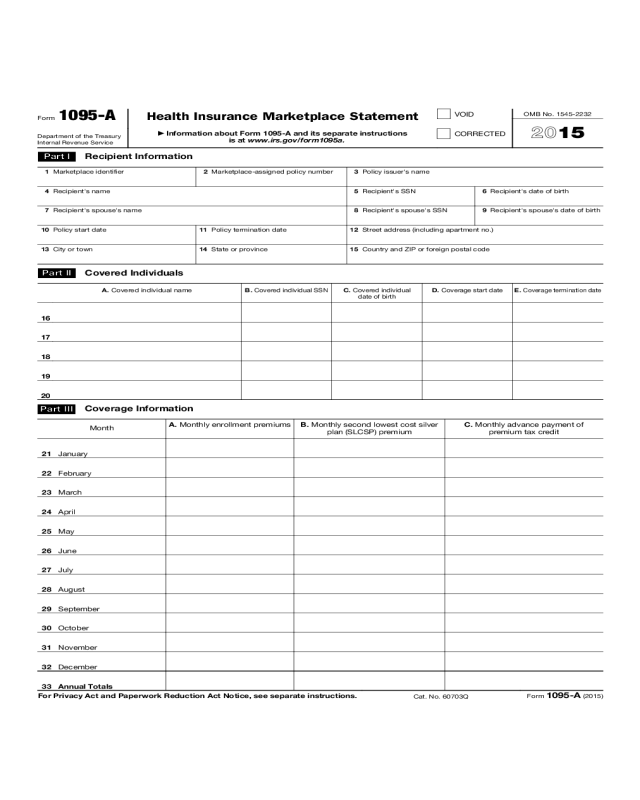

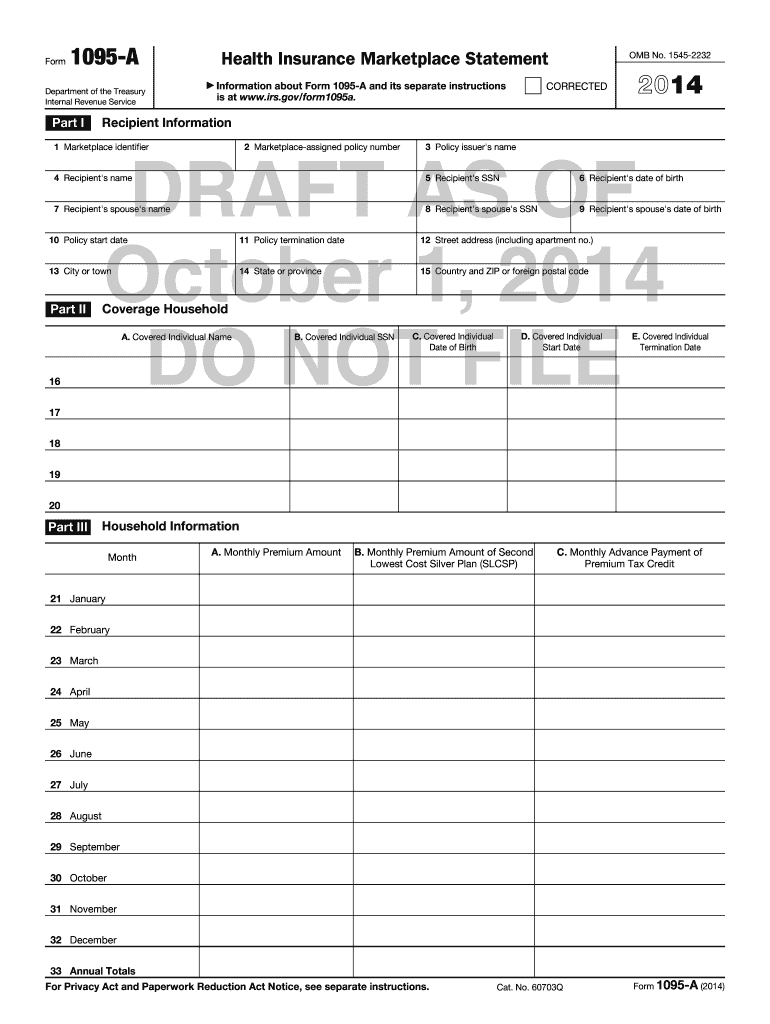

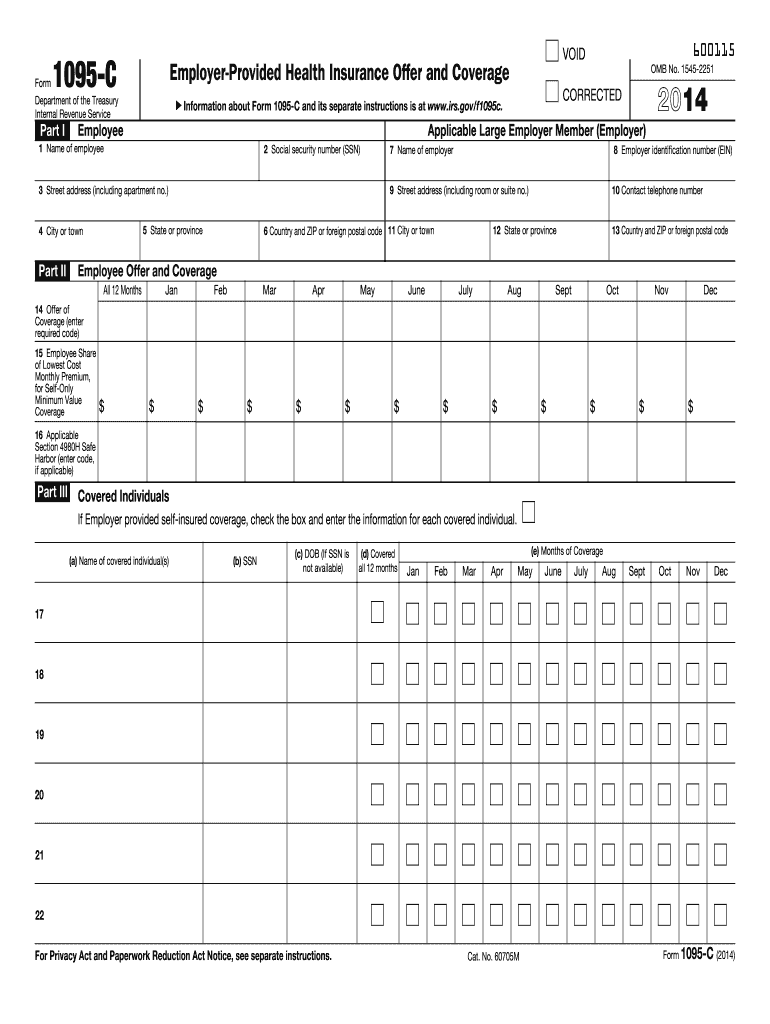

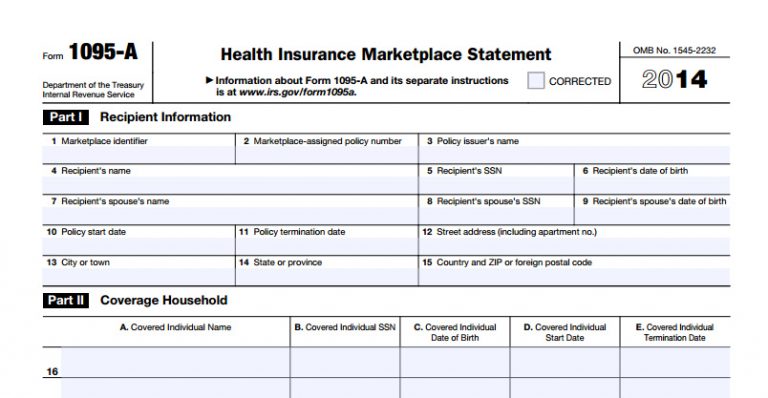

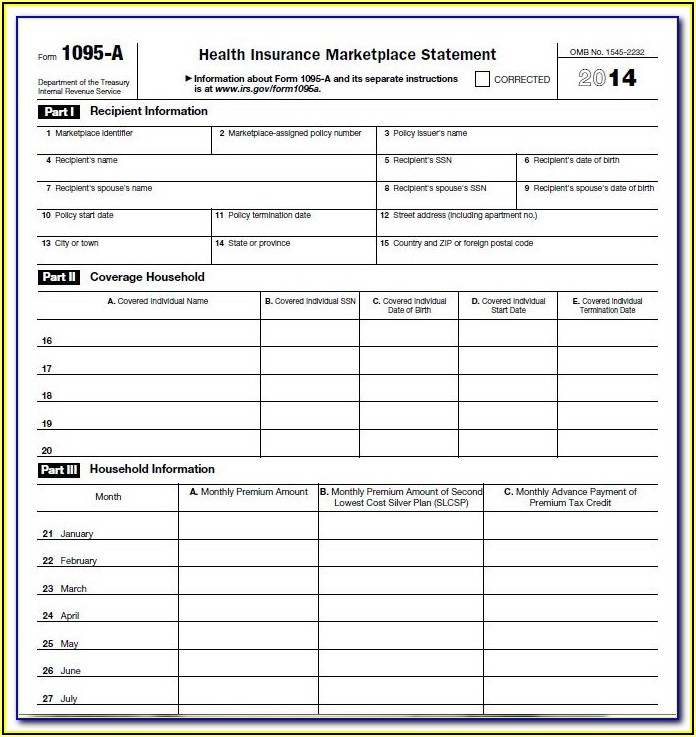

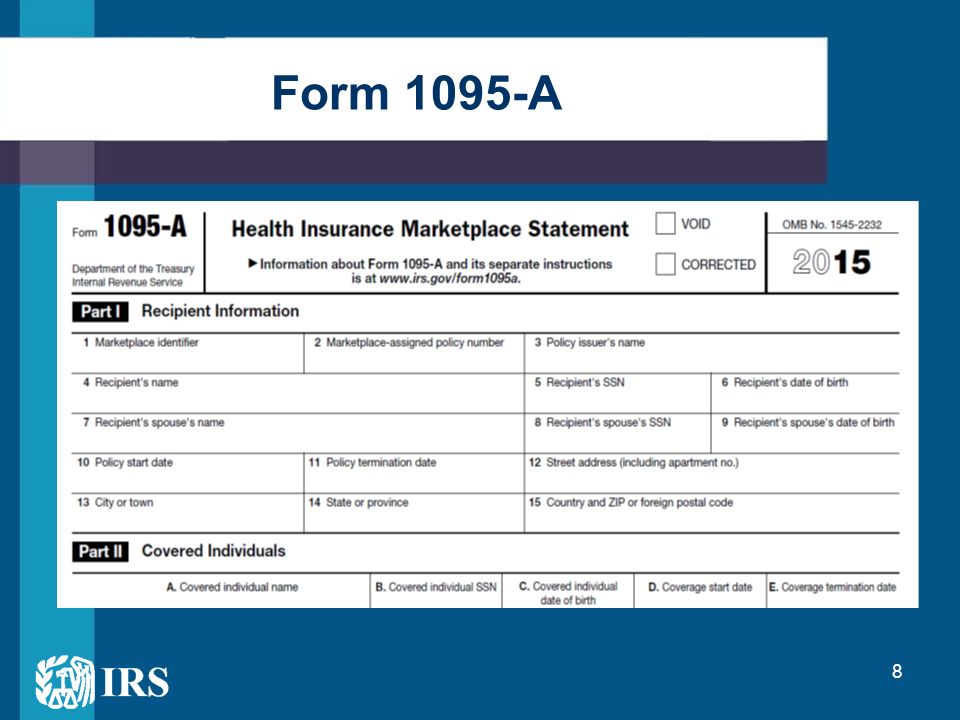

1095 A Form Printable Form 1095 A is a form that is sent to Americans who obtain health insurance coverage through a Health Insurance Marketplace carrier It includes information such as the effective date of the

Get a quick overview of health care tax Form 1095 A when you ll get it what to do if you don t how to know if it s right and how to use it Get a sample 1095 A PDF 132 KB This is just a preview don t fill it out STEP 1 Log into your Marketplace account STEP 2 Under My Applications Coverage select your 2022 application not your 2023 application STEP 3 Select Tax forms from the menu on the left How to find your Form 1095 A online 2 STEP 4 Under Your Forms 1095 A for Tax Filing click Download

1095 A Form Printable

1095 A Form Printable

1095 A Form Printable

http://www.communitytax.com/wp-content/uploads/2017/10/Form-1095-1.-Form.png

Select tax forms located on the left side of the screen Click on Form 1095 A for tax filing Save and print the PDF form You may notice multiple 1095 A forms listed under your account This may be the case if your household enrolled in more than one health insurance plan from the marketplace

Templates are pre-designed documents or files that can be used for different purposes. They can save time and effort by providing a ready-made format and design for developing different type of content. Templates can be utilized for personal or professional tasks, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

