report miscellaneous taxable payments to many different kinds of payees You can t use the 1099 MISC form for payments you make to nonemployees independent contractors and others who provide services to your business You must file Form 1099 NEC for nonemployee

Templates are pre-designed files or files that can be utilized for different purposes. They can save effort and time by offering a ready-made format and design for developing various kinds of material. Templates can be used for individual or professional tasks, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

1099 Misc Form Printable Free

1099 Misc Printable Template Free Printable Templates

Printable 1099 nec Form 2021 Customize And Print

Fillable 1099 S Forms Printable Forms Free Online

Fillable Forms Tax Form 1099 Printable Forms Free Online

1099 Form Printable Template Printable Forms Free Online

Printable Form 1099 Printable Forms Free Online

https://eforms.com/irs/form-1099/misc

A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal exchanges and several other specific transactions must be reported to the IRS using this form

https://www.irs.gov/forms-pubs/about-form-1099-misc

Information about Form 1099 MISC Miscellaneous Information including recent updates related forms and instructions on how to file Form 1099 MISC is used to report rents royalties prizes and awards and other fixed determinable income

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png?w=186)

https://www.irs.gov/instructions/i1099mec

Continuous use form and instructions Form 1099 MISC Form 1099 NEC and these instructions have been converted from an annual revision to continuous use Both the forms and instructions will be updated as needed For the most recent version go to IRS gov Form1099MISC or IRS gov Form1099NEC New box 13

https://www.irs.gov/pub/irs-prior/f1099msc--2020.pdf

Www irs gov Form1099MISC Federal income tax withheld Nonqualified deferred compensation Copy B For Recipient This is important tax information and is being furnished to the IRS

https://legaltemplates.net/form/1099-misc

Create Document Updated September 21 2023 Legally reviewed by Brooke Davis What Is A 1099 MISC Form A 1099 MISC form is an IRS tax form typically used by businesses to report miscellaneous non salary income exceeding 600 paid to non employees such as independent contractors consultants and landlords i e rent

IRS Form 1099 MISC is filed by payers to report miscellaneous payments of 600 or more made to independent contractors during the tax year Form 1099 Misc is a tax form that reports the year end summary of all non employee compensation The 1099 Misc form covers rent royalties self employment and independent contractor income crop

Copy 1 For your state if you live in a state that requires a copy most do 1099 Copy A uses specific red inked paper that the IRS computers can scan All Copy A forms must be printed on this paper It s not just a matter of using a color printer loaded with red For Copies B C and 1 however feel free to use whatever paper you like