1099 Form Download Printable Form 1099 is also used to report interest 1099 INT dividends 1099 DIV sales proceeds 1099 B and some kinds of miscellaneous income 1099 MISC Blank 1099 forms and the related instructions can be downloaded from the IRS website

Instructions for Recipient Recipient s taxpayer identification number TIN For your protection this form may show only the last four digits of your social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number EIN 1099 forms report a taxpayer s non employment income received throughout the tax year to the Internal Revenue Service IRS The IRS compares reported income on Form 1040 with the information

1099 Form Download Printable

1099 Form Download Printable

1099 Form Download Printable

https://images.ctfassets.net/ifu905unnj2g/z2Z7wwYsfeSmoqoswCUgG/bd7ac7e2ca8002ba0a4067695dbda1ac/Form_1099_Copy_B.png

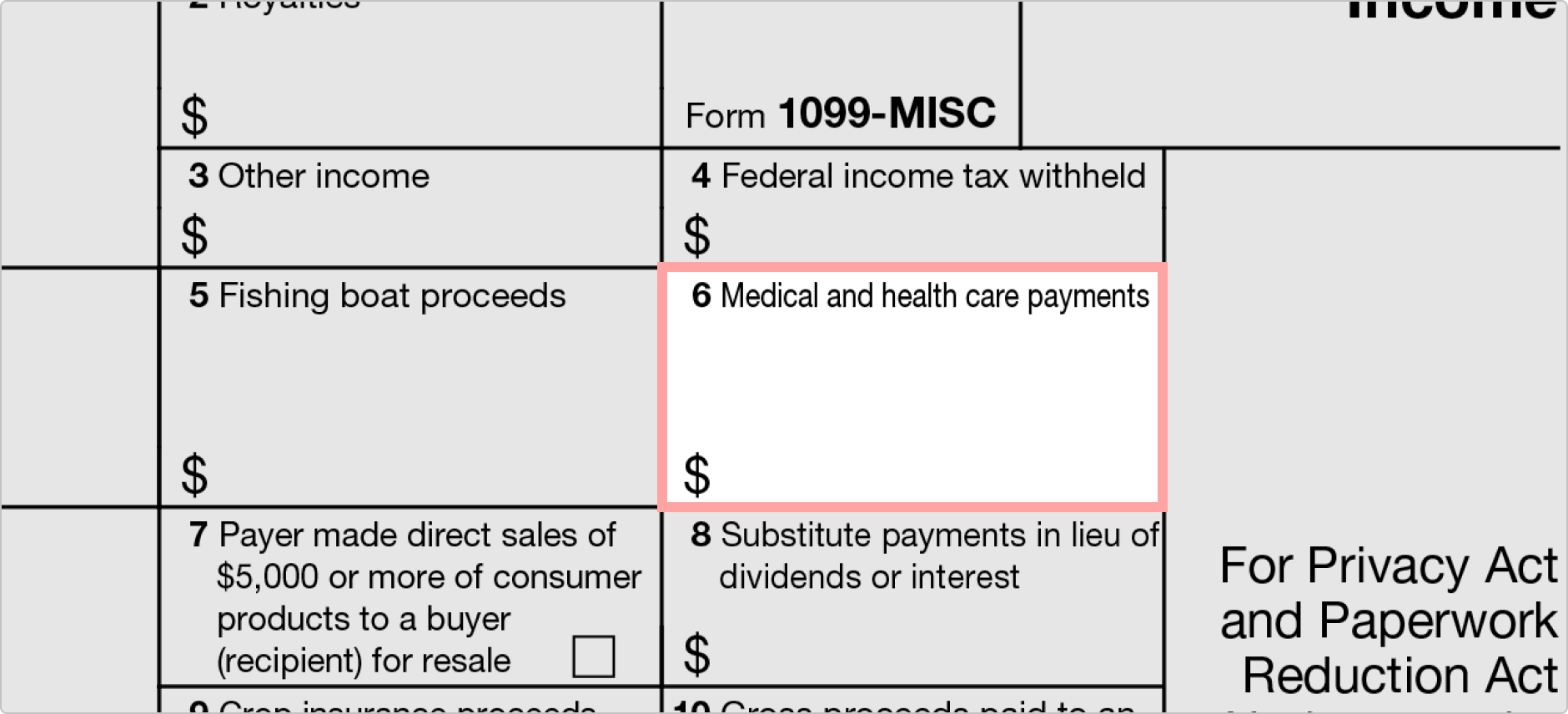

Continuous use form and instructions Form 1099 MISC Form 1099 NEC and these instructions have been converted from an annual revision to continuous use Both the forms and instructions will be updated as needed For the most recent version go to IRS gov Form1099MISC or IRS gov Form1099NEC New box 13

Pre-crafted templates offer a time-saving solution for producing a varied range of files and files. These pre-designed formats and designs can be utilized for numerous personal and professional tasks, consisting of resumes, invites, leaflets, newsletters, reports, discussions, and more, streamlining the material production process.

