1099 Form Independent Contractor Printable Contractor timesheet templates are a simple way to track a contractor s working hours Since contractors usually don t work set hours each day timesheets can help you record their work hours and pay them accordingly And with a customizable template in hand you won t have to create timesheets from scratch every time you need

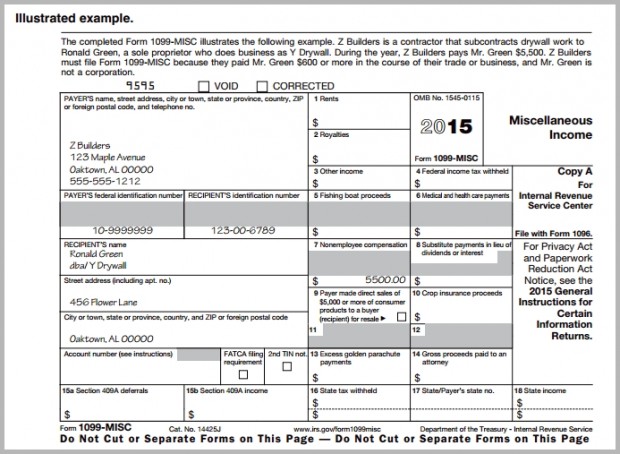

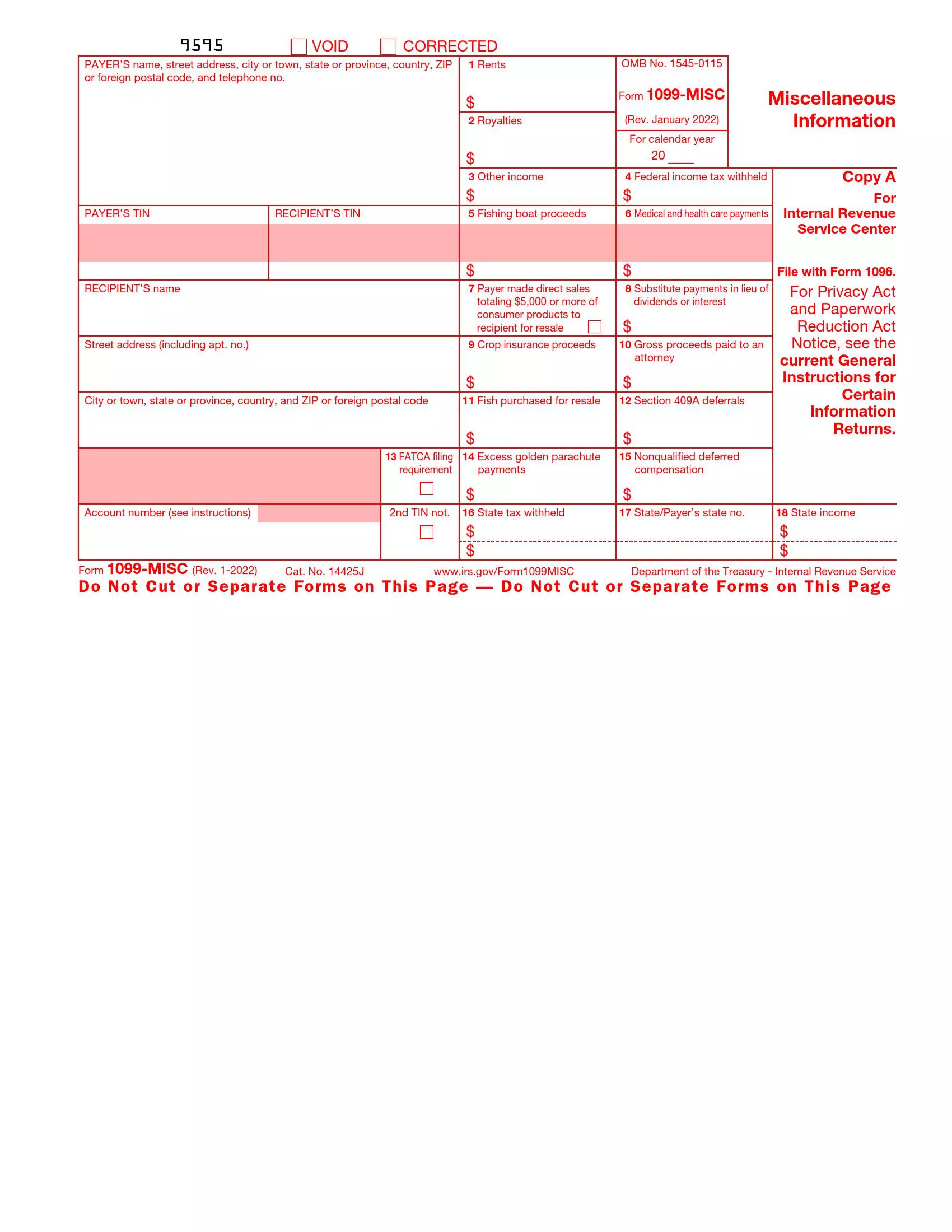

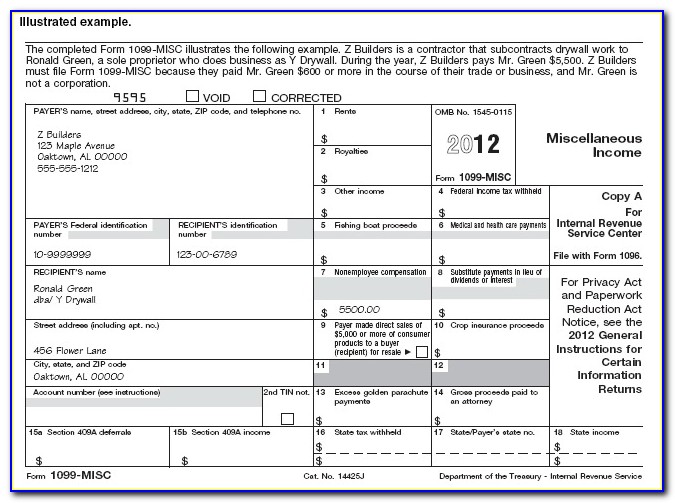

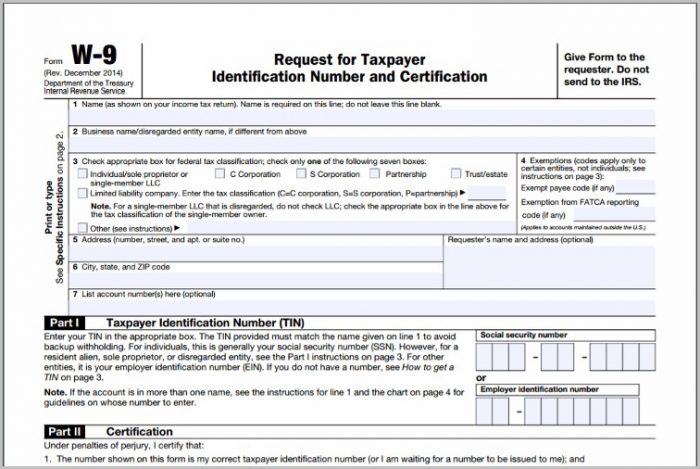

STEP 3 Prepare Your 1099 MISC Forms Start preparing 1099 MISC forms for independent contractors once you have bought the 1099 forms Fill in your Federal Tax ID number SSN or EIN and contractor s information SSN or EIN accurately Fill out Form 1099 MISC accurately using the information you ve gathered To send a 1099 NEC form you first need to have independent contractors fill out a W 9 form which contains information like their name address and tax ID or social security number

1099 Form Independent Contractor Printable

1099 Form Independent Contractor Printable

1099 Form Independent Contractor Printable

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/07/20746/independent_contractor_invoice_sample_2015_4rlatvee_1_.5676ddbcd58b2.png

If you are a U S based business or nonprofit organization and have used the services of independent contractors or freelancers you must prepare IRS Form 1099 MISC and make it available to them after filing IRS Form W 9 1099 MISC officially referred to as Other Income is used to report all payments you have made to non legal entities

Templates are pre-designed files or files that can be used for numerous functions. They can conserve effort and time by providing a ready-made format and layout for creating different kinds of material. Templates can be utilized for individual or professional jobs, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

1099 Form Independent Contractor Printable

Printable Independent Contractor 1099 Form Printable Forms Free Online

IRS Form 1099 MISC Fill Out Printable PDF Forms Online

Irs 1099 Form Fillable Printable Forms Free Online

1009 1 Free Fillable Form Printable Forms Free Online

Printable Independent Contractor 1099 Form Printable Forms Free Online

Printable Independent Contractor 1099 Form Printable Forms Free Online

https://1099-printable-form.net