1095 A Form Printable

Fillable 1095 Form Printable Forms Free Online

Fillable 1095 Form Printable Forms Free Online

Irs Form 1095 A Fillable Printable Forms Free Online

Irs Form 1095 A Fillable Printable Forms Free Online

Irs Form 1095 A Fillable Printable Forms Free Online

Free Printable 1095 A Form Printable Templates

https://www.irs.gov/pub/irs-access/f1095a_accessible.pdf

Instructions for Recipient You received this Form 1095 A because you or a family member enrolled in health insurance coverage through the Health Insurance Marketplace This Form 1095 A provides information you need to complete Form 8962 Premium Tax Credit PTC

https://www.irs.gov/affordable-care-act/individuals-and-families/

The Form 1095 A will tell you the dates of coverage total amount of the monthly premiums for your insurance plan the second lowest cost silver plan premium that you may use to determine the amount of your premium tax credit and amounts of advance payments of the premium tax credit

https://www.canada.ca/en/revenue-agency/services/forms-publications

Yes No thank you Forms and publications Forms guides tax packages and other Canada Revenue Agency CRA publications Most requested Income tax package TD1 Personal Tax Credits Return TD1 forms for pay received 5000 G 5000 G C Income Tax and Benefit Guide All Provinces Except Non Residents T2201 Disability Tax Credit Certificate

https://www.healthcare.gov/tax-form-1095

File IRS form 1095 A to get highest federal tax return Learn what to do how to file why you got form what to do if no 1095 A

https://www.irs.gov/instructions/i1095a

Form 1095 A is used to report certain information to the IRS about individuals who enroll in a qualified health plan through the Health Insurance Marketplace Form 1095 A is also furnished to individuals to allow them to take the premium tax credit to reconcile the credit on their returns with advance payments of the premium tax credit

Your 1095 A tax form If you received financial assistance to help lower your monthly health coverage premiums in 2022 through Pennie you must file a federal tax return Pennie will mail or send all forms by January 31 st you will need this You and the IRS will receive Form 1095 A if you had health coverage through the Marketplace This form is essential for preparing your tax return if you received a premium subsidy or if you paid full price for coverage through the exchange and want to claim the premium subsidy on your tax return Your 1095 A should be available online

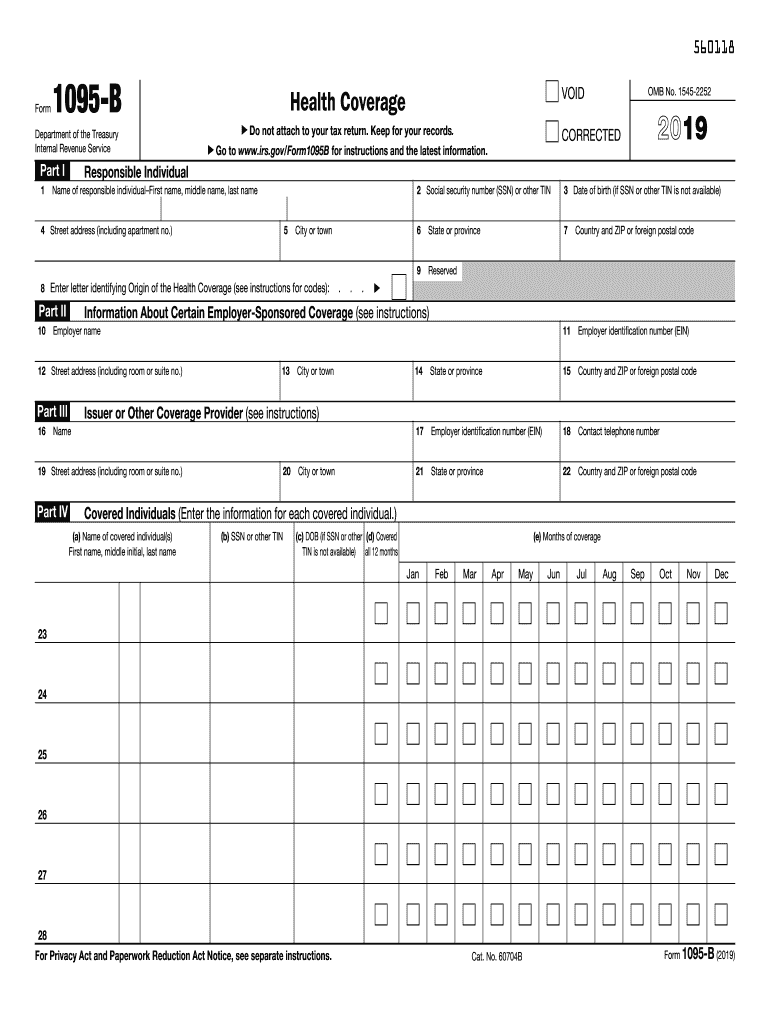

Select Your State Shop Our Plans Tax Information 1095 A 1095 B Earned income tax credit EITC Ambetter members may qualify for the Earned Income Tax Credit meaning there may be extra money waiting for you See if you qualify Advanced premium tax credit APTC helps you save on your Ambetter premiums