1099 Form Download Printable

Irs Printable 1099 Form Printable Form 2023

1099 Nec Form 2020 Printable Customize And Print

Az 1099 Form Printable Printable World Holiday

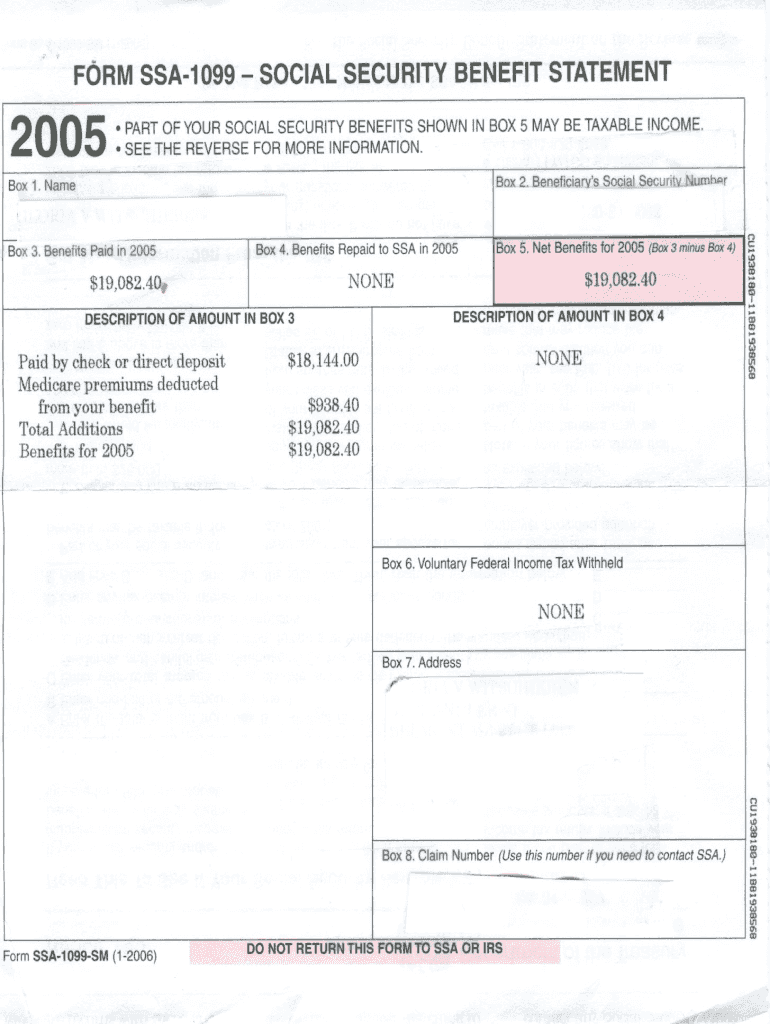

Ssa 1099 Form Example Fill Out And Sign Printable PDF Template SignNow

1099 MISC Form Fillable Printable Download Free 2021 Instructions

Printable 1099 Form 2023 Printable Forms Free Online

https://eforms.com/irs/form-1099/misc

5 0 Stars 4 Ratings 57 Downloads A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal

https://www.irs.gov/pub/irs-prior/f1099msc--2020.pdf

Instructions for Recipient Recipient s taxpayer identification number TIN For your protection this form may show only the last four digits of your social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number EIN

https://www.keepertax.com/posts/how-do-i-print-a-1099

Copy 1 For your state if you live in a state that requires a copy most do 1099 Copy A uses specific red inked paper that the IRS computers can scan All Copy A forms must be printed on this paper It s not just a matter of using a color printer loaded with red For Copies B C and 1 however feel free to use whatever paper you like

https://formswift.com/1099-misc

A 1099 NEC Form is now the appropriate form to file for compensation over 600 to non employees freelancers and contractors 1099 MISC for 2022 2021 2020 Download 1099 MISC for 2023

https://www.irs.gov/pub/irs-pdf/f1099nec.pdf

Copy A of this form is provided for informational purposes only Copy A appears in red similar to the official IRS form The official printed version of Copy A of this IRS form is scannable but the online version of it printed from this website is not

Download PDF Create Your 1099 MISC in Minutes Create Document Download a 1099 MISC form here to report non salary income paid to non employees Set up Form 1099 for recipients Accounting CS features the ability to set up forms for vendors and independent contractors who should receive a Form 1099 NEC at the end of the year Use one of the following procedures to set up a Form 1099 NEC and other applicable 1099 forms for vendors

2021 1099 NEC Used for the 2021 tax year only Download PDF The featured form 2022 version is the current version for all succeeding years 1099 NEC vs 1099 MISC 1099 NECs were first introduced by the IRS for the 2020 tax year