For independent contractors or self employed individuals the 1099 form holds key significance This guide will outline steps to print the 1099 form for 2023 correctly breaking it down into manageable sections

https://www.irs.gov/businesses/small-businesses-self-employed/forms

Find Form W 9 Form 1099 and instructions on filing electronically for independent contractors Form W 9 If you ve made the determination that the person you re paying is an independent contractor the first step is to have the contractor complete Form W 9 Request for Taxpayer Identification Number and Certification

https://eforms.com/employment/independent-contractor

How to Hire an Independent Contractor 6 steps Independent Contractor Completes IRS Form W 9 Verify Contractor Negotiate with the Contractor Complete the Form Sign the Agreement File IRS Form 1099 Once an individual or company has decided that services are needed they will need to determine which independent

:max_bytes(150000):strip_icc()/1099-R2022-2372bb9e77514c4a8af4bcc393b6cd36.jpeg?w=186)

https://www.contractscounsel.com/b/1099-independent-contractor

Excellent Jump to Section What is a 1099 Independent Contractor Classification Rules for 1099 Independent Contractors 1099 Independent Contractor vs Employee Examples of an Independent Contractor Tax Requirements for 1099 Independent Contractors Need help with an Independent Contractor Agreement

https://www.irs.gov/pub/irs-pdf/f1099msc.pdf

Attention Attention Copy A of this form is provided for informational purposes only Copy A appears in red similar to the official IRS form The official printed version of Copy A of this IRS form is scannable but the online version of it printed from this website is not Do not print and file copy A downloaded from this website a

This form report the amount shown in box 1 on the line for Wages salaries tips etc of Form 1040 1040 SR or 1040 NR You must also complete Form 8919 and attach it to your return For more information see Pub 1779 Independent Contractor or Employee A 1099 NEC form non employee compensation is an IRS tax document that reports payments made by businesses or individuals to independent contractors or non employees during a calendar year The paying party must issue a 1099 NEC if payments during the year exceed 600 and the recipient must use the form to report their income

Independent Contractor 1099 Invoice Template An independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer Clients are not responsible for paying the contractor s taxes therefore payments should be made in full Make a Free Invoice Now By Type